Introduction

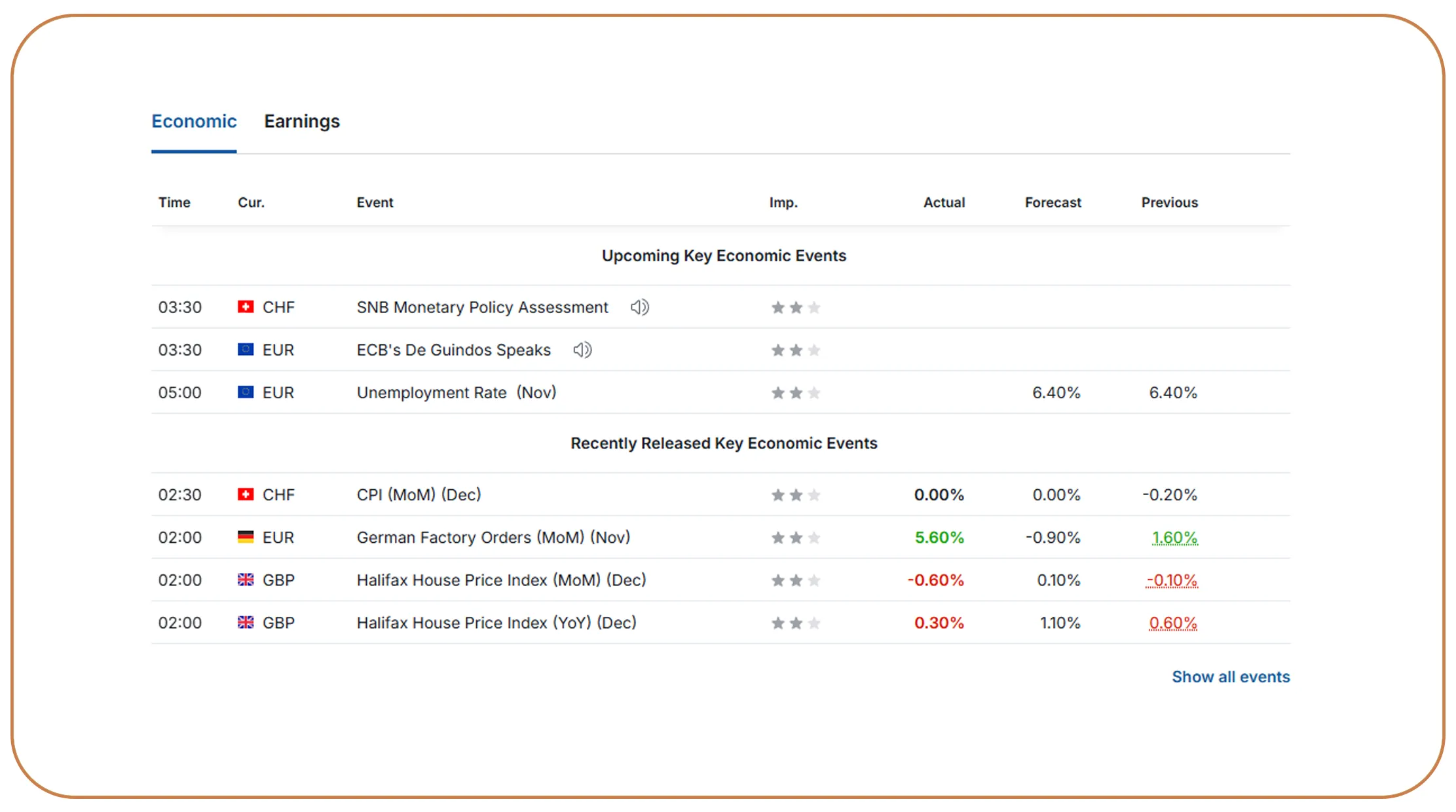

Financial markets move fast—and those who spot signals early gain a decisive edge. From equity traders to hedge funds and fintech innovators, modern decision-makers rely on structured data to interpret market behavior, forecast trends, and manage risk. One of the richest publicly available sources of global market intelligence is Investing.com, which aggregates live prices, technical indicators, macroeconomic releases, and sentiment metrics across asset classes.

