Introduction

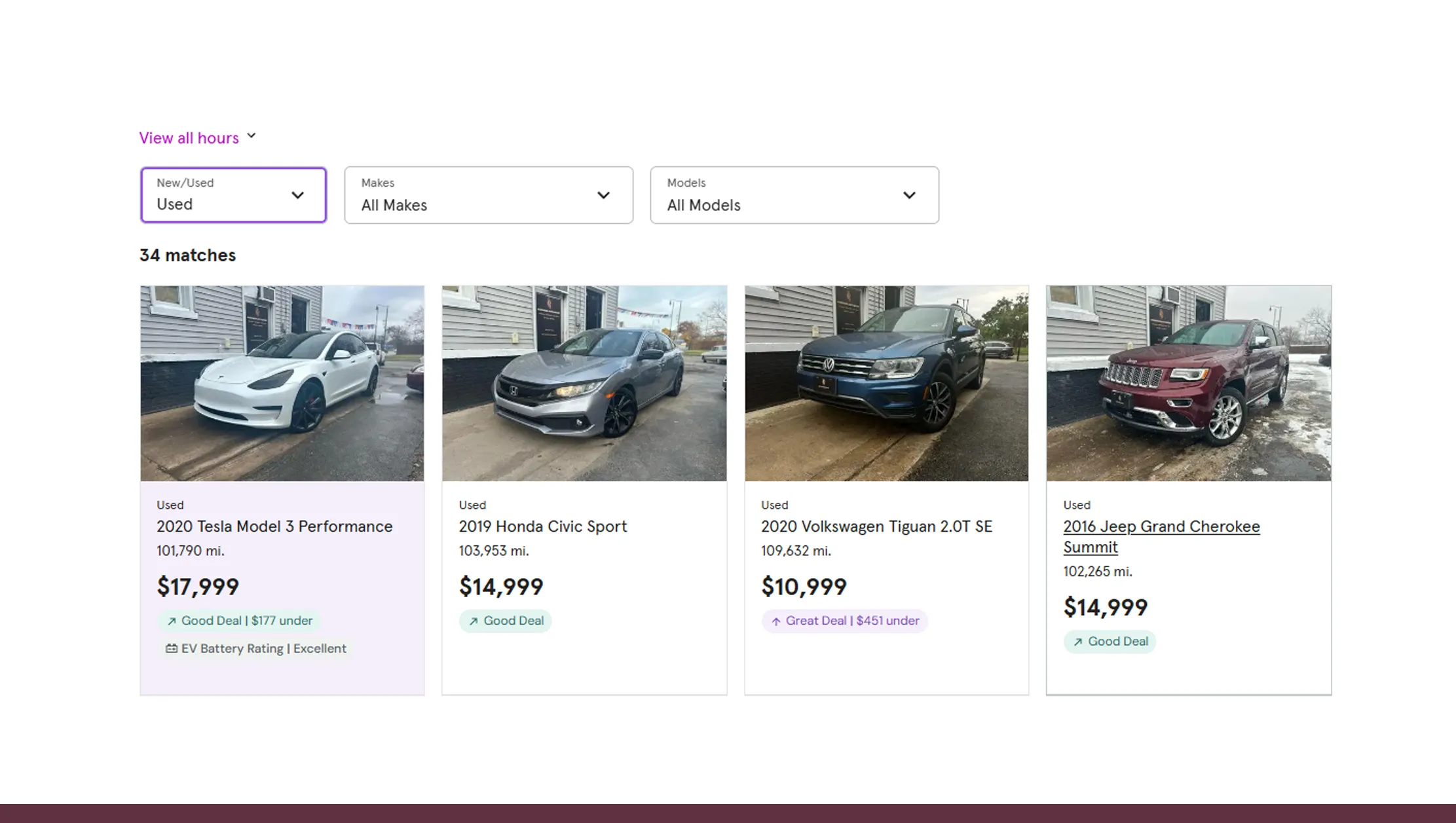

The used-car market has evolved into a highly data-driven ecosystem where pricing accuracy and demand visibility define competitive advantage. Automotive brands, dealers, and analysts increasingly rely on advanced data pipelines to scrape Vehis auto listings for pricing and demand analysis, enabling real-time intelligence across vehicle types, fuel categories, and regional markets. Vehis, as a structured automotive listings platform, provides valuable insights into listing volumes, price fluctuations, mileage trends, and seller behavior. By transforming raw listings into actionable intelligence, brands can respond faster to market shifts, identify undervalued inventory, and align pricing with real buyer demand. This blog explores how Vehis-driven analytics empowers businesses with historical depth, predictive visibility, and scalable market intelligence from 2020 to 2026.

