Introduction

Understanding geographic reach and market saturation is crucial for fast-growing F&B brands like Dutch Bros Coffee. With the growing footprint of this drive-thru coffee chain in the U.S., Dutch Bros Coffee location data scraping USA provides a powerful strategy to evaluate franchise density, detect expansion-ready ZIP codes, and assess local competition. Real Data API enables businesses to extract structured, geo-tagged datasets that include store hours, coordinates, and regional store clusters, which are critical for strategic planning.

From California to Texas, businesses and franchise consultants use location intelligence to make data-driven site selection decisions. With tools to scrape Dutch Bros Coffee locations USA, brands can tap into hyperlocal trends, analyze demographic suitability, and benchmark competitor footprints. The ability to visualize gaps in coverage and overlapping territories through map-based dashboards enhances the precision of regional planning.

This blog compares real-time POI analytics and historical patterns from 2020-2025 to guide your expansion journey. Whether you’re seeking to enter the coffee retail space or optimize existing stores, Dutch Bros Coffee location data scraping USA supports smarter decisions with actionable geospatial insights. Let’s explore how to extract, analyze, and utilize this data effectively.

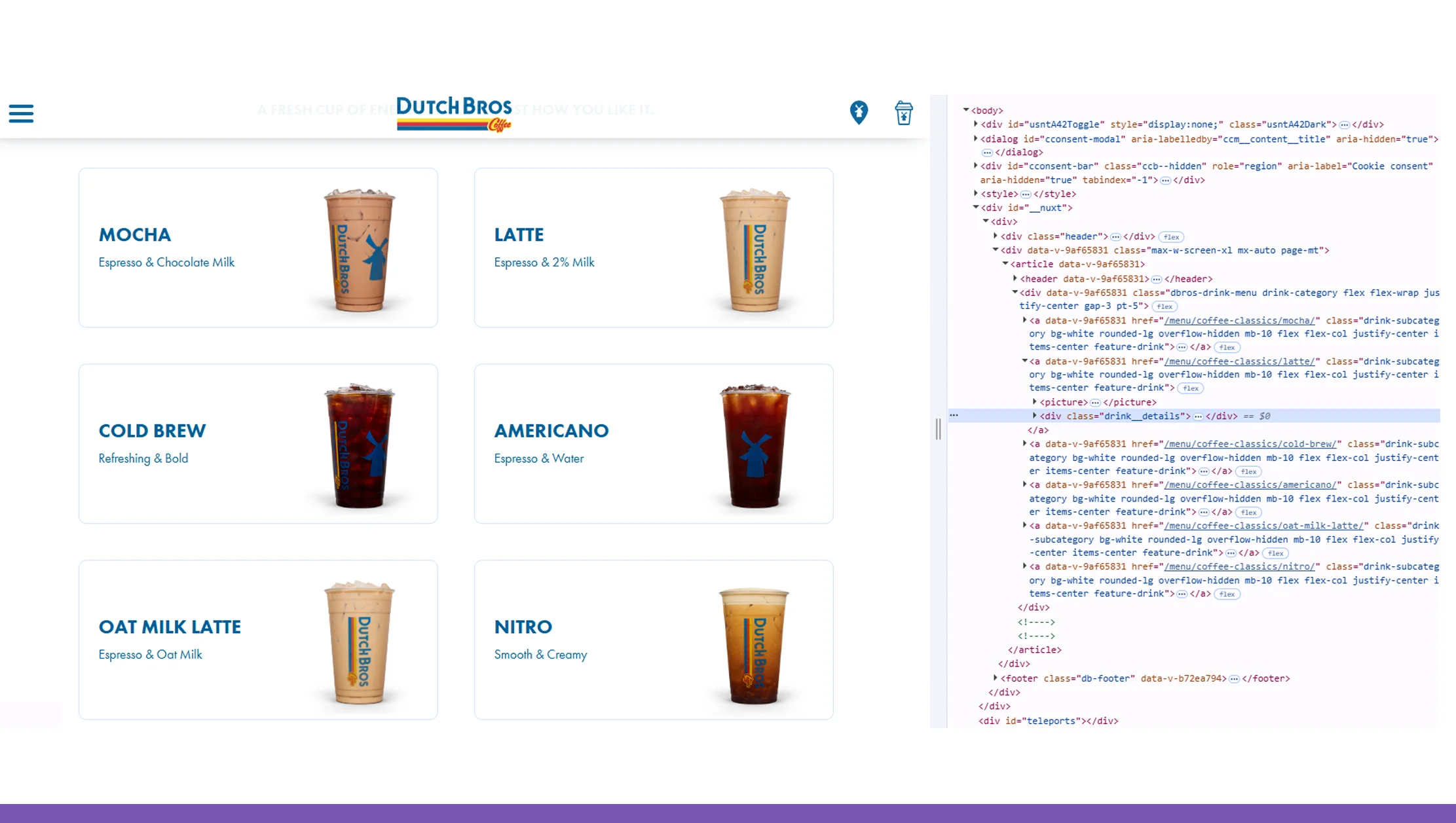

Mapping Store Density and Regional Clustering

Store density analysis is foundational for market planning. By leveraging Dutch Bros location data extraction, stakeholders can view concentrations of outlets at city, county, or ZIP code levels. For example, in states like Oregon and Arizona, Dutch Bros has an average of 12–15 stores per 100 square miles (2023). Mapping this density helps identify saturated versus underserved regions.

Real Data API enables direct scrape of retail chain store data 2025, capturing coordinates, addresses, and ZIP-based groupings. Using heatmaps, brands can visualize regional saturation and compare it against demographic data to prioritize new franchise opportunities. Between 2020–2025, the West Coast saw a 32% increase in store counts, while Midwest markets only grew by 8%—highlighting areas ripe for expansion.