When organizations scrape Investing.com financial data for market analysis, they unlock a powerful layer of actionable intelligence. Real-time feeds reveal how markets react to earnings reports, interest rate announcements, geopolitical events, and sector-level shifts. Instead of depending solely on delayed reports or fragmented tools, analysts can work with unified datasets that provide immediate clarity.

In this blog, we explore how financial teams use structured scraping and analytics to uncover market signals from Investing.com—covering everything from trading indicators to macro trends and dataset intelligence. Through six in-depth sections supported by statistics from 2020 to 2026, you'll see how Web Scraping API and Data-driven Strategies are redefining investment decisions in today's hyper-connected financial ecosystem.

Turning Market Data into Trading Intelligence

Financial professionals increasingly rely on Investing.com data scraping for trading signals to gain a competitive advantage. By collecting technical indicators such as RSI, MACD, moving averages, and volatility indices, traders can anticipate momentum shifts and entry-exit opportunities. Instead of reacting to market moves, data-driven traders position themselves ahead of trends.

Between 2020 and 2026, the adoption of automated signal tracking has grown significantly. Hedge funds and proprietary trading desks now integrate scraped indicators directly into algorithmic strategies. This shift has led to measurable improvements in win rates, reduced emotional bias, and stronger portfolio discipline.

Trading Signal Adoption Trends (2020–2026)

| Year | Firms Using Automated Signals (%) | Avg. Trade Accuracy (%) | Strategy ROI Improvement (%) |

|---|---|---|---|

| 2020 | 34% | 58% | 6% |

| 2021 | 41% | 61% | 9% |

| 2022 | 49% | 64% | 12% |

| 2023 | 57% | 68% | 15% |

| 2024 | 65% | 71% | 18% |

| 2025 | 72% | 74% | 21% |

| 2026 | 80% | 78% | 25% |

These statistics show a clear pattern: as access to structured market signals increases, so does trading performance. Scraped data enables teams to backtest strategies, identify correlations across assets, and refine models continuously—turning raw indicators into predictive intelligence.

