Introduction

Loss leader pricing has evolved from a simple footfall tactic into a sophisticated data-driven strategy across retail, consumer electronics, and SaaS markets. With the rise of real-time pricing intelligence, companies increasingly rely on large-scale data collection to understand how below-cost pricing impacts customer acquisition, lifetime value, and cross-sell success. In this research report, we focus on analyzing loss leader pricing using scraped retail data to uncover how brands deploy aggressive discounts while maintaining long-term profitability.

By examining millions of price points collected across marketplaces, brand websites, and SaaS subscription portals, this study reveals how loss leader pricing has changed between 2020 and 2026. We explore sector-specific behaviors, seasonal patterns, and the role of automation and APIs in identifying competitive pricing movements. The findings are designed to help pricing strategists, revenue leaders, and data teams make informed decisions using structured, high-frequency datasets powered by Real Data API.

Market Signals from Below-Cost Pricing

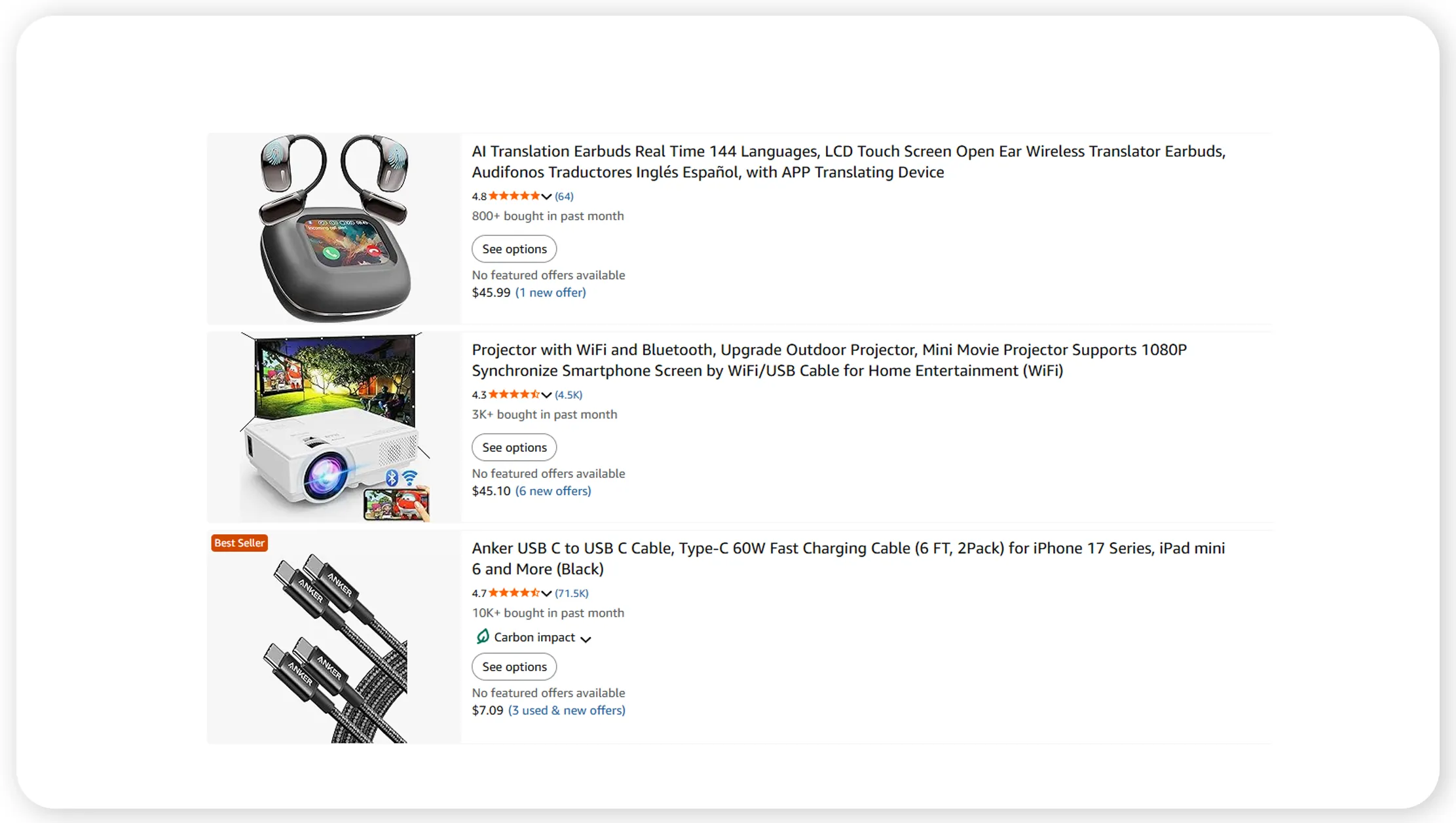

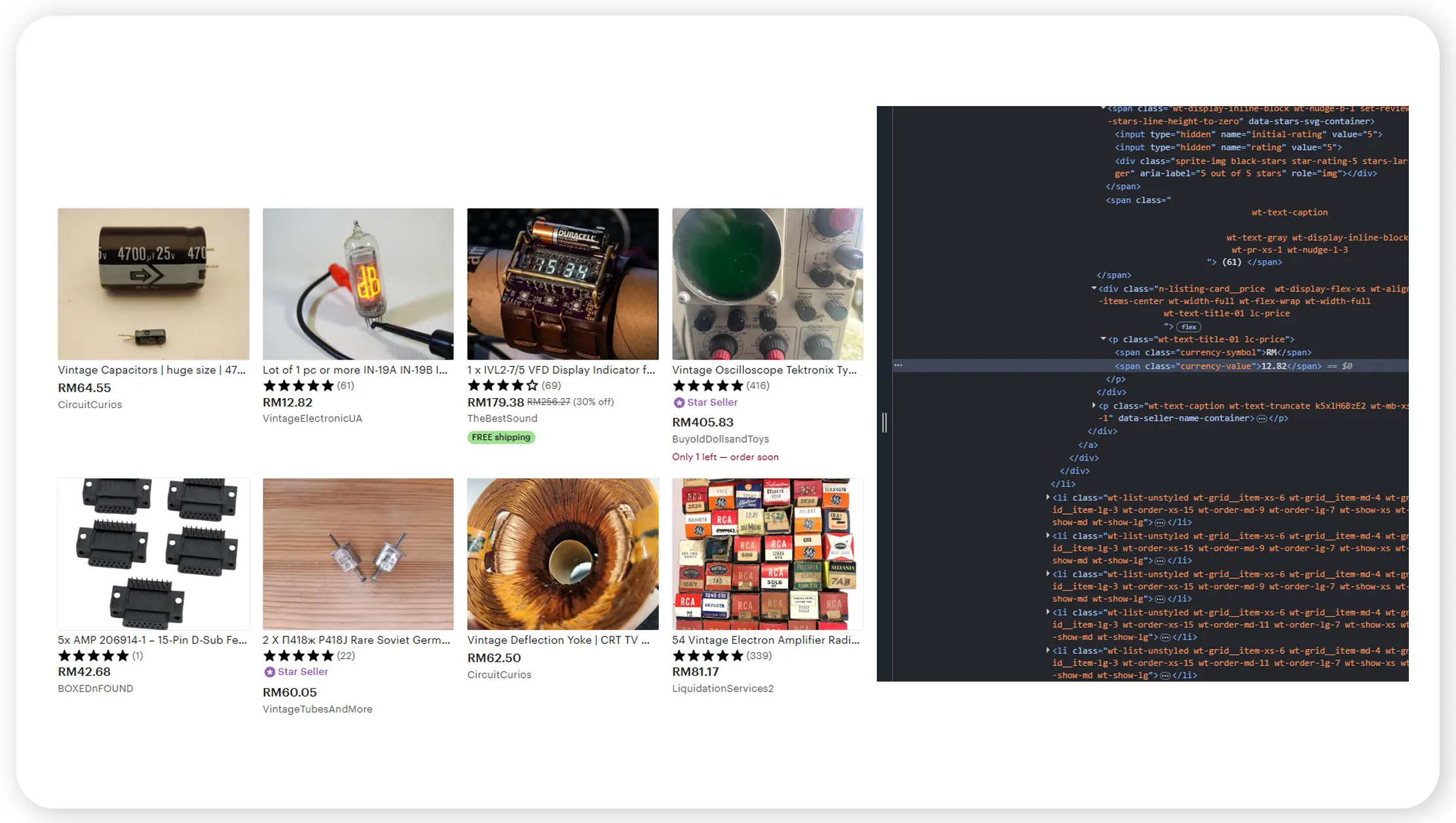

Modern data pipelines have made it possible to observe loss leader tactics at scale. Through web scraping reveals loss leader pricing tactics, organizations can detect early signals of aggressive pricing used to capture market share, especially during product launches and seasonal campaigns. Retailers frequently use essentials, electronics accessories, and entry-level SaaS plans as loss leaders to drive ecosystem adoption.

Loss Leader Pricing Frequency by Sector (2020–2026)

| Year | Retail (%) | Consumer Electronics (%) | SaaS (%) |

|---|---|---|---|

| 2020 | 18 | 14 | 9 |

| 2022 | 24 | 19 | 13 |

| 2024 | 31 | 26 | 18 |

| 2026 | 36 | 29 | 22 |

Data shows a steady increase in below-cost pricing, driven by intensified competition and platform-driven price transparency. Retail and electronics exhibit faster adoption due to high SKU overlap, while SaaS relies on freemium and deeply discounted entry tiers.

These insights highlight how scraped data helps companies anticipate competitor behavior and adjust pricing models dynamically, preventing margin erosion while retaining market relevance.

Competitive Shifts in 2025 Pricing Models

In 2025, pricing strategies became more algorithmic and customer-segment driven. The loss leader pricing strategy 2025 emphasizes precision rather than blanket discounts. Companies selectively apply loss leaders based on geography, customer intent, and purchase history.

Average Discount Depth on Loss Leaders (2020–2026)

| Year | Avg Discount (%) | Conversion Lift (%) |

|---|---|---|

| 2020 | 22 | 11 |

| 2022 | 28 | 17 |

| 2024 | 34 | 23 |

| 2026 | 38 | 27 |

The data reveals that deeper discounts correlate with higher conversion rates but only when supported by effective upsell paths. SaaS firms, in particular, offset discounted entry plans with premium feature bundles and usage-based pricing.

This shift underscores the importance of real-time monitoring. Without scraped datasets, companies risk reacting too late to pricing changes, losing both competitiveness and revenue opportunities.

Cross-Industry Pricing Behavior Patterns

Pricing behaviors differ significantly across industries. Using retail and SaaS pricing trends analysis, scraped datasets expose how each sector balances acquisition costs with long-term monetization.

Loss Leader Product Categories by Industry (2024–2026)

| Industry | Primary Loss Leader |

|---|---|

| Retail | Grocery staples |

| Electronics | Accessories & peripherals |

| SaaS | Entry-tier subscriptions |

Retail focuses on high-frequency items, electronics brands push ecosystem lock-in, and SaaS companies prioritize onboarding at scale. Despite these differences, the common objective remains reducing friction at the first purchase point.

This section demonstrates how structured datasets enable companies to benchmark pricing behaviors across sectors, identify anomalies, and predict competitor moves with higher confidence.

Measuring Discount Impact on Revenue

Discounts alone do not guarantee success. Through discount pricing strategy insights, scraped pricing and sales data reveal how effective loss leaders depend on post-purchase behavior.

Revenue Recovery Timeline After Loss Leader Sale

| Year | Avg Recovery Time (Days) |

|---|---|

| 2020 | 42 |

| 2022 | 36 |

| 2024 | 29 |

| 2026 | 24 |

Shorter recovery cycles indicate improved personalization and cross-selling strategies. Retailers now pair loss leaders with dynamic bundling, while SaaS platforms leverage in-app nudges and tiered upgrades.

Understanding these metrics allows businesses to refine discount thresholds and avoid prolonged margin dilution.

Role of Scalable Data Infrastructure

At the core of modern pricing intelligence lies automation. The E-Commerce Data Scraping API enables continuous monitoring of prices, promotions, and availability across thousands of digital touchpoints.

API-Driven Data Collection Growth (2020–2026)

| Year | Data Volume Indexed |

|---|---|

| 2020 | 1x |

| 2022 | 2.4x |

| 2024 | 4.1x |

| 2026 | 6.8x |

APIs reduce latency, ensure structured outputs, and support analytics-ready pipelines. Real-time access empowers pricing teams to act proactively instead of reactively, especially in high-velocity markets like consumer electronics.

Value of Structured Pricing Intelligence

Reliable decision-making depends on clean, consistent datasets. The E-Commerce Dataset curated through scraping and validation processes enables trend forecasting, competitor benchmarking, and AI-driven pricing models.

Dataset Utilization by Use Case (2026)

| Use Case | Adoption Rate (%) |

|---|---|

| Dynamic Pricing | 41 |

| Market Benchmarking | 33 |

| Demand Forecasting | 26 |

As AI adoption grows, structured datasets will become the foundation for autonomous pricing systems, reducing manual intervention while increasing accuracy.

Real Data API empowers businesses with scalable, compliant, and high-frequency pricing intelligence. By supporting Loss Leader Pricing Strategy initiatives and enabling analyzing loss leader pricing using scraped retail data, the platform helps organizations stay competitive across fast-changing markets. With flexible endpoints, global coverage, and enterprise-grade reliability, Real Data API transforms raw pricing signals into actionable insights.

Conclusion

Loss leader pricing in 2025 and beyond demands precision, speed, and data depth. Companies that invest in automation and intelligence gain a decisive edge in managing margins while accelerating growth. With advanced Web Scraping Services and expertise in analyzing loss leader pricing using scraped retail data, Real Data API delivers the insights needed to optimize pricing strategies at scale.

Partner with Real Data API today to transform pricing data into competitive advantage and future-proof your revenue strategy