Market Evolution Through Data Signals

Understanding long-term shifts in the used-car market requires structured extraction of listings, pricing, and availability. By applying Vehis data scraping to analyze used car market trends, brands gain visibility into how demand evolved during supply disruptions, post-pandemic recovery, and digital-first purchasing behavior.

From 2020 onward, listing volumes steadily increased while average prices fluctuated due to supply constraints and fuel transitions. Data shows a sharp rise in compact SUVs and electric vehicles beginning in 2023, driven by affordability and sustainability preferences.

Used-Car Market Listing Growth (Vehis Data)

| Year | Avg Listings (Millions) | Avg Price (USD) | YoY Demand Growth |

|---|---|---|---|

| 2020 | 1.8 | 9,200 | 3% |

| 2021 | 2.1 | 9,800 | 6% |

| 2022 | 2.6 | 10,900 | 11% |

| 2023 | 3.2 | 11,400 | 14% |

| 2024 | 3.7 | 11,900 | 9% |

| 2025 | 4.1 | 12,300 | 7% |

| 2026 (Projected) | 4.6 | 12,800 | 6% |

These insights allow brands to align inventory planning with evolving buyer behavior while anticipating demand saturation points.

Visibility Into Pricing & Stock Availability

Accurate decision-making depends on structured access to pricing and inventory depth. By extracting vehicle price and availability data from Vehis, businesses track how long vehicles remain listed, which price bands convert faster, and where oversupply exists.

Between 2020 and 2025, mid-range vehicles priced between $8,000 and $14,000 showed the fastest turnover, while premium listings experienced longer shelf lives. Availability data also revealed strong regional variation, with metro areas showing higher inventory velocity.

Vehis Price & Availability Trends

| Year | Avg Days on Market | Low-Price Share | Mid-Range Share | Premium Share |

|---|---|---|---|---|

| 2020 | 42 | 48% | 38% | 14% |

| 2021 | 39 | 45% | 41% | 14% |

| 2022 | 36 | 43% | 44% | 13% |

| 2023 | 33 | 41% | 46% | 13% |

| 2024 | 31 | 39% | 48% | 13% |

| 2025 | 30 | 38% | 49% | 13% |

| 2026 (Projected) | 28 | 36% | 51% | 13% |

Such insights help dealers optimize acquisition strategies and reduce overpricing risks.

Responding to Market Volatility Instantly

Speed is critical in competitive automotive markets. Leveraging real-time used car pricing insights using Vehis scraping enables brands to respond instantly to price drops, competitor adjustments, and inventory surges.

During 2022–2024, fuel price volatility caused daily price swings, particularly for diesel vehicles. Real-time scraping revealed that listings with dynamic price adjustments sold up to 22% faster than static-priced vehicles.

Real-Time Price Adjustment Impact

| Year | Dynamic Pricing Adoption | Avg Sale Speed Increase |

|---|---|---|

| 2020 | 18% | 6% |

| 2021 | 24% | 9% |

| 2022 | 37% | 15% |

| 2023 | 46% | 19% |

| 2024 | 54% | 22% |

| 2025 | 59% | 24% |

| 2026 (Projected) | 63% | 26% |

Real-time intelligence ensures brands stay competitive without eroding margins.