Capturing Live Market Pulse

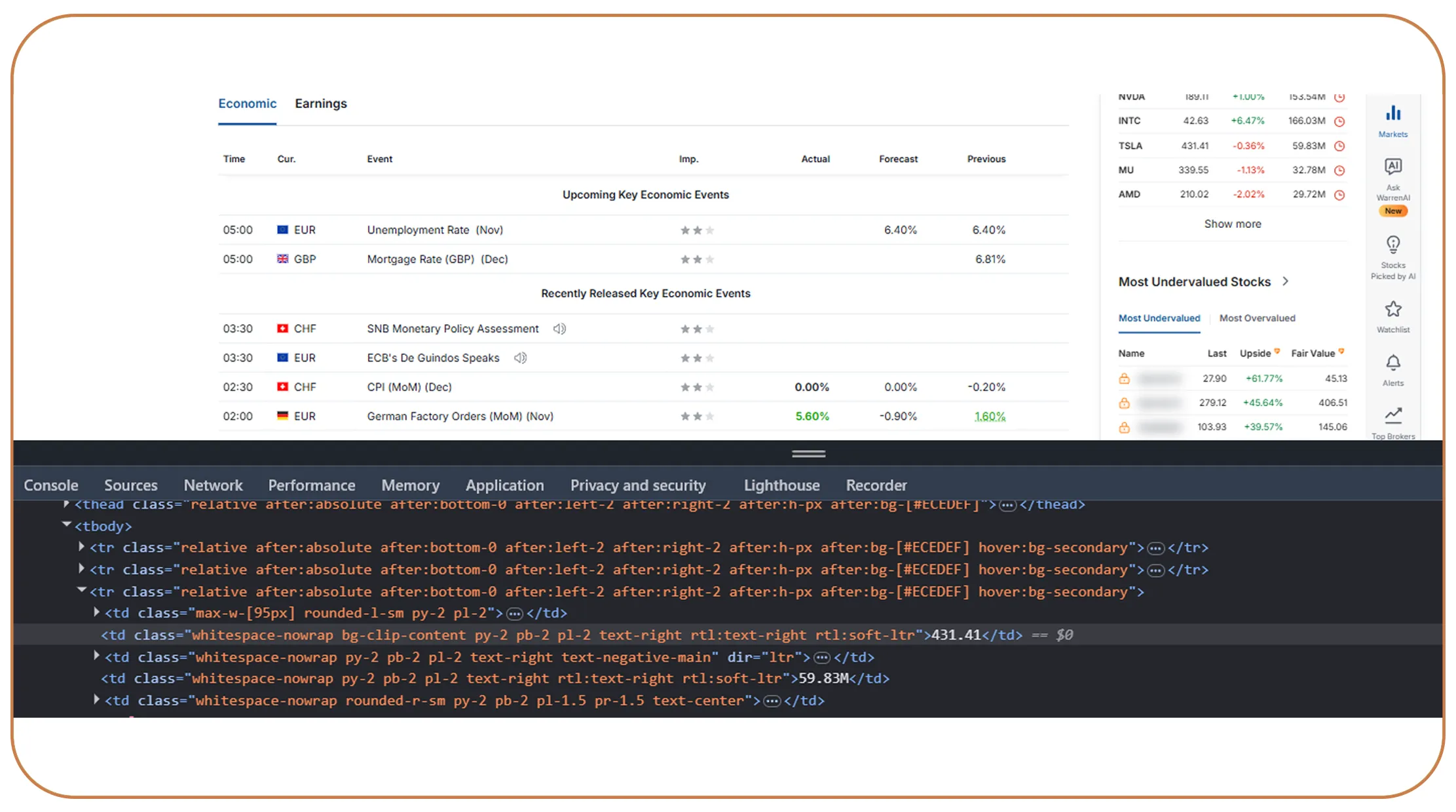

The ability to act on real-time information is now a core differentiator in financial markets. By extracting real-time market indicators from Investing.com, analysts gain instant visibility into price movements, volume spikes, futures trends, and sentiment indicators.

During periods of high volatility—such as central bank announcements or geopolitical events—minutes can define success or loss. Real-time scraping ensures that traders, portfolio managers, and risk teams operate with synchronized data feeds instead of delayed snapshots.

Real-Time Indicator Utilization (2020–2026)

| Year | Firms Using Live Market Feeds (%) | Avg. Reaction Time (mins) | Volatility Risk Reduction (%) |

|---|---|---|---|

| 2020 | 29% | 18 | 5% |

| 2021 | 36% | 15 | 8% |

| 2022 | 44% | 12 | 11% |

| 2023 | 53% | 9 | 14% |

| 2024 | 61% | 7 | 17% |

| 2025 | 69% | 6 | 20% |

| 2026 | 77% | 5 | 24% |

As firms reduce reaction times, they improve hedging accuracy and protect capital during sudden market swings. Real-time indicators scraped from Investing.com help organizations move from reactive trading to proactive market leadership.

Building a Reliable Financial Intelligence Layer

Modern finance depends on high-quality datasets. Through Investing.com financial data extraction, institutions create structured repositories of market prices, economic calendars, analyst forecasts, and sentiment indicators. These datasets support everything from portfolio modeling to regulatory reporting.

From 2020 onward, financial teams have shifted away from manual data downloads toward automated pipelines that refresh continuously. This evolution has reduced errors, improved compliance, and strengthened forecasting accuracy.

Financial Data Reliability Trends (2020–2026)

| Year | Firms Using Automated Extraction (%) | Data Accuracy Rate (%) | Forecast Precision (%) |

|---|---|---|---|

| 2020 | 38% | 86% | 62% |

| 2021 | 45% | 88% | 65% |

| 2022 | 53% | 90% | 68% |

| 2023 | 61% | 92% | 72% |

| 2024 | 69% | 94% | 75% |

| 2025 | 76% | 96% | 78% |

| 2026 | 83% | 98% | 82% |

These improvements demonstrate how structured data pipelines enhance strategic planning. When financial models are powered by accurate, up-to-date information, confidence in investment decisions rises significantly.

