Introduction

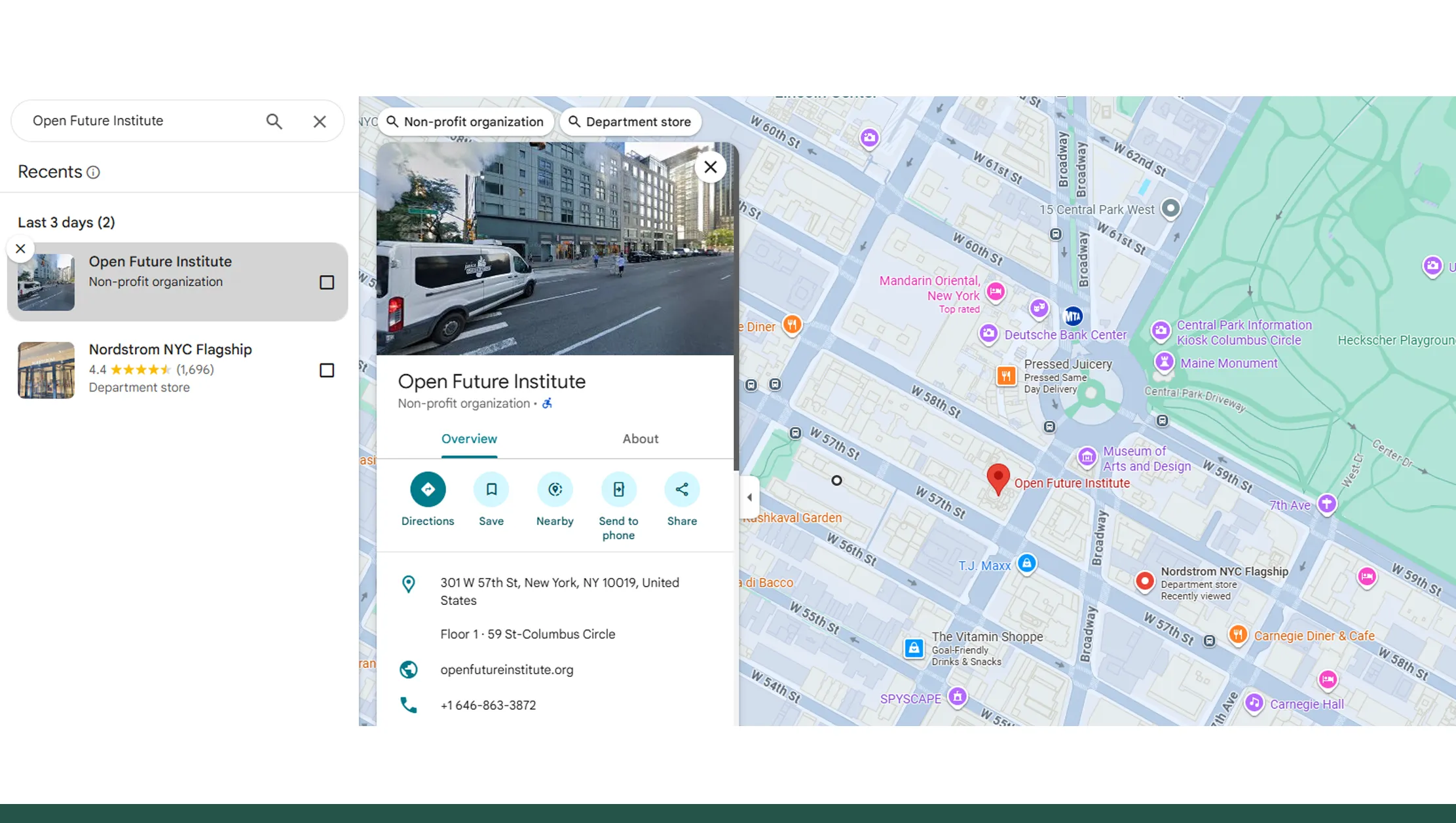

Retail growth in a hyper-competitive market depends heavily on choosing the right locations, understanding nearby competitors, and responding to shifting consumer footfall patterns. Digital location intelligence has become a decisive factor in determining where retailers open stores, optimize operations, and maximize profitability. With the rise of location-based consumer behavior, businesses increasingly rely on Extract google maps location intelligence data for retail growth to gain structured, actionable insights from real-world geographic signals.

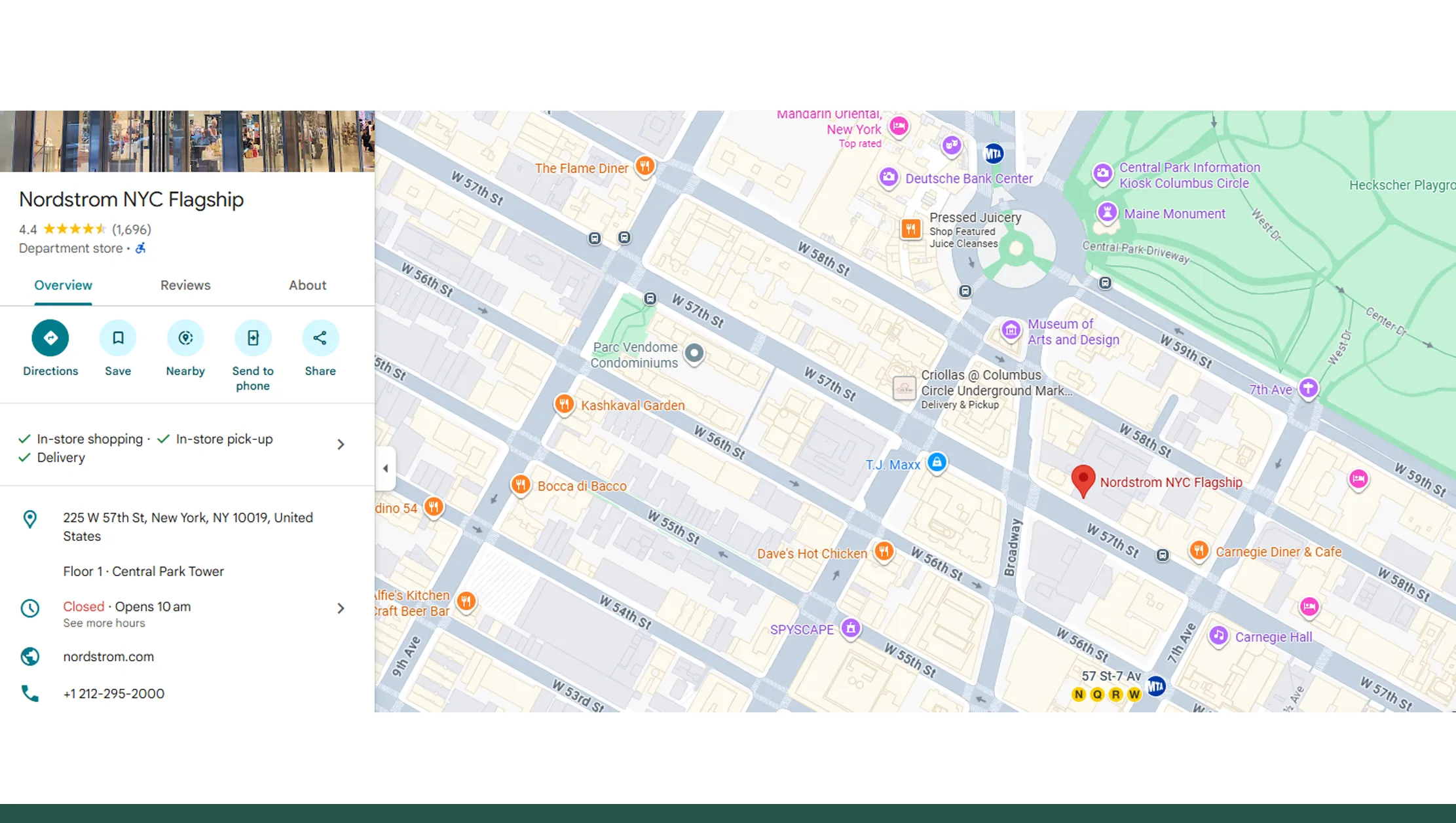

Google Maps contains rich, continuously updated information such as store density, customer reviews, operating hours, ratings, pricing indicators, and nearby points of interest. When systematically collected and analyzed, this data enables retailers to identify underserved markets, evaluate saturation risks, and benchmark competitors with precision. Instead of relying on assumptions or outdated reports, retailers now use location intelligence to forecast demand, refine expansion strategies, and improve decision-making across regions. By transforming unstructured map data into analytics-ready datasets, businesses gain clarity on where to grow, when to enter new markets, and how to outperform competitors in both urban and suburban landscapes.

Understanding the Competitive Landscape Through Location Signals

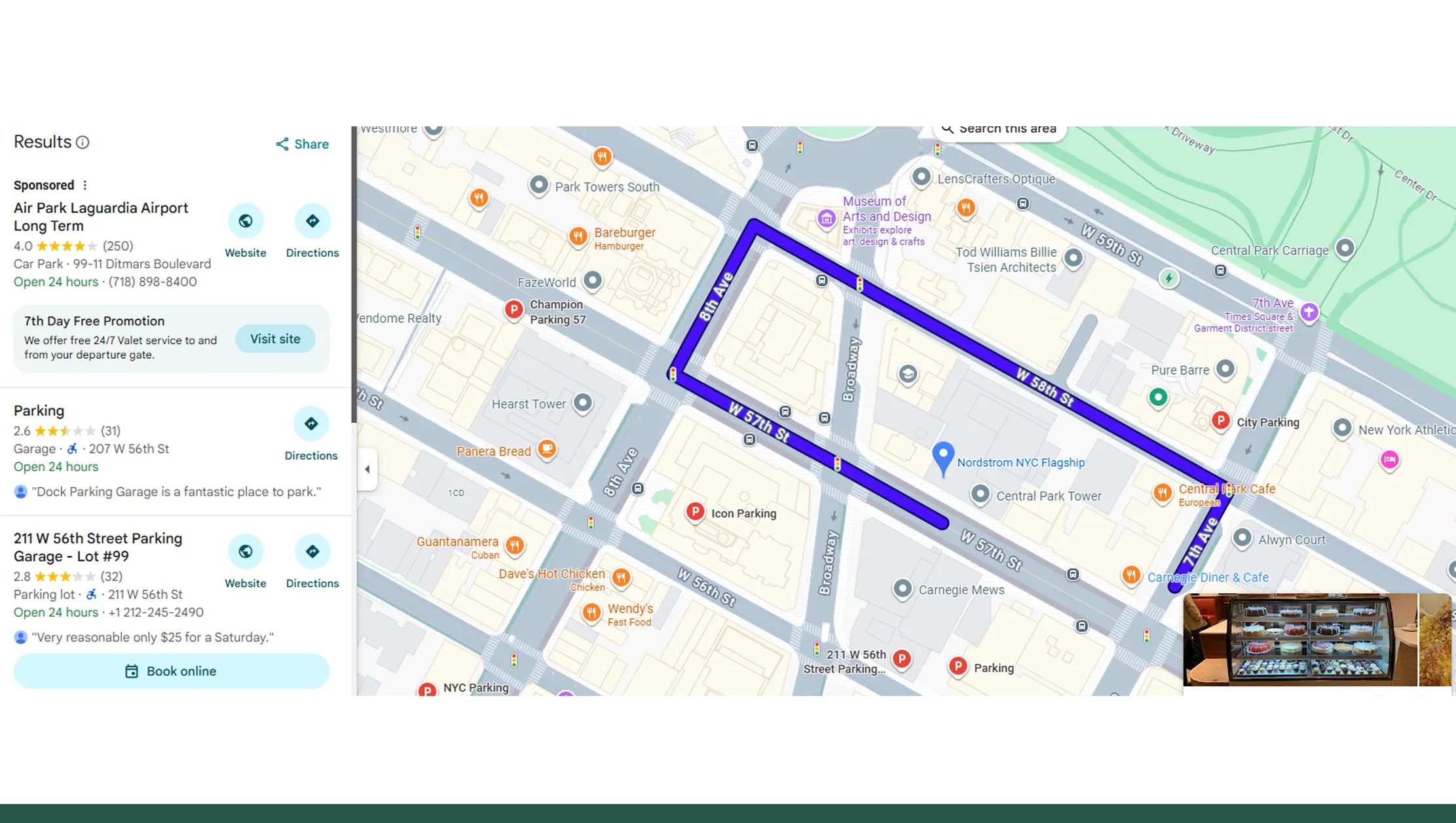

Modern retail competition is no longer defined only by pricing or product assortment—it is deeply influenced by physical proximity, accessibility, and customer convenience. By scraping Google Maps data for competitor analysis, retailers can gain a detailed view of how competitors are distributed across cities, neighborhoods, and high-traffic zones. This includes identifying store clusters, brand dominance in specific regions, and gaps where competition is minimal.

Between 2020 and 2026, urban retail density in major metro areas increased by over 28%, while suburban expansion grew by nearly 35%, according to aggregated location data trends. Google Maps competitor datasets reveal patterns such as which brands prioritize premium zones, how often competitors relocate or shut down outlets, and how customer sentiment varies by location.

| Year | Avg Competitor Stores per Sq. Km | Avg Customer Rating | Store Closure Rate (%) |

|---|---|---|---|

| 2020 | 4.8 | 4.1 | 6.2 |

| 2022 | 5.6 | 4.2 | 4.9 |

| 2024 | 6.4 | 4.3 | 3.8 |

| 2026 | 7.1 | 4.4 | 3.1 |

Analyzing these metrics helps retailers proactively respond to competitive threats, reposition stores, and develop smarter market-entry strategies backed by real geographic intelligence.

Making Smarter Expansion Decisions with Location Intelligence

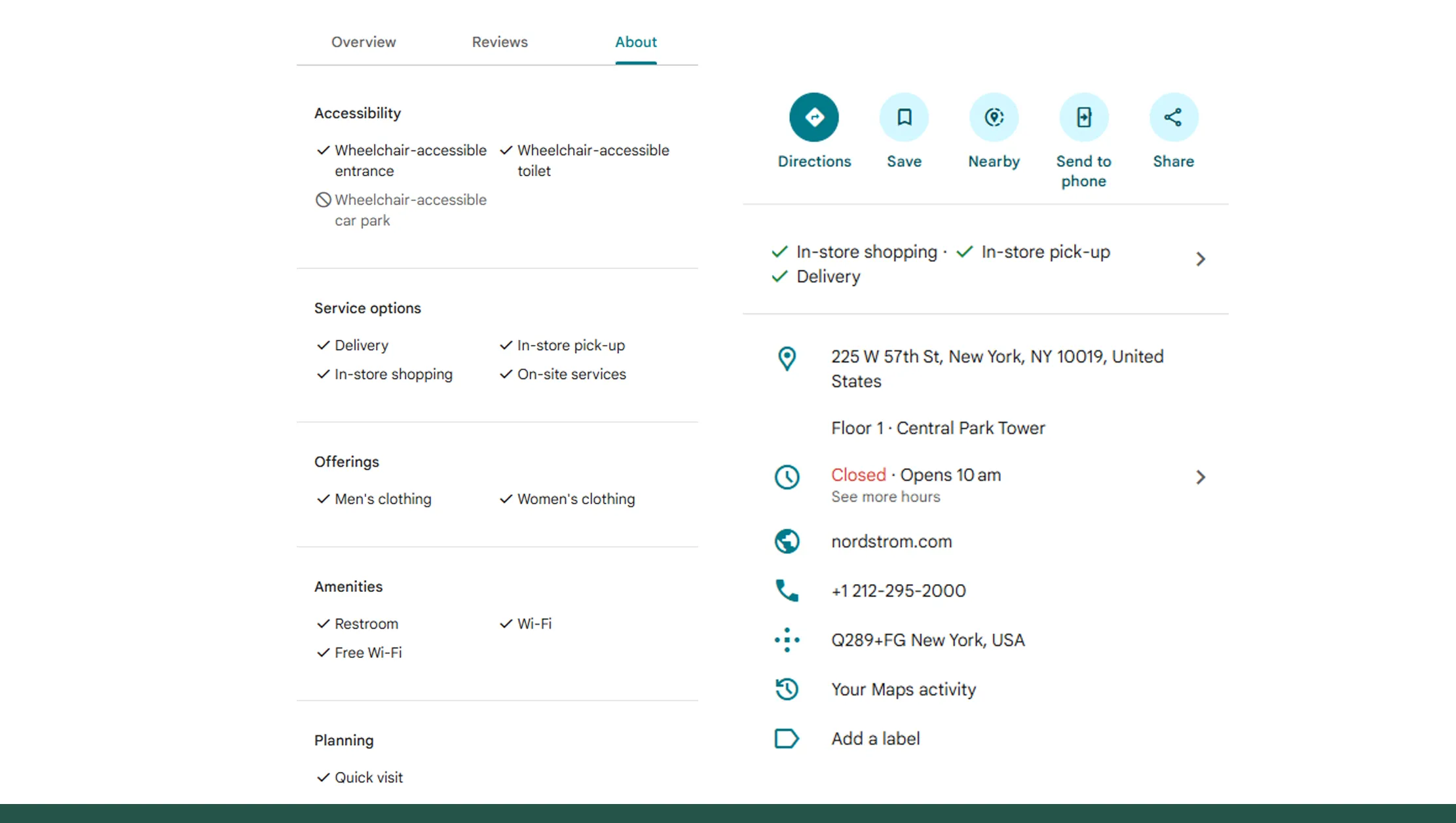

Retail expansion decisions carry high financial stakes, making accuracy and data reliability essential. Through Google Maps data extraction for retail site selection, businesses can evaluate potential store locations using real-world indicators such as foot traffic proxies, surrounding amenities, population density, and competitor proximity. This approach replaces intuition-driven expansion with data-backed planning.

From 2020 to 2026, retailers using location intelligence improved store success rates by approximately 22%, reducing underperforming openings significantly. Google Maps datasets reveal how factors like parking availability, public transport access, and nearby anchor stores influence customer visits.

| Year | New Store Success Rate (%) | Avg Distance from Competitors (km) | Avg Monthly Footfall Index |

|---|---|---|---|

| 2020 | 61 | 1.9 | 78 |

| 2022 | 68 | 2.3 | 84 |

| 2024 | 74 | 2.7 | 89 |

| 2026 | 83 | 3.1 | 94 |

These insights allow retailers to identify locations with high growth potential while avoiding oversaturated areas. By aligning expansion strategies with location intelligence, brands can maximize ROI and accelerate sustainable growth.

Unlocking Value from Points of Interest and Local Signals

Points of Interest (POI) data plays a crucial role in understanding consumer behavior patterns around retail locations. Using Web Scraping Google Maps POI data, retailers can analyze nearby restaurants, offices, schools, malls, and entertainment hubs that influence store traffic. POI proximity often determines whether a store benefits from daily commuters, weekend shoppers, or seasonal visitors.

Between 2020 and 2026, stores located near high-density POIs experienced up to 31% higher engagement compared to isolated locations. Google Maps POI datasets also provide insights into peak visiting hours, popular nearby categories, and review sentiment tied to specific locations.

| Year | Avg POIs Within 1 km | Footfall Uplift (%) | Repeat Visit Rate (%) |

|---|---|---|---|

| 2020 | 18 | 12 | 41 |

| 2022 | 23 | 18 | 46 |

| 2024 | 29 | 24 | 51 |

| 2026 | 35 | 31 | 57 |

By combining POI data with retail performance metrics, brands gain deeper context on why certain locations outperform others and how surrounding environments shape consumer behavior.

Turning Geographic Data into Predictive Insights

Raw location data alone is not enough—its true power emerges when transformed into analytical intelligence. With geo-spatial retail data analytics, retailers can map trends, identify expansion corridors, and forecast future demand across regions. Spatial analytics enables visualization of customer density, competitive pressure, and growth potential across cities and countries.

From 2020 to 2026, retailers using geospatial analytics reduced expansion risks by nearly 27% by identifying declining zones early and focusing on high-growth micro-markets. Heatmaps derived from Google Maps data show how retail demand shifts due to urban development, infrastructure changes, and consumer migration patterns.

| Year | High-Growth Zones Identified | Forecast Accuracy (%) | Expansion ROI Increase (%) |

|---|---|---|---|

| 2020 | 42 | 68 | 14 |

| 2022 | 58 | 74 | 19 |

| 2024 | 71 | 81 | 24 |

| 2026 | 89 | 87 | 29 |

These insights help retailers move from reactive planning to proactive, data-driven expansion strategies powered by location intelligence.

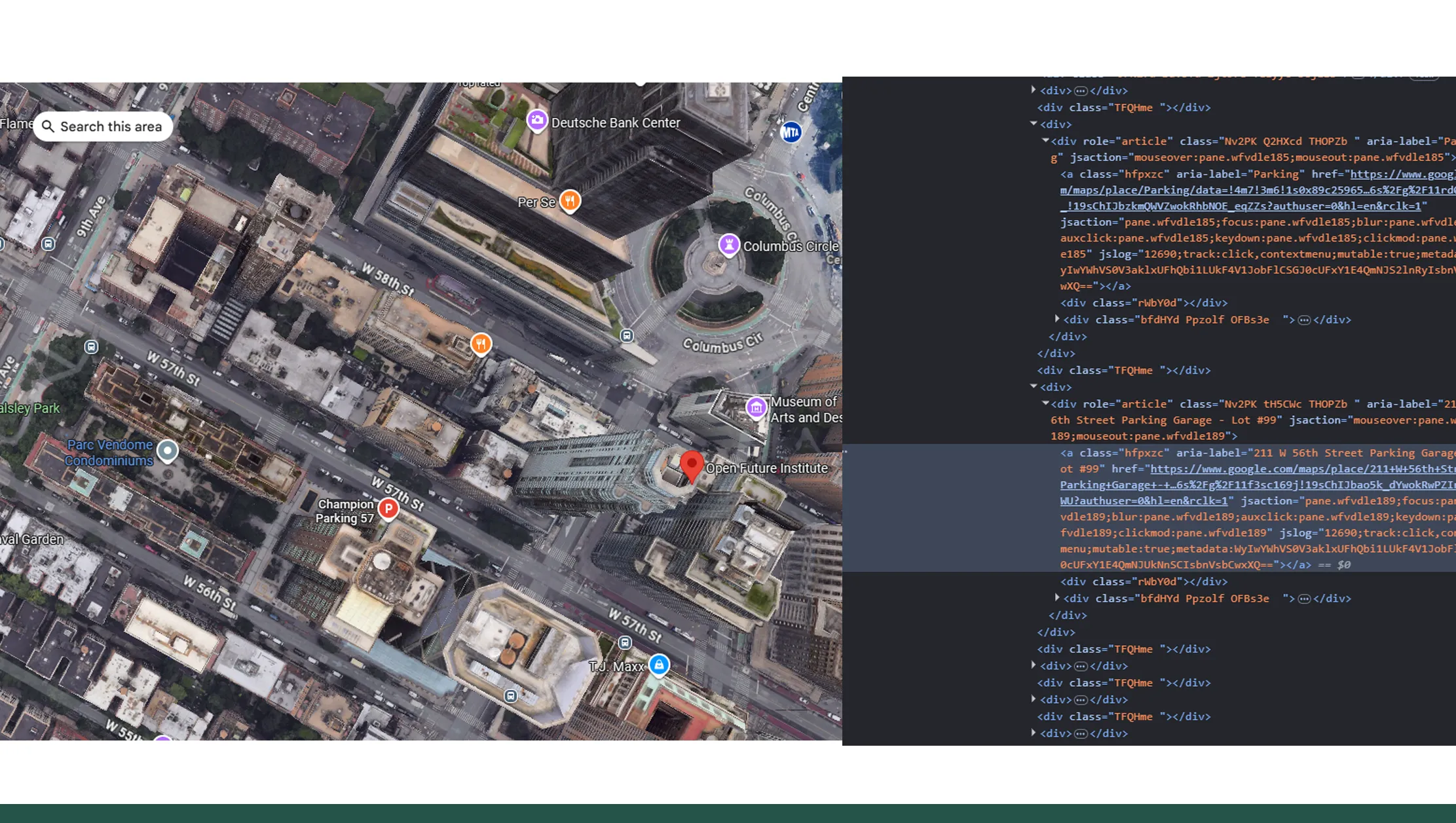