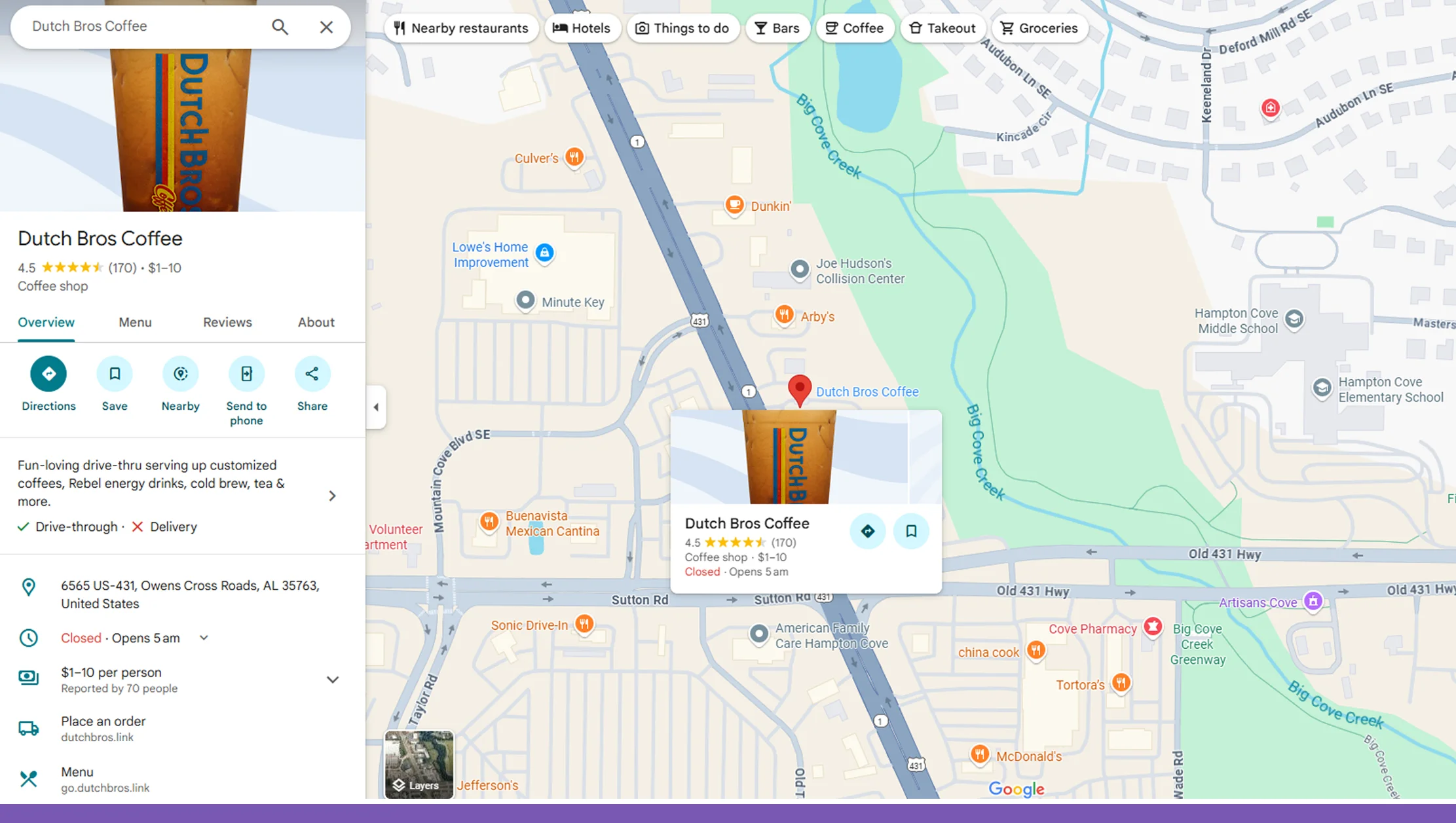

Franchisees can map Dutch Bros franchise locations to understand competitive overlap or complementary clustering (e.g., near universities or high-traffic retail zones). This geospatial insight minimizes cannibalization and maximizes ROI. Cross-comparing Dutch Bros outlets with local competitors like Starbucks or Scooter’s Coffee through restaurant chain web scraping further strengthens local positioning.

In conclusion, store density mapping powered by Real Data API helps businesses visualize growth trends, optimize site selection, and mitigate oversaturation risks.