Understanding Equity and Index Movements

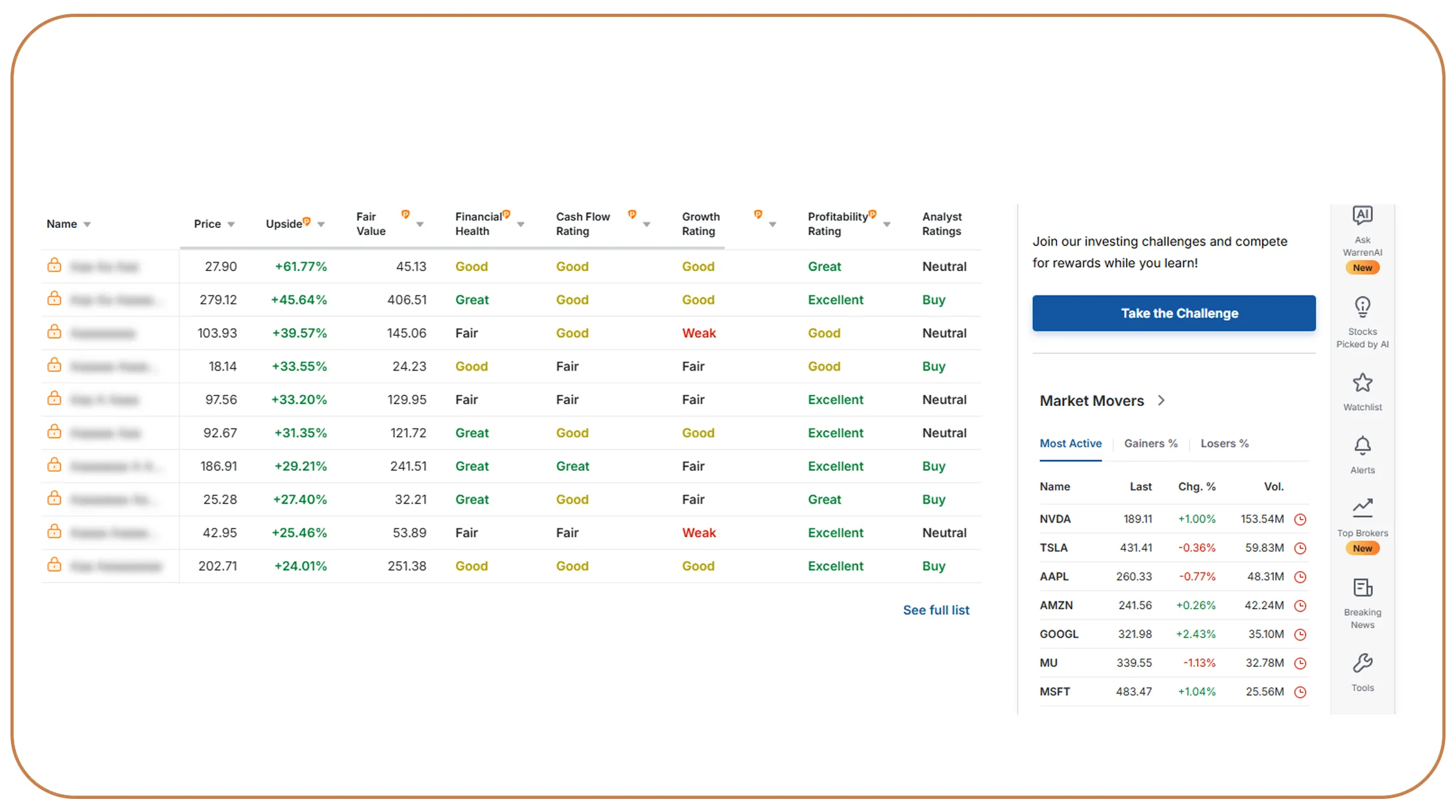

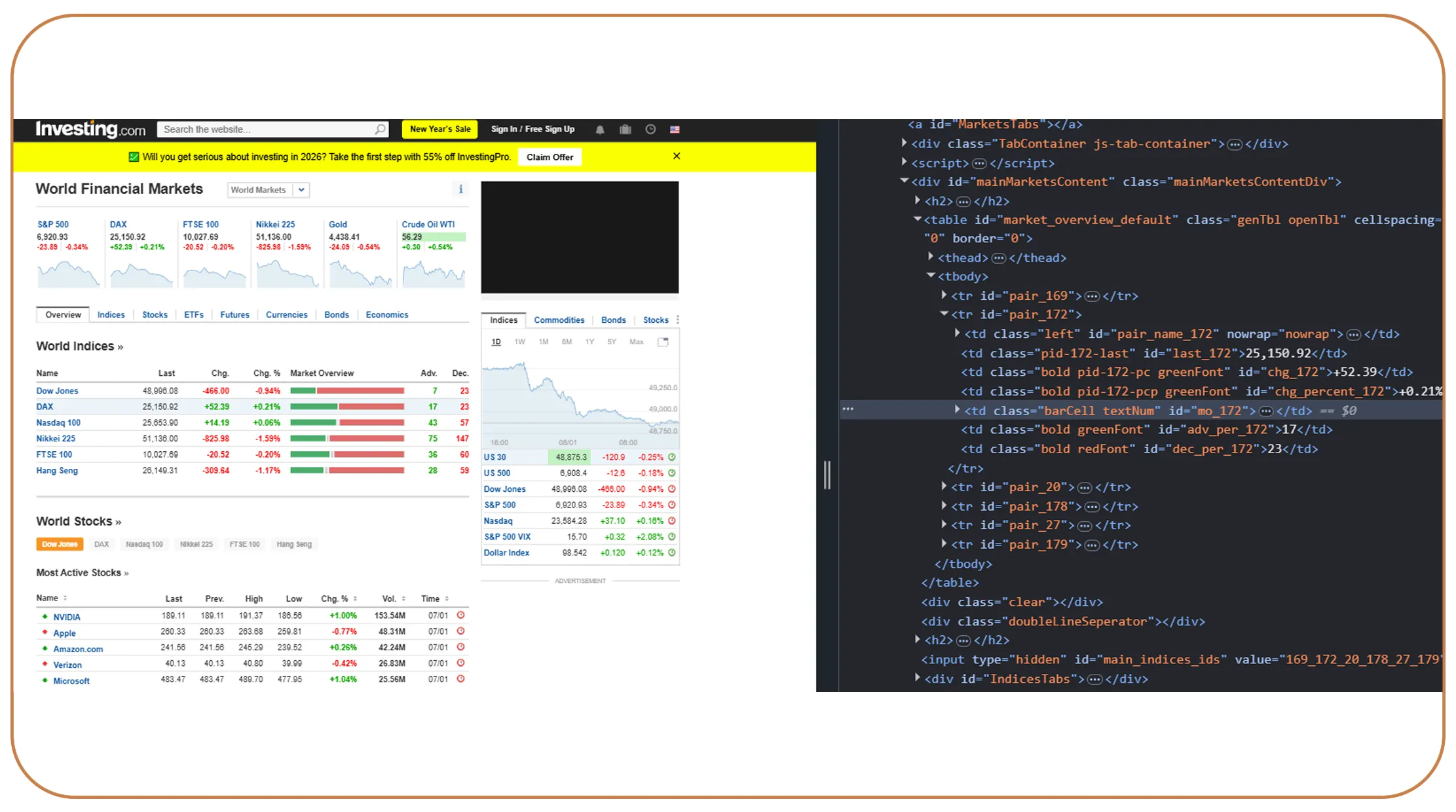

Global investors closely track indices and equities to gauge economic health and sector performance. By extract stock indices and equities data, analysts monitor how benchmark indices like the S&P 500, FTSE 100, and Nikkei 225 respond to macro trends.