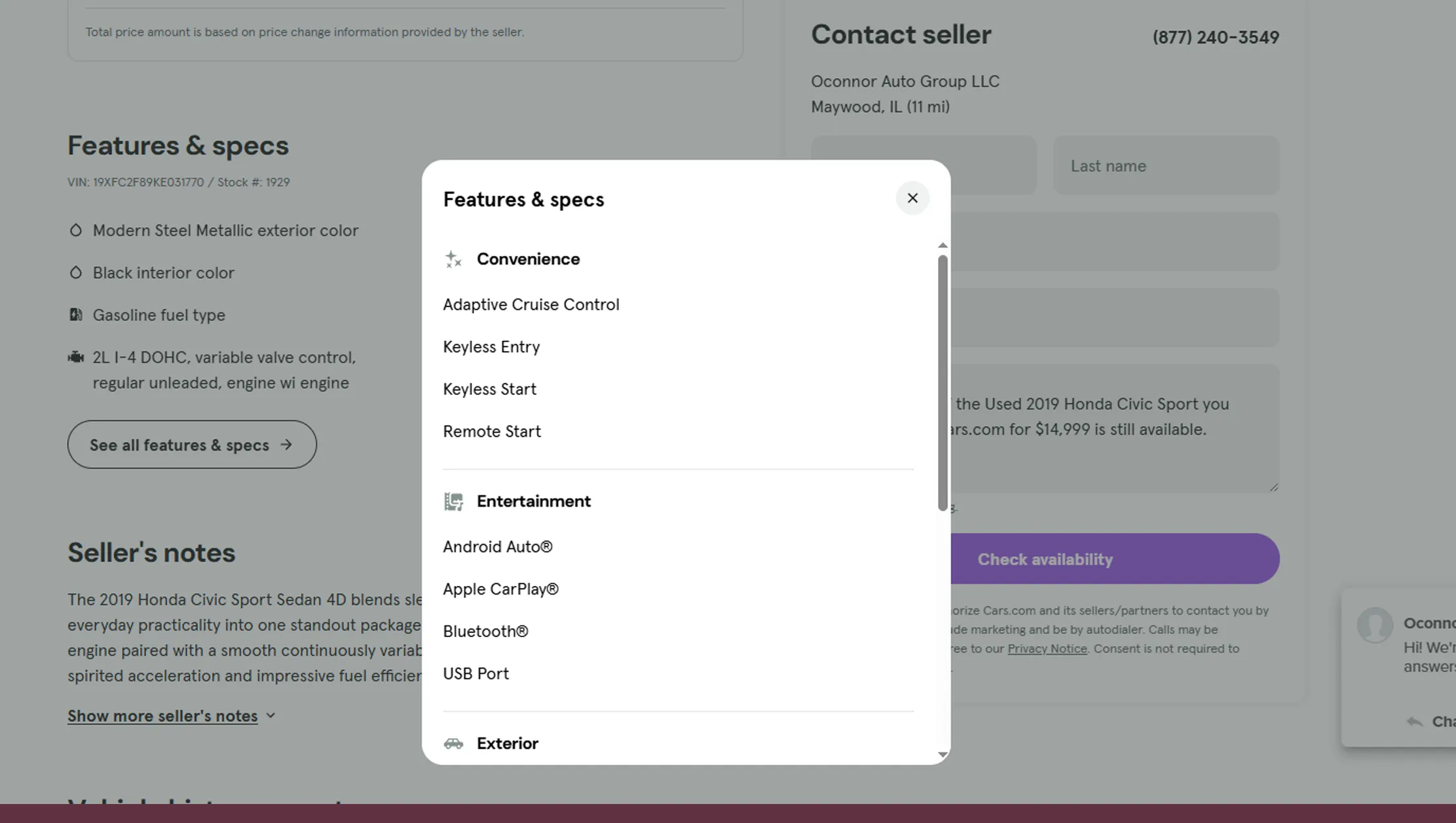

Understanding Demand Drivers Holistically

Beyond pricing, demand is influenced by mileage, age, fuel type, and brand reputation. With Vehis used car market analysis, enterprises uncover correlations between vehicle attributes and buyer interest.

For example, listings under 60,000 miles consistently attract 1.6x more inquiries, while hybrid vehicles saw a 31% demand increase between 2022 and 2024.

Demand Drivers from Vehis Listings

| Attribute | Demand Impact |

|---|---|

| Mileage < 60k | +60% inquiries |

| Hybrid Fuel | +31% demand |

| Single Owner | +22% faster sale |

| Warranty Listed | +18% price premium |

| Urban Location | +27% visibility |

These insights help brands refine sourcing and marketing strategies.

