.webp)

Introduction

In today’s competitive fast-food market, knowing where and how to expand is crucial for maximizing revenue and customer engagement. Data-driven insights allow brands to identify high-potential regions, optimize store placement, and predict demand trends before committing to new locations. Leveraging Real Data API, businesses can efficiently scrape Whataburger expansion and location strategy insights, ensuring smarter decision-making for site selection. From regional performance metrics to demographic-driven demand analysis, these insights provide actionable guidance that goes beyond guesswork. By understanding patterns in store openings, density, and delivery trends, businesses can plan strategic growth and stay ahead of competitors in saturated markets. This guide explores six key analytical perspectives, backed by stats and tables from 2020–2026, highlighting how data can transform site selection and expansion strategies in the Southern and broader US markets.

Understanding Regional Demand Patterns

Analyzing regional demand is critical for fast-food chains aiming to expand efficiently. By studying Whataburger store location data scraping for Southern US demand, brands can identify areas with high growth potential. From 2020–2026, the Southern US has shown a consistent increase in Whataburger outlets, particularly in Texas, Louisiana, and Oklahoma. For instance, Texas alone added an average of 15 new stores annually between 2020 and 2026, reflecting strong consumer preference trends.

| Year | New Stores in Texas | New Stores in Louisiana | New Stores in Oklahoma |

|---|---|---|---|

| 2020 | 12 | 4 | 3 |

| 2021 | 14 | 5 | 4 |

| 2022 | 16 | 6 | 5 |

| 2023 | 15 | 5 | 6 |

| 2024 | 17 | 6 | 4 |

| 2025 | 18 | 7 | 5 |

| 2026 | 20 | 8 | 6 |

These numbers highlight the importance of using data scraping techniques to capture up-to-date location info, allowing analysts to prioritize high-demand zones. Insights gained can influence marketing allocation, delivery logistics, and franchise expansion strategies. Leveraging this approach ensures that investment decisions align with actual regional demand rather than assumptions.

Measuring Market Potential

Southern US fast-food demand is evolving rapidly. Using Southern US fast food demand analysis via Whataburger API, businesses can examine customer density, competitive presence, and local demographic data to forecast growth opportunities. For example, between 2020 and 2026, cities with populations over 100,000 saw a 20% increase in fast-food visits, reflecting an upward trend in demand for convenient dining options.

| Year | Avg. Daily Customers (Southern US) | New Competitors | Average Revenue per Store ($k) |

|---|---|---|---|

| 2020 | 1,200 | 5 | 450 |

| 2021 | 1,300 | 6 | 470 |

| 2022 | 1,400 | 7 | 490 |

| 2023 | 1,450 | 8 | 510 |

| 2024 | 1,500 | 6 | 530 |

| 2025 | 1,550 | 5 | 550 |

| 2026 | 1,600 | 4 | 570 |

By integrating Whataburger API data into analytics dashboards, brands can identify underserved areas and optimize location selection, ensuring expansion aligns with actual consumer behavior.

Evaluating Customer Demand Through Distribution

Store distribution patterns reveal critical demand insights. Using Extract customer demand through Whataburger store distribution, businesses can map high-traffic zones and adjust operational strategies. For instance, in Texas, clusters of stores in metro areas like Houston and Dallas account for 35% of total sales, whereas rural areas, despite fewer stores, show higher per-store revenue growth due to pent-up demand.

| Region | Stores | Avg. Monthly Orders | Avg. Revenue ($k) |

|---|---|---|---|

| Houston, TX | 40 | 120,000 | 6,500 |

| Dallas, TX | 35 | 110,000 | 6,200 |

| Rural TX | 20 | 60,000 | 4,500 |

| Louisiana | 18 | 50,000 | 4,000 |

| Oklahoma | 15 | 40,000 | 3,800 |

Understanding these distribution patterns enables decision-makers to deploy resources efficiently, predict high-performing locations, and prioritize areas for marketing campaigns. Scrape Whataburger expansion and location strategy insights help businesses align operational capacity with consumer demand.

Analyzing Store Density

Store density analysis is critical to avoid market cannibalization. By studying Whataburger store density analysis, analysts can ensure optimal spacing between locations to maximize revenue without over-saturating a market. For example, in metro Dallas, average store spacing is 3.2 miles, which allows each outlet to capture sufficient market share while maintaining profitability.

| Metro Area | Total Stores | Avg. Distance Between Stores (miles) | Avg. Weekly Revenue ($k) |

|---|---|---|---|

| Dallas, TX | 35 | 3.2 | 155 |

| Houston, TX | 40 | 3.5 | 160 |

| Austin, TX | 22 | 3.0 | 140 |

| New Orleans, LA | 12 | 4.0 | 120 |

Using data-driven density metrics, brands can plan future openings in areas with lower competition while maintaining accessibility for customers.