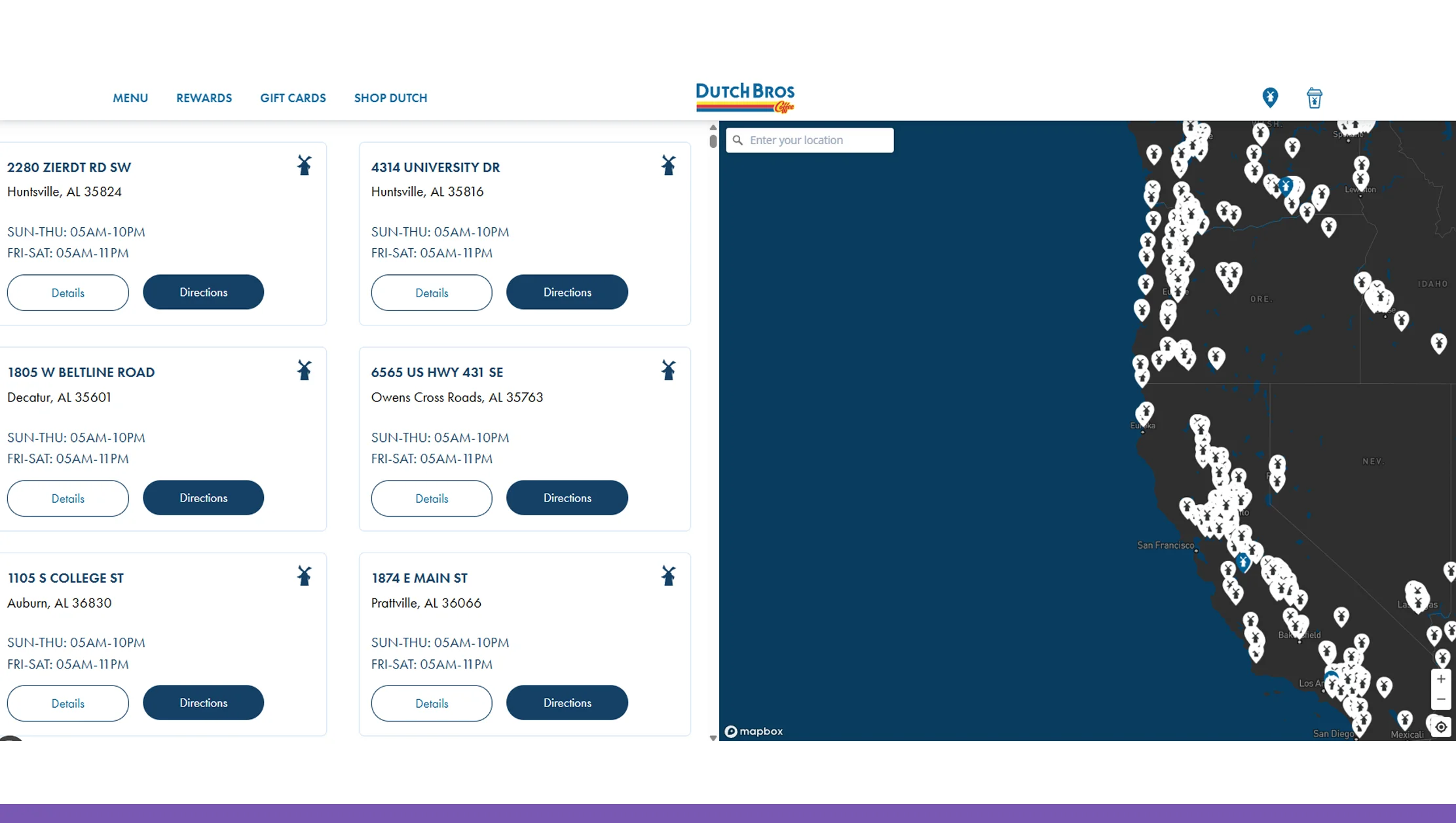

Identifying ZIP Code-Based Coverage Gaps

Not all ZIP codes are created equal—some are prime for new locations, while others lack enough foot traffic or customer demand. With the ability to extract ZIP code-based coffee outlets, brands can pinpoint white spaces where Dutch Bros has no footprint but market demand exists.

Using POI intelligence between 2020 and 2025, over 1,200 ZIP codes across the U.S. were flagged as "high-potential" due to rising F&B foot traffic but lacking Dutch Bros presence. This reveals an opportunity to scrape retail chain store data 2025 to validate missing coverage against sales data and census trends.

Dutch Bros franchise developers can also scrape opening hours and geodata to assess location viability in those gaps. High-performing outlets often operate for longer hours and are near main transit routes. By identifying ZIPs with similar patterns but no Dutch Bros outlet, businesses can shortlist potential expansion areas.

Real Data API’s dashboard visualizes ZIPs with untapped potential based on variables like income bracket, traffic density, and competitor absence. This not only informs site expansion but also helps in repositioning low-performance stores to more profitable geographies.

Competitive Intelligence Across Coffee Chains

With POI data API for coffee brands, competitive benchmarking becomes seamless. Real Data API enables businesses to analyze how Dutch Bros stacks up against rivals across state lines and metros.

In Texas, for instance, Real Data API found that from 2020 to 2025, Dutch Bros expanded from 25 to 118 stores—a 372% increase—compared to Starbucks' 15% growth. Such insights guide investor confidence and local market targeting.

By overlaying Dutch Bros locations with coffee shop store locator scraping for Starbucks, Dunkin’, and Peet’s, brands can analyze market share per ZIP code. Metrics such as store-to-population ratio, drive-thru availability, and average star ratings offer deeper market context.

Real-time tools also allow you to scrape Dutch Bros Coffee locations USA alongside competitors to monitor new store openings, closures, and territory shifts. This supports dynamic strategic responses and promotional planning.