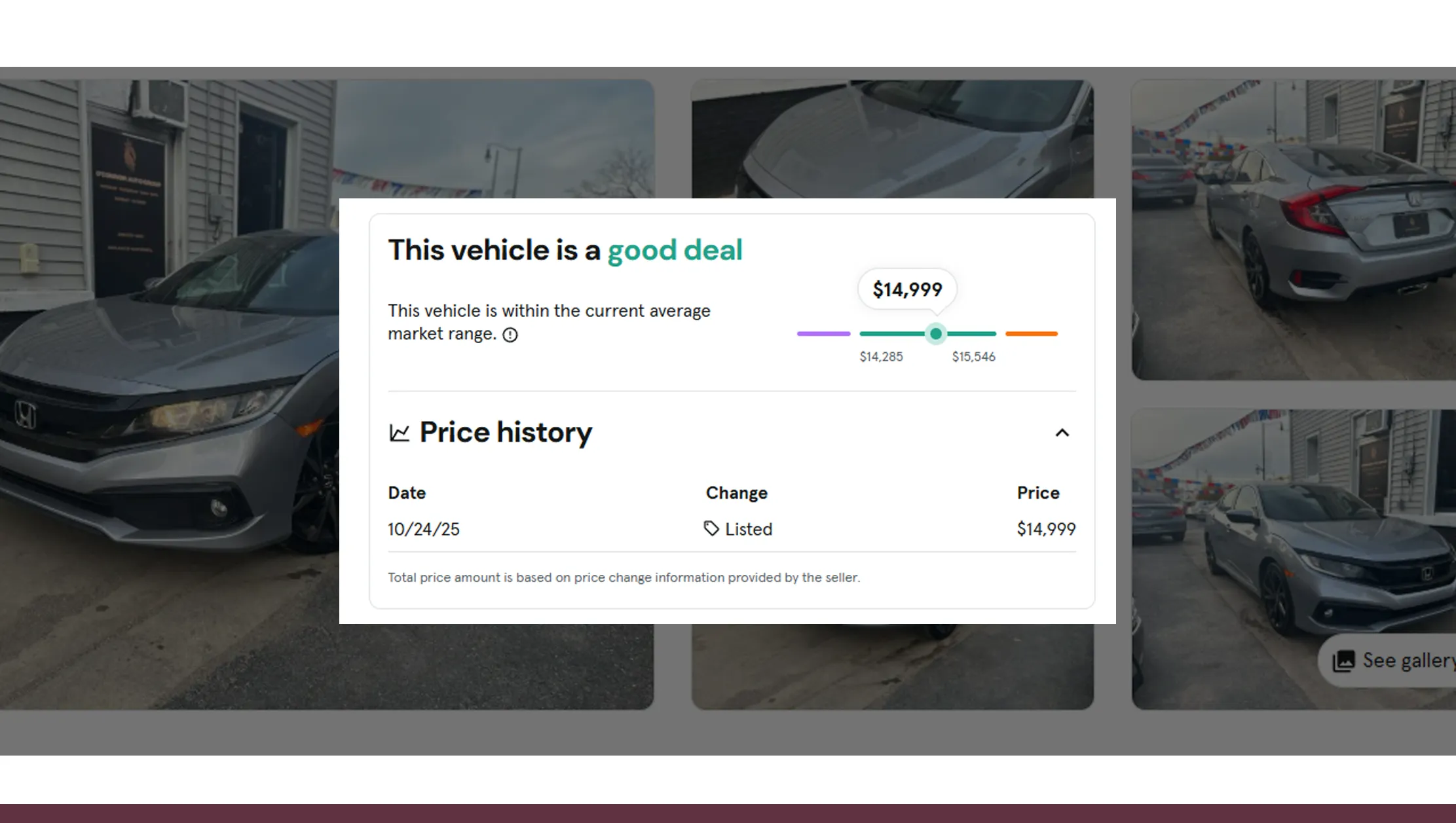

Competitive Price Positioning at Scale

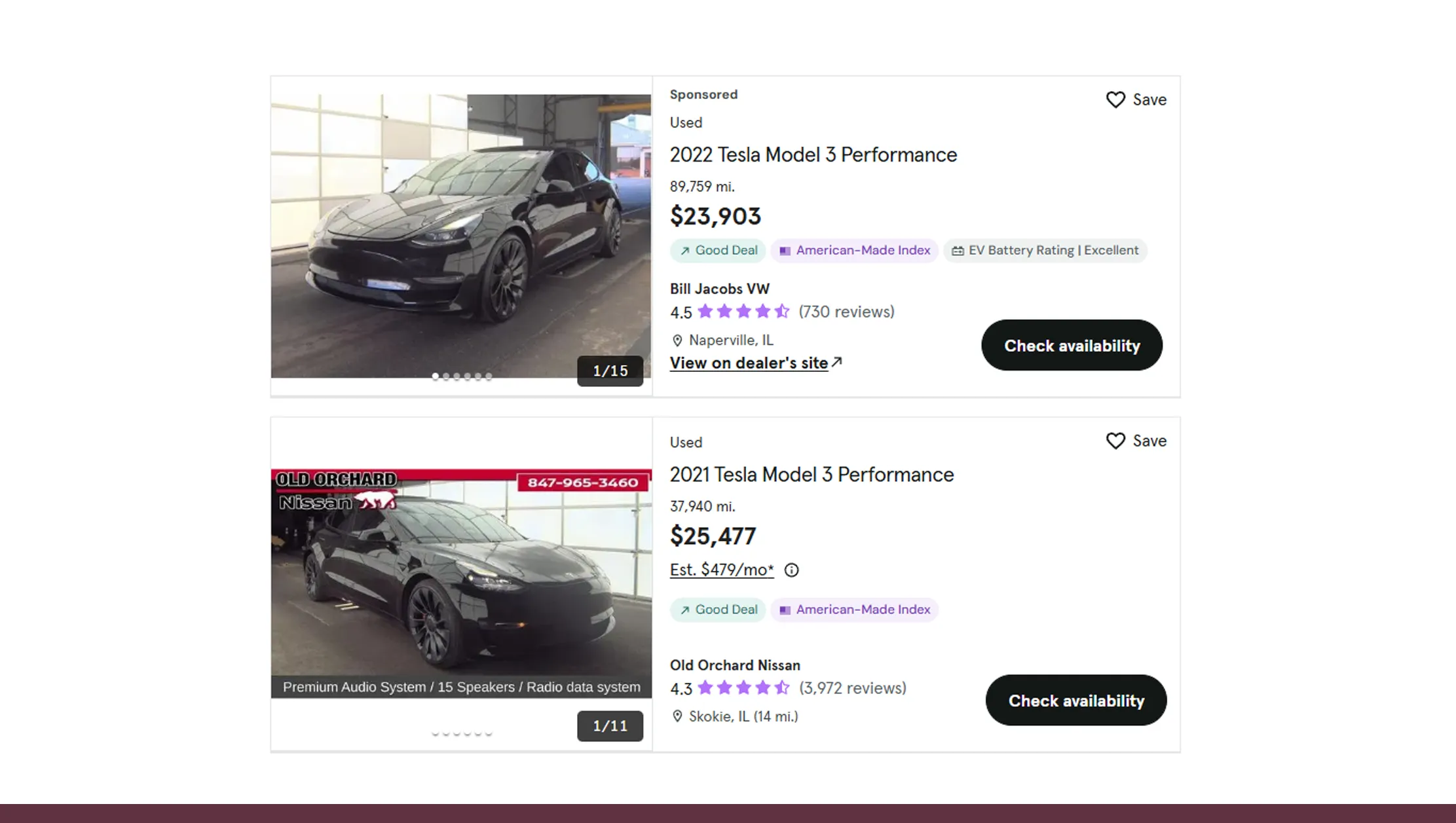

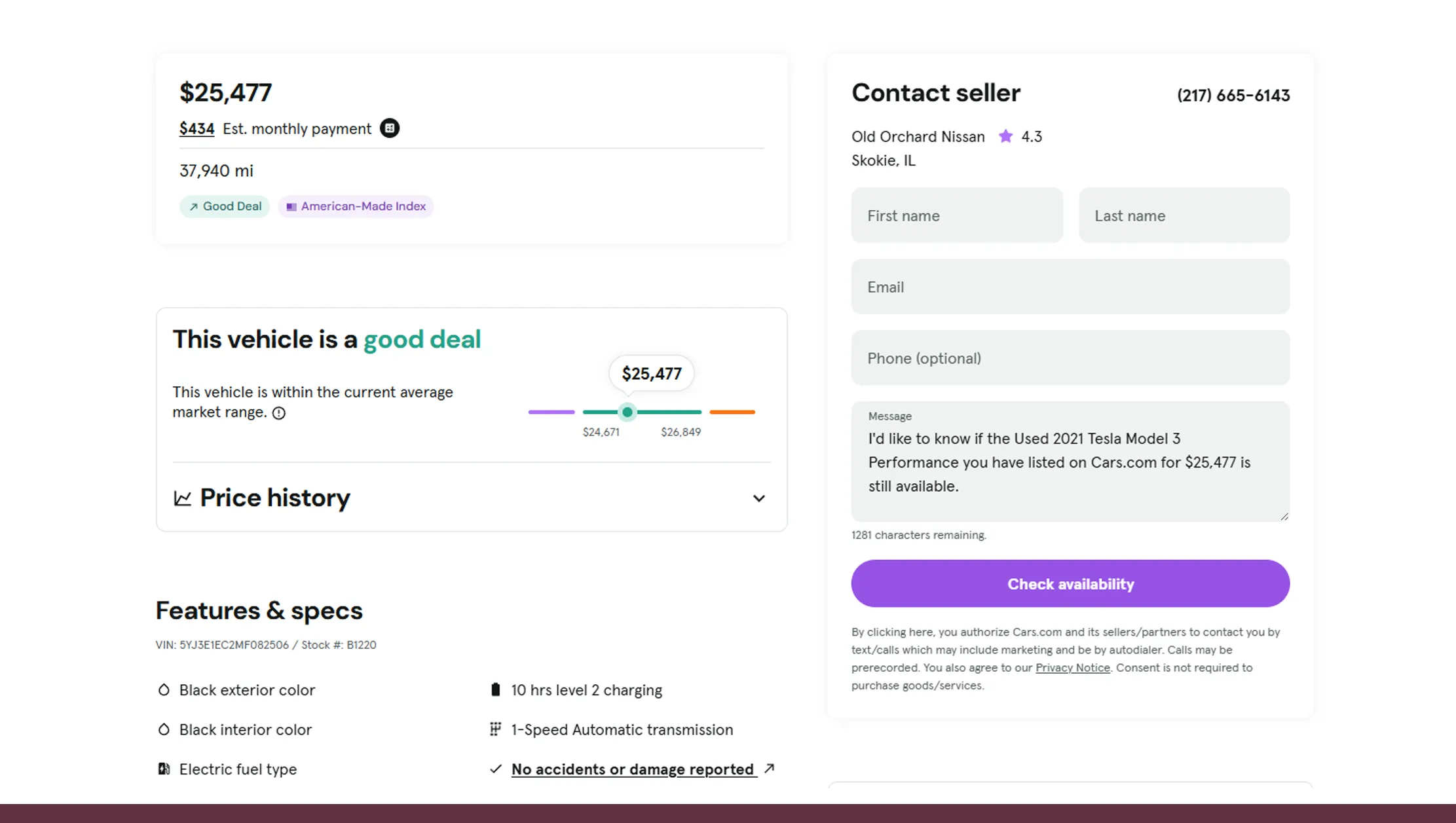

Strategic pricing requires continuous benchmarking. Through Price Comparison, brands track how similar vehicles are priced across sellers, regions, and conditions, ensuring optimal positioning.

Data from 2020–2025 shows that listings priced within 3–5% of market average convert fastest, while deviations beyond 10% significantly slow sales.

Pricing Benchmark Performance

| Price Deviation | Avg Days on Market |

|---|---|

| ±3% | 21 days |

| ±5% | 26 days |

| ±8% | 34 days |

| ±10% | 41 days |

| >10% | 55+ days |

Consistent benchmarking supports both revenue growth and inventory liquidity.

Scaling Intelligence for Enterprise Needs

Large automotive platforms require infrastructure capable of handling millions of records. Enterprise Web Crawling enables structured, compliant, and scalable extraction of Vehis data across regions and vehicle categories.

From 2023 onward, enterprise crawlers supported multi-country expansion, historical backfills, and API-based delivery for analytics platforms.

Enterprise Crawling Growth

| Year | Listings Crawled (Millions) | Data Refresh Frequency |

|---|---|---|

| 2020 | 8 | Weekly |

| 2021 | 12 | Weekly |

| 2022 | 18 | Daily |

| 2023 | 26 | Near Real-Time |

| 2024 | 34 | Near Real-Time |

| 2025 | 41 | Real-Time |

| 2026 (Projected) | 48 | Real-Time |

This scalability ensures consistent insights even as markets expand.

Why Choose Real Data API?

Real Data API delivers enterprise-grade solutions to scrape Vehis auto listings for pricing and demand analysis with unmatched accuracy and reliability. Our Mobile App Scraping API ensures complete market coverage across web and mobile sources, delivering clean, structured datasets in real time. We support historical backfills, live monitoring, and seamless API integration, empowering brands to act faster, smarter, and with confidence across competitive automotive markets.

Conclusion

Used-car markets demand precision, speed, and foresight. By leveraging Real Data API to scrape Vehis auto listings for pricing and demand analysis, brands unlock deep visibility into pricing movements, demand signals, and competitive positioning. These insights transform raw listings into strategic intelligence for Market Research, pricing optimization, and growth planning.

Ready to turn Vehis data into a competitive advantage? Partner with Real Data API today and power your automotive decisions with real-time market intelligence.