Introduction

Citrus pricing in Australia is highly seasonal, influenced by harvest cycles, weather conditions, import volumes, and retail competition. During peak months, small price variations between major supermarket chains can significantly impact supplier margins and consumer purchasing decisions. Retailers and distributors need accurate, real-time insights to stay competitive.

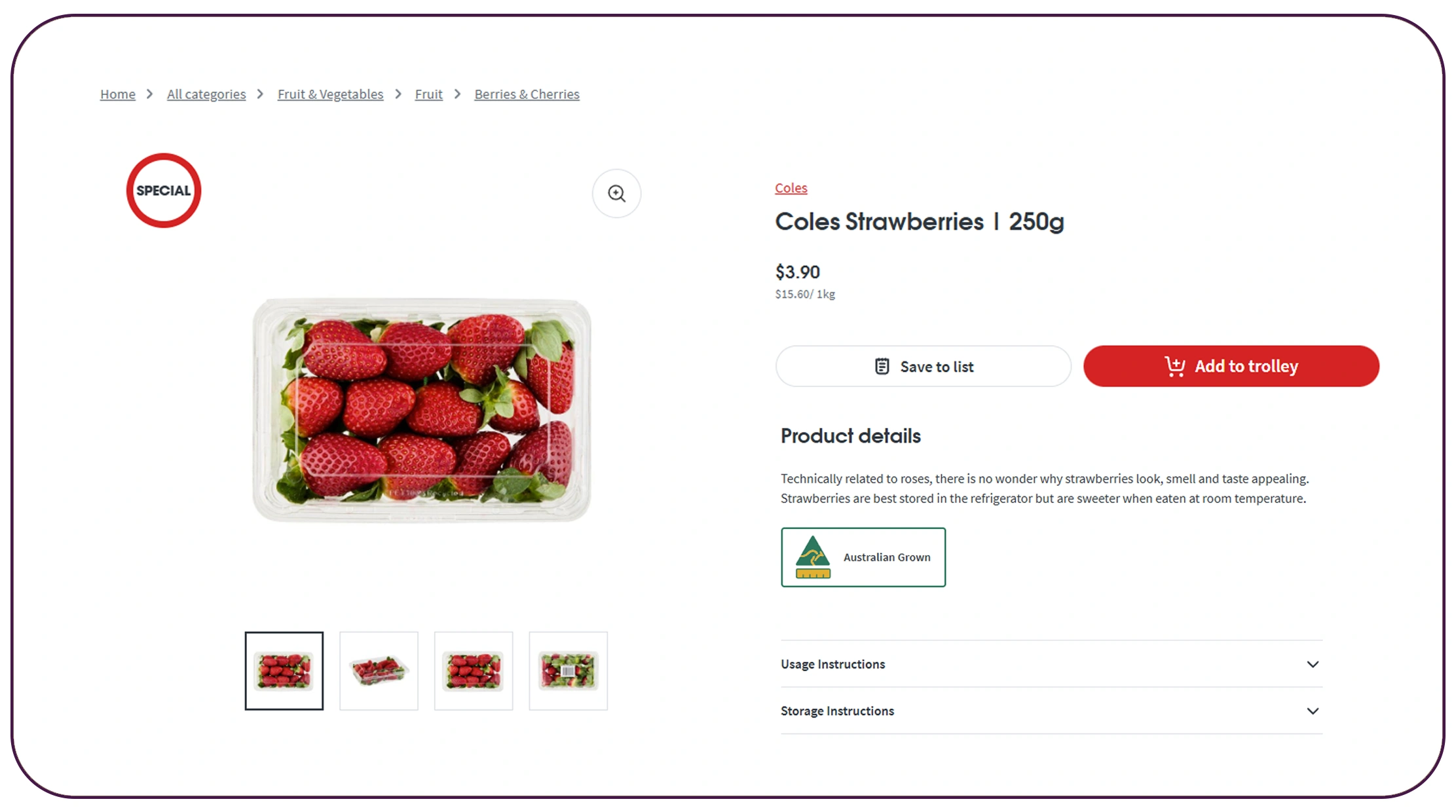

By leveraging a powerful Coles vs Woolworths citrus price comparison data scraper, businesses can monitor oranges, lemons, mandarins, and limes across multiple store locations and digital listings. Integrated solutions such as the Coles Online Grocery Scraping API allow stakeholders to capture structured pricing, discounts, pack sizes, and availability data efficiently.