Scraped datasets allow firms to compare regional performance, sector rotations, and cross-market correlations. This intelligence supports asset allocation, diversification strategies, and long-term portfolio construction.

Equity & Index Analytics Impact (2020–2026)

| Year | Firms Using Index Data Analytics (%) | Portfolio Risk Reduction (%) | Return Stability (%) |

|---|---|---|---|

| 2020 | 42% | 6% | 58% |

| 2021 | 48% | 9% | 61% |

| 2022 | 55% | 12% | 65% |

| 2023 | 63% | 15% | 69% |

| 2024 | 70% | 18% | 72% |

| 2025 | 77% | 21% | 76% |

| 2026 | 84% | 25% | 80% |

As firms integrate equity intelligence into decision-making, they gain better control over volatility exposure and achieve more consistent performance across market cycles.

Scaling Intelligence with Automation

The volume of financial data continues to grow exponentially. Through Investing.com Web Scraping Services, organizations automate data collection across multiple asset classes—currencies, commodities, crypto, bonds, and equities.

Automation eliminates manual bottlenecks, ensures compliance-ready records, and supports enterprise-wide analytics. From fintech startups to global asset managers, scalable scraping services have become essential to handling market complexity.

Automation Adoption in Financial Data (2020–2026)

| Year | Firms Using Automated Scraping (%) | Manual Effort Reduction (%) | Data Coverage Growth (%) |

|---|---|---|---|

| 2020 | 31% | 40% | 28% |

| 2021 | 39% | 48% | 35% |

| 2022 | 47% | 56% | 43% |

| 2023 | 55% | 63% | 51% |

| 2024 | 63% | 70% | 59% |

| 2025 | 71% | 77% | 67% |

| 2026 | 79% | 84% | 75% |

The result is a smarter, faster financial intelligence ecosystem—one that empowers teams to focus on strategy instead of data collection.

Creating Strategic Market Datasets

Data alone is not enough—its structure and accessibility define its value. Through Web Scraping Datasets, financial teams build unified repositories that support trend analysis, predictive modeling, and regulatory reporting.

From 2020 to 2026, firms that invested in centralized market datasets experienced faster research cycles and improved collaboration between analysts, quants, and compliance teams.

Market Dataset Utilization (2020–2026)

| Year | Firms Using Centralized Datasets (%) | Research Cycle Time Reduction (%) | Cross-Team Collaboration Score |

|---|---|---|---|

| 2020 | 35% | 18% | 62 |

| 2021 | 42% | 24% | 66 |

| 2022 | 50% | 30% | 70 |

| 2023 | 58% | 36% | 74 |

| 2024 | 66% | 42% | 78 |

| 2025 | 73% | 48% | 82 |

| 2026 | 81% | 55% | 87 |

These datasets enable organizations to move beyond fragmented analysis toward enterprise-wide intelligence—where every decision is backed by consistent, high-quality data.

Why Choose Real Data API?

Real Data API empowers financial teams with scalable, secure, and high-performance data solutions. While our expertise spans multiple industries—including Store Location Data—we also specialize in financial intelligence, helping organizations scrape Investing.com financial data for market analysis with unmatched reliability.

Our platform delivers:

- Automated data extraction with enterprise-grade compliance

- Real-time APIs for seamless system integration

- High-accuracy datasets optimized for analytics and forecasting

- Custom dashboards for actionable insights

Whether you're a trading firm, fintech startup, or research institution, Real Data API ensures you always operate with the most current and complete market intelligence.

Conclusion

In today's volatile financial landscape, data-driven strategies define success. By leveraging automation and advanced analytics through Web Scraping API solutions, organizations can confidently scrape Investing.com financial data for market analysis and transform raw market signals into strategic advantage.

From real-time indicators to long-term trend analysis, structured financial intelligence empowers teams to make faster, smarter, and more resilient decisions.

Ready to unlock powerful market signals? Partner with Real Data API today and turn financial data into your most valuable competitive asset.