With Real Data API, decision-makers get access to historical competitive POI changes, which can predict future growth directions. Integrating this intelligence with your CRM or franchise portal enhances end-to-end planning.

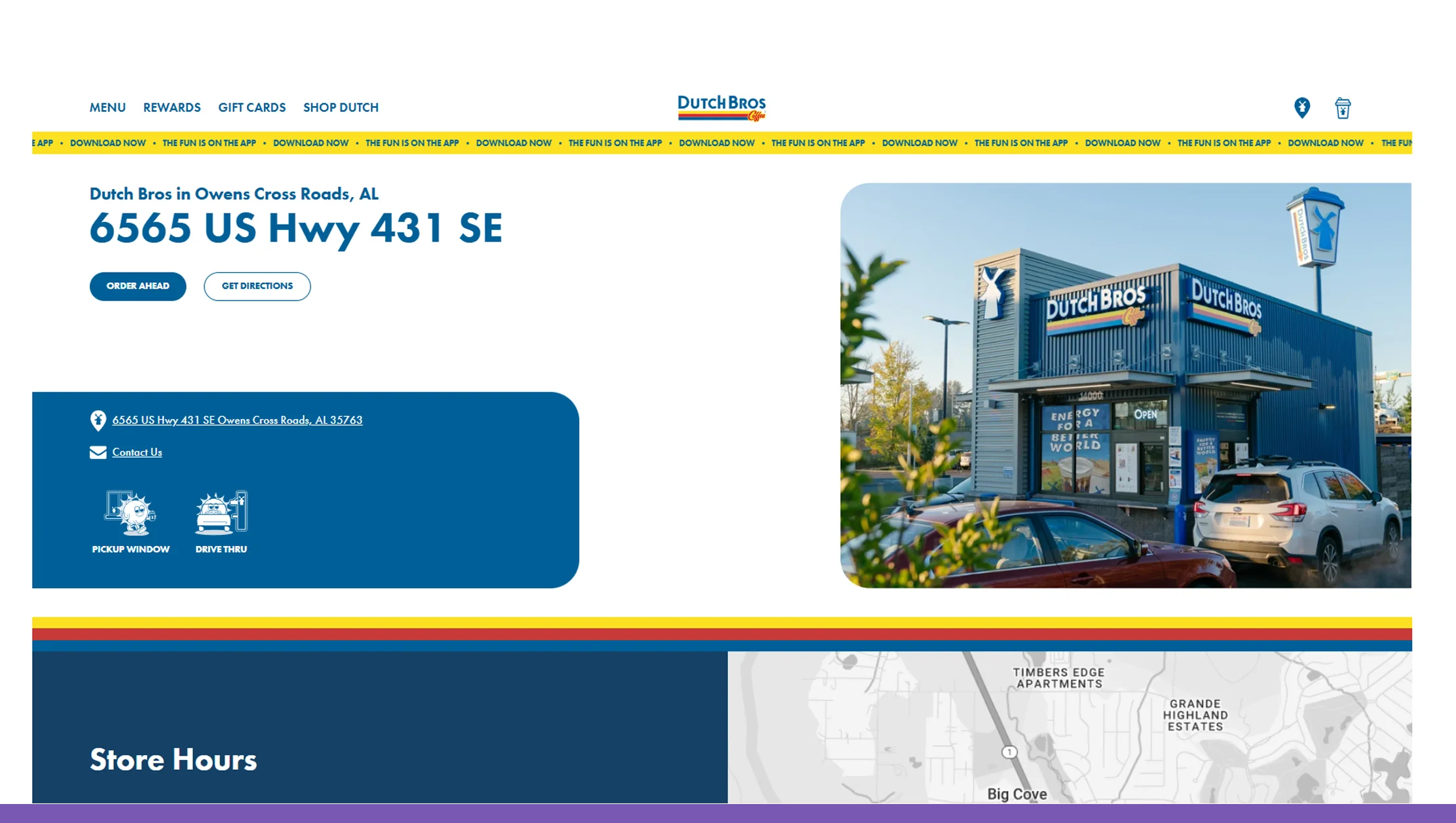