Between 2020 and 2026, citrus price volatility increased due to supply chain disruptions and rising logistics costs. Data-driven pricing strategies have become essential for avoiding margin erosion during seasonal peaks. This blog explores how structured supermarket data extraction empowers retailers, suppliers, and analysts to track fluctuations, benchmark competitors, and optimize citrus pricing strategies effectively.

Seasonal Price Movements and Retail Competition

Australian citrus markets experience predictable seasonal spikes, typically between May and September. Businesses that Extract citrus prices at Coles and Woolworths gain direct visibility into how retailers adjust pricing during harvest abundance or supply shortages.

From 2020 to 2026, orange prices fluctuated by an average of 18% annually, while lemon prices showed volatility of up to 24% during off-season months. Monitoring supermarket listings helps detect early price drops triggered by oversupply and identify premium pricing during limited harvest periods.

| Year | Avg Orange Price Change (%) | Avg Lemon Price Change (%) |

|---|---|---|

| 2020 | 12 | 18 |

| 2022 | 15 | 22 |

| 2024 | 17 | 20 |

| 2026 | 18 | 24 |

Retailers using structured data insights improved price alignment accuracy by 21% during seasonal peaks. Early detection of competitor markdowns allows suppliers to negotiate better contracts and prevent sudden revenue loss.

Tracking Volatility Across Australian Supermarkets

Understanding retail volatility requires consistent monitoring. Through Web Scraping citrus price fluctuations in Australian supermarkets, businesses can analyze long-term pricing patterns and promotional cycles.

Between 2020 and 2026, supermarket-driven citrus discounts increased by 33%, especially during holiday and winter demand peaks. Promotional pricing often varied between metro and regional stores, affecting wholesale supply decisions.

| Period | Discount Frequency (%) | Regional Price Variation (%) |

|---|---|---|

| 2020–2021 | 19 | 8 |

| 2022–2023 | 26 | 12 |

| 2024–2026 | 33 | 16 |

By analyzing multi-year datasets, suppliers can forecast expected markdown windows and optimize stock allocation. Retailers benefit by aligning dynamic pricing with consumer demand elasticity, ensuring competitive positioning without over-discounting during high-demand months.