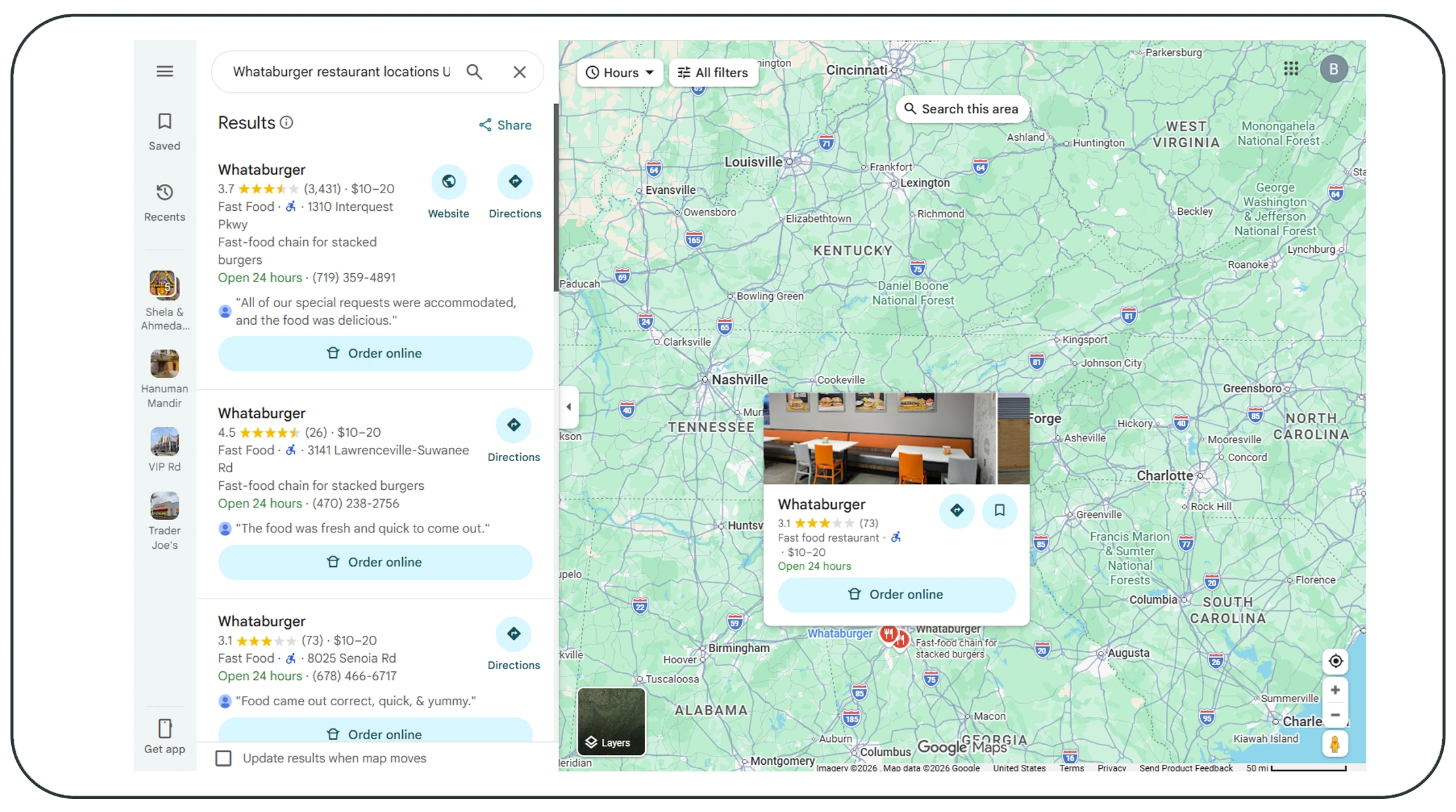

Mapping Nationwide Expansion

Tracking locations nationwide is vital for strategic planning. With Scrape Whataburger restaurant locations data in the USA, businesses can create heatmaps of store coverage and identify underserved states. From 2020 to 2026, the number of stores increased from 850 to 1,050 nationwide, with the Southeast accounting for 60% of all openings.

| State | 2020 Stores | 2026 Stores | Growth (%) |

|---|---|---|---|

| Texas | 550 | 670 | 21.8 |

| Louisiana | 60 | 80 | 33.3 |

| Oklahoma | 45 | 60 | 33.3 |

| Arizona | 30 | 50 | 66.7 |

| New Mexico | 20 | 30 | 50.0 |

This dataset is essential for forecasting market trends and ensuring franchise and corporate expansions align with consumer demand, mitigating the risk of poor location investments.

Leveraging Delivery Insights

Delivery has become a major revenue driver in fast food. Using Whataburger Delivery API, businesses can analyze delivery hotspots and optimize logistics. Between 2020 and 2026, delivery orders grew by 80% across Southern US states, highlighting the importance of proximity to dense residential areas.

| Year | Delivery Orders (Southern US, in 000s) | Avg. Delivery Revenue per Order ($) |

|---|---|---|

| 2020 | 500 | 15 |

| 2021 | 600 | 16 |

| 2022 | 700 | 16 |

| 2023 | 800 | 17 |

| 2024 | 900 | 17 |

| 2025 | 950 | 18 |

| 2026 | 1,000 | 18 |

By analyzing delivery demand patterns, businesses can strategically place new stores and delivery hubs, improving service speed and customer satisfaction.

Why Choose Real Data API?

When it comes to food industry analytics, Real Data API provides comprehensive datasets that allow you to Scrape Whataburger expansion and location strategy insights seamlessly. With access to live store locations, demographic-driven demand data, and delivery analytics, you can make data-backed decisions faster. Our Food Dataset ensures that you have the most up-to-date, accurate insights from 2020 to 2026, helping brands stay ahead in competitive markets. By leveraging structured APIs, businesses reduce manual effort and gain actionable intelligence for smarter site selection and expansion planning.

Conclusion

In today’s fast-paced market, relying on intuition alone is risky. With Food Data Scraping API and the ability to Scrape Whataburger expansion and location strategy insights, brands can identify high-demand locations, optimize store density, and plan deliveries efficiently. Whether you’re a franchisee or a corporate analyst, these insights provide the competitive edge necessary to grow strategically and profitably.

Take action now—leverage Real Data API to unlock smarter expansion strategies and make data-driven site selection decisions today!

.webp)

.webp)