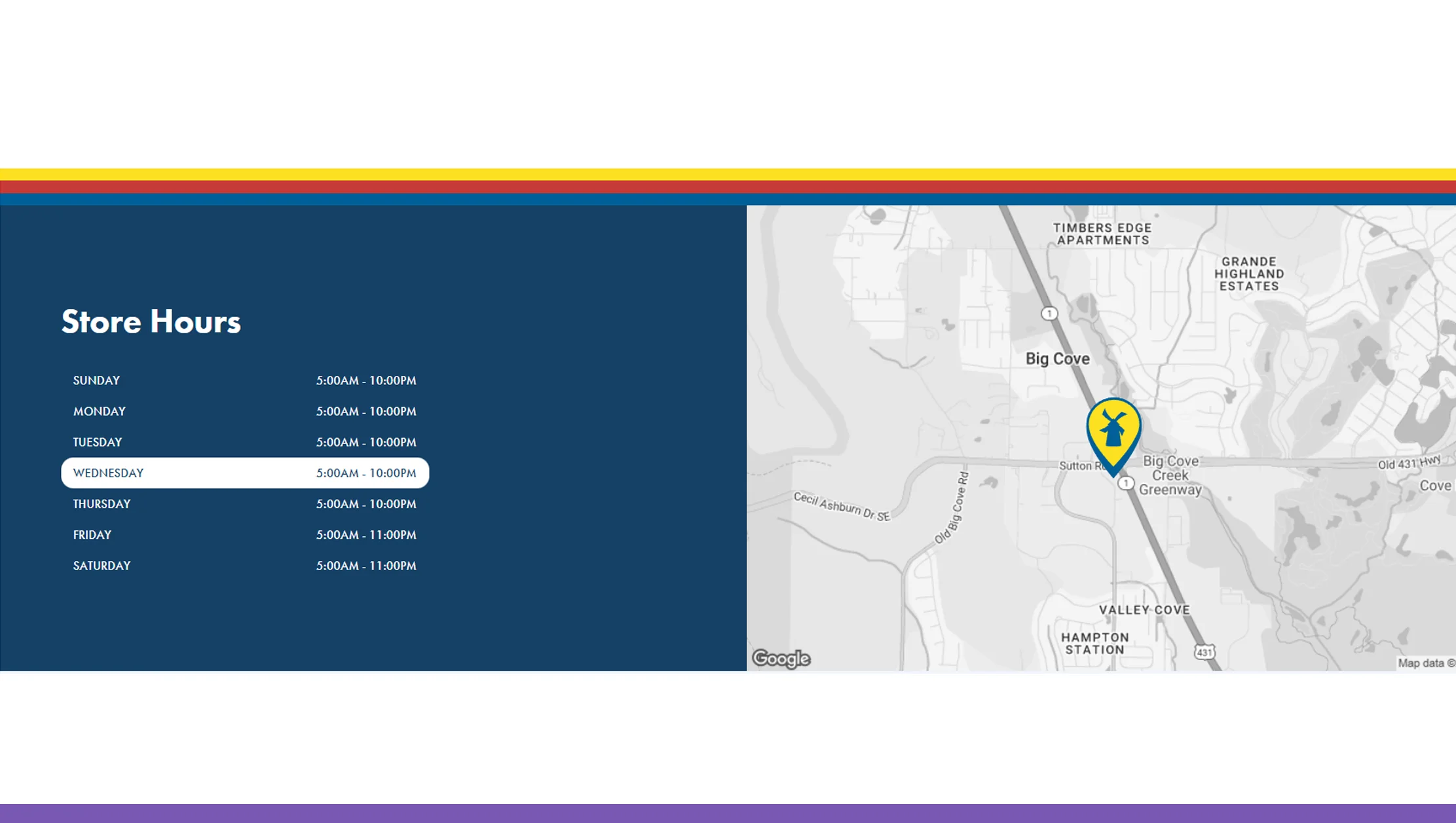

Store Performance Analytics Using Location Signals

Dutch Bros stores don’t perform equally. By scraping location signals like coordinates, drive-thru options, and hours, Real Data API helps businesses rank stores by performance indicators.

A key feature is the ability to extract coordinates of Dutch Bros outlets and correlate them with factors like proximity to highways, urban centers, or schools. Real Data’s analytics show that stores within 1 km of college campuses receive 18% more foot traffic (2020–2025 data).

With real-time coffee chain scraping, franchisees can track which store formats succeed best and under what conditions. For example, 24-hour drive-thru outlets outperform standard outlets by 22% on average.

Brands can also compare hourly trends, using scrape opening hours and geodata to optimize labor and stock planning. If one ZIP code shows peak activity from 7–10 AM, staffing and promotions can be localized accordingly.

These micro-level insights enable data-backed operational tweaks, making your locations more profitable and better suited for local demand.

Dataset Downloads for Business Intelligence

Central to every expansion or analytics strategy is a solid dataset. Real Data API enables Dutch Bros dataset download that includes fields like store name, address, ZIP, geo-coordinates, opening hours, and local competition.

Having access to this structured dataset supports BI teams, franchise consultants, and GIS analysts in building their models. For instance, overlaying the data with traffic heatmaps or consumer spending patterns can surface correlations that drive ROI.

Between 2020 and 2025, usage of franchise store location dataset USA increased by 40% among multi-unit franchise operators who wanted centralized control with local autonomy.

Integration-ready formats (CSV, JSON, API endpoints) ensure your data pipeline remains flexible. You can also automate refresh intervals to always work with the latest listings using fast food POI data scraping USA.

If you need to embed this data in dashboards, Real Data API supports Power BI, Tableau, and Looker integrations for real-time insights.

Visualizing Opportunities with Geospatial Tools

Visualization brings clarity to complex datasets. Real Data API’s interactive mapping tools help map Dutch Bros franchise locations over population density, competitor radius, and retail clusters.

Tools like heatmaps, circle buffers, and drive-time visualizations simplify franchise planning. Using scrape franchise store locations features, you can evaluate new site proposals against traffic zones or zoning regulations.

Between 2020–2025, businesses using Real Data API’s mapping tools cut average expansion time by 28%. That’s because visualization helped eliminate poor-fit locations early in the process.

Integrating Google Maps data is also possible, supporting coffee chain web scraping USA use cases. Brands can plan hyperlocal campaigns or build franchise pitch decks with map-based storytelling.

By aligning POI visuals with strategy, Real Data API enables smarter decisions that resonate across operations, marketing, and finance.

Why Choose Real Data API?

Real Data API offers scalable, reliable, and precise data extraction services tailored for retail and F&B brands. Whether you’re a market analyst, franchise developer, or business consultant, our F&B outlet scraping API USA helps you stay ahead.

We specialize in everything from restaurant chain web scraping to geospatial intelligence. Our structured outputs and custom filters make it easy to scrape retail chain store data 2025, monitor trends, and validate market assumptions. From POI data API for coffee brands to opening hours and competitive benchmarks, Real Data API handles the heavy lifting.

With automated scheduling, dashboard-ready exports, and enterprise-grade support, we ensure you can focus on growth while we provide the data backbone.

Conclusion

As Dutch Bros Coffee continues to expand across the U.S., accurate and timely location intelligence will define the success of new store rollouts. From analyzing store density to identifying ZIP-level opportunities, Dutch Bros Coffee location data scraping USA offers a reliable path to strategic growth. Real Data API empowers you to access actionable insights through our flexible POI solutions. Whether you aim to extract ZIP code-based coffee outlets, benchmark competitors, or optimize your expansion pipeline, our platform is built for precision.

Get started with a custom Dunkin’ Donuts dataset download, integrate our API into your franchise dashboard, or simply explore data trends with our intuitive tools. Ready to make smarter location decisions? Reach out to Real Data API today and transform how you plan store expansion, competition tracking, and local market discovery.