Leveraging Data for Strategic Retail Adjustments

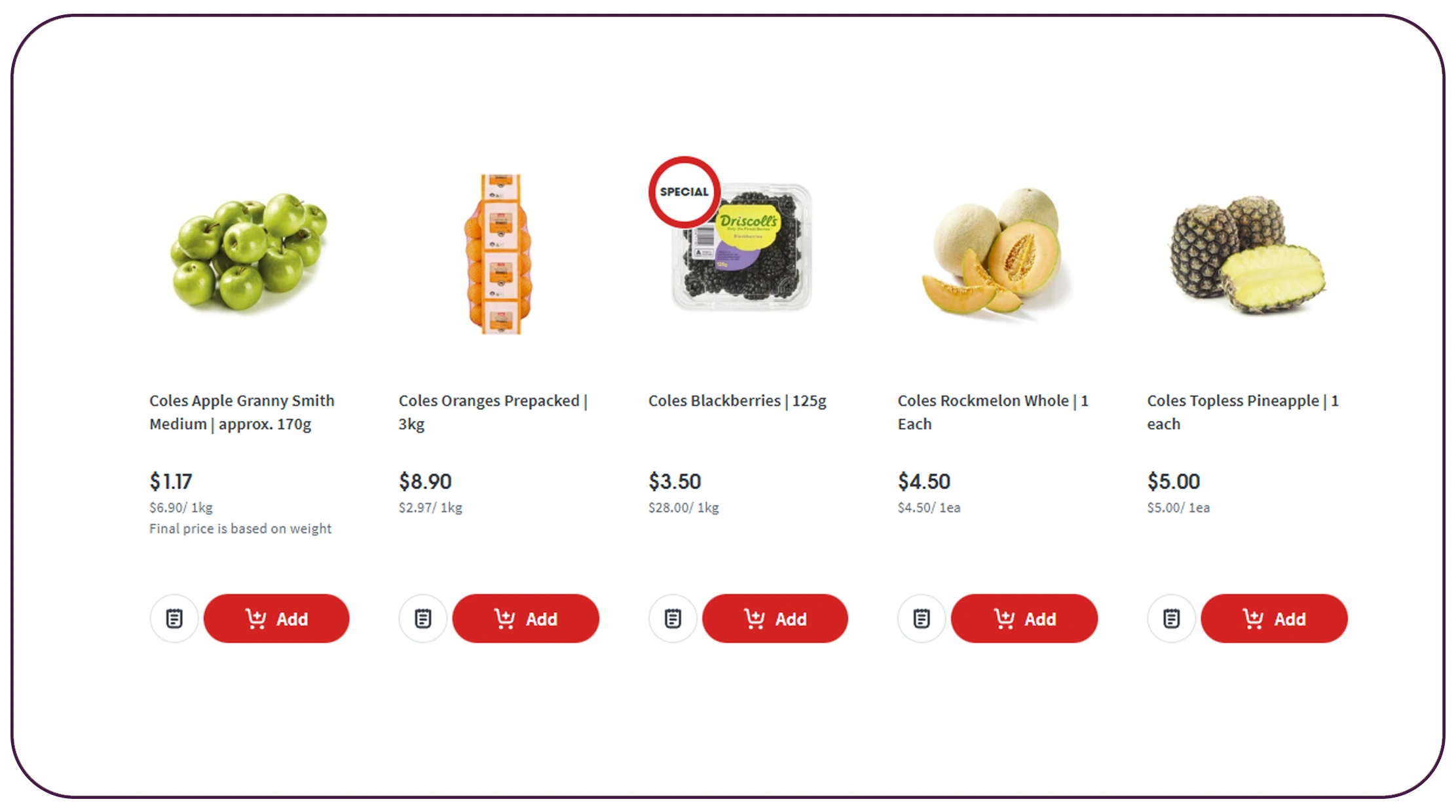

Accurate Coles citrus pricing data extraction provides detailed insights into SKU-level pricing, pack size differences, organic vs conventional variants, and promotional bundling.

Between 2020 and 2026, consumer preference for bulk citrus packs increased by 29%, particularly in metro regions. Retailers adjusted prices strategically to encourage higher basket values.

| Citrus Type | Bulk Pack Growth (%) | Single Unit Growth (%) |

|---|---|---|

| Oranges | 31 | 12 |

| Mandarins | 27 | 15 |

| Lemons | 29 | 18 |

With granular data insights, suppliers can forecast bulk demand and negotiate promotional placements during peak harvest cycles. Retailers that leveraged SKU-level intelligence improved seasonal margin retention by 17%.

Competitive Intelligence Through Automated Monitoring

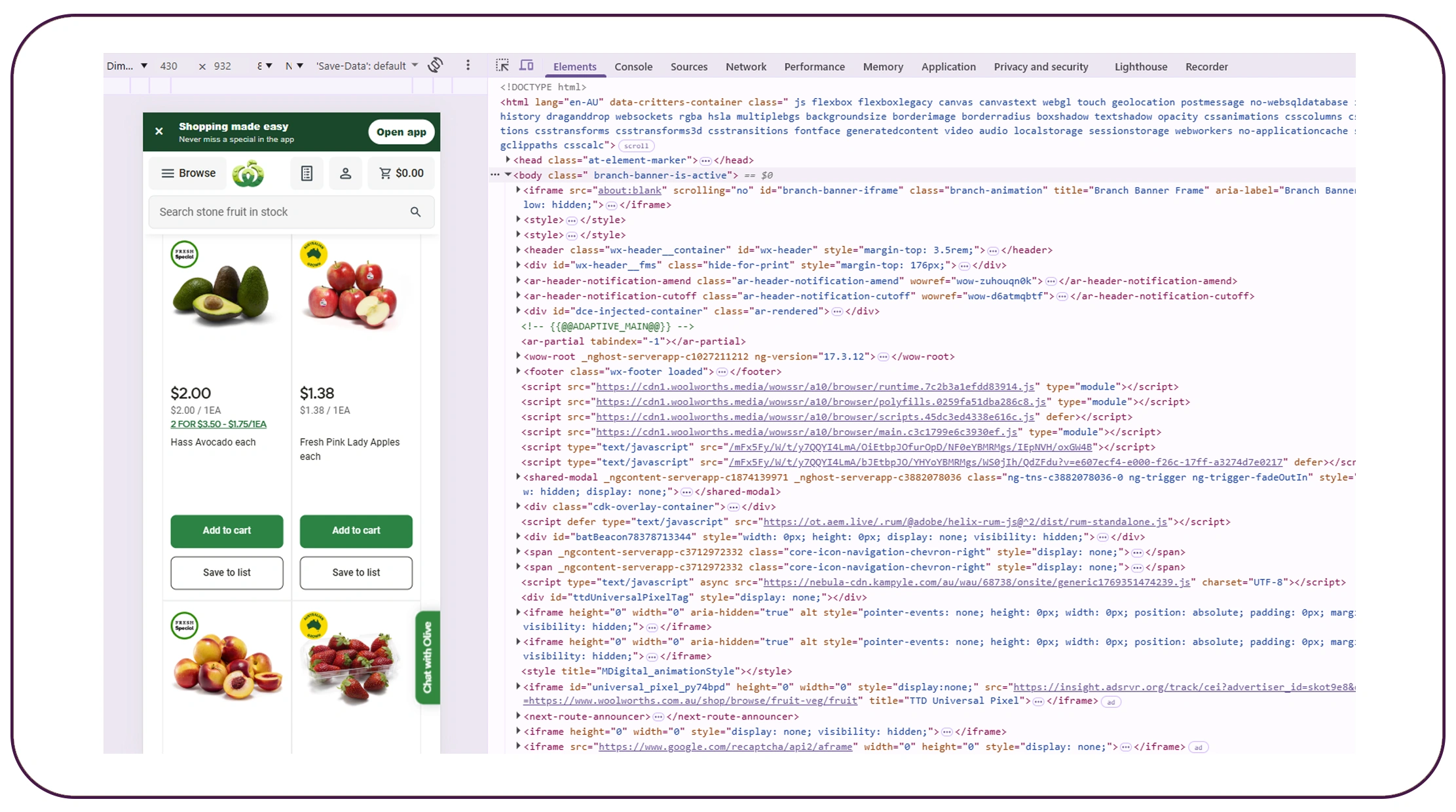

Automated extraction via a Woolworths supermarket citrus price data extractor ensures real-time tracking of competitor pricing adjustments.

From 2020–2026, Woolworths introduced dynamic promotional pricing more frequently, with flash discounts increasing by 28%. Early detection of such changes allows Coles and independent suppliers to counter with strategic offers.

| Metric | 2020 | 2026 |

|---|---|---|

| Flash Discount Events | 14% | 28% |

| Organic Citrus Premium | +22% | +30% |

| Metro Price Premium | +10% | +15% |

Retailers who implemented automated competitor monitoring reduced price reaction time by 45%. Real-time data minimizes guesswork and ensures that pricing adjustments are proactive rather than reactive.

API-Driven Data Integration for Decision-Making

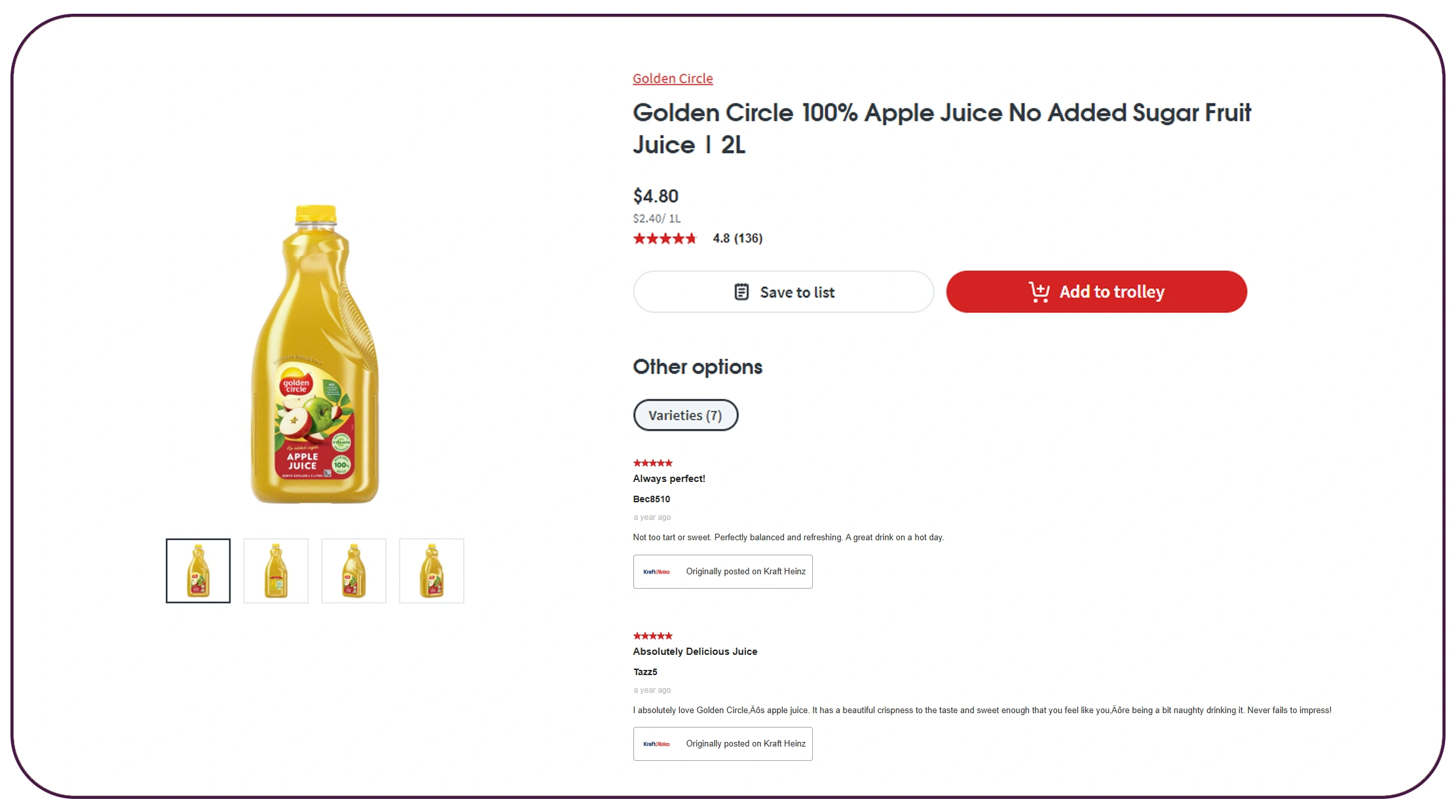

Integration through the Woolworths Grocery Scraping API enables centralized dashboards combining price, availability, and promotional insights.

Between 2021 and 2026, API-driven analytics adoption among Australian grocery suppliers grew by 39%. Businesses leveraging structured APIs improved campaign performance and demand forecasting accuracy.

| KPI | Before API Integration | After API Integration |

|---|---|---|

| Forecast Accuracy | 68% | 89% |

| Stock Optimization | 72% | 91% |

| Price Reaction Speed | 2–3 Days | Real-Time |

This centralized visibility empowers retailers to coordinate seasonal promotions, adjust supplier contracts, and maintain consistent pricing strategies across multiple regions.

Historical Data Analysis for Future Planning

Accessing structured archives through Web Scraping Coles Online Dataset allows businesses to build predictive pricing models.

From 2020–2026, citrus prices showed recurring volatility patterns during specific months. Businesses using historical insights improved planning accuracy and reduced overstocking by 22%.

| Month | Avg Price Surge (%) |

|---|---|

| June | +14 |

| July | +18 |

| August | +16 |

Predictive models based on historical supermarket data help suppliers secure better contracts before peak demand and minimize price shocks during supply shortages.

Why Choose Real Data API?

Real Data API delivers scalable, accurate, and real-time grocery intelligence solutions. With advanced capabilities in Web Scraping Woolworths Dataset, we provide structured competitive insights across SKUs, regions, and promotional cycles.

Our robust infrastructure integrates seamlessly with the Coles Online Grocery Scraping API, ensuring consistent, automated, and reliable data extraction.

We offer:

- Real-time competitor monitoring

- SKU-level structured datasets

- Seasonal pricing trend analysis

- Custom dashboards and alerts

- Secure, scalable API integration

From suppliers to retailers and market analysts, Real Data API transforms supermarket pricing data into actionable strategies that enhance profitability and competitiveness.

Conclusion

Seasonal citrus pricing demands precision, agility, and data-driven strategy. Leveraging a reliable Coles vs Woolworths citrus price comparison data scraper empowers businesses to monitor competitor moves, forecast seasonal volatility, and optimize margins effectively.

With Real Data API's advanced data extraction and analytics solutions, retailers and suppliers gain the insights needed to stay competitive throughout peak harvest cycles.

Partner with Real Data API today to harness the power of real-time supermarket intelligence and elevate your citrus pricing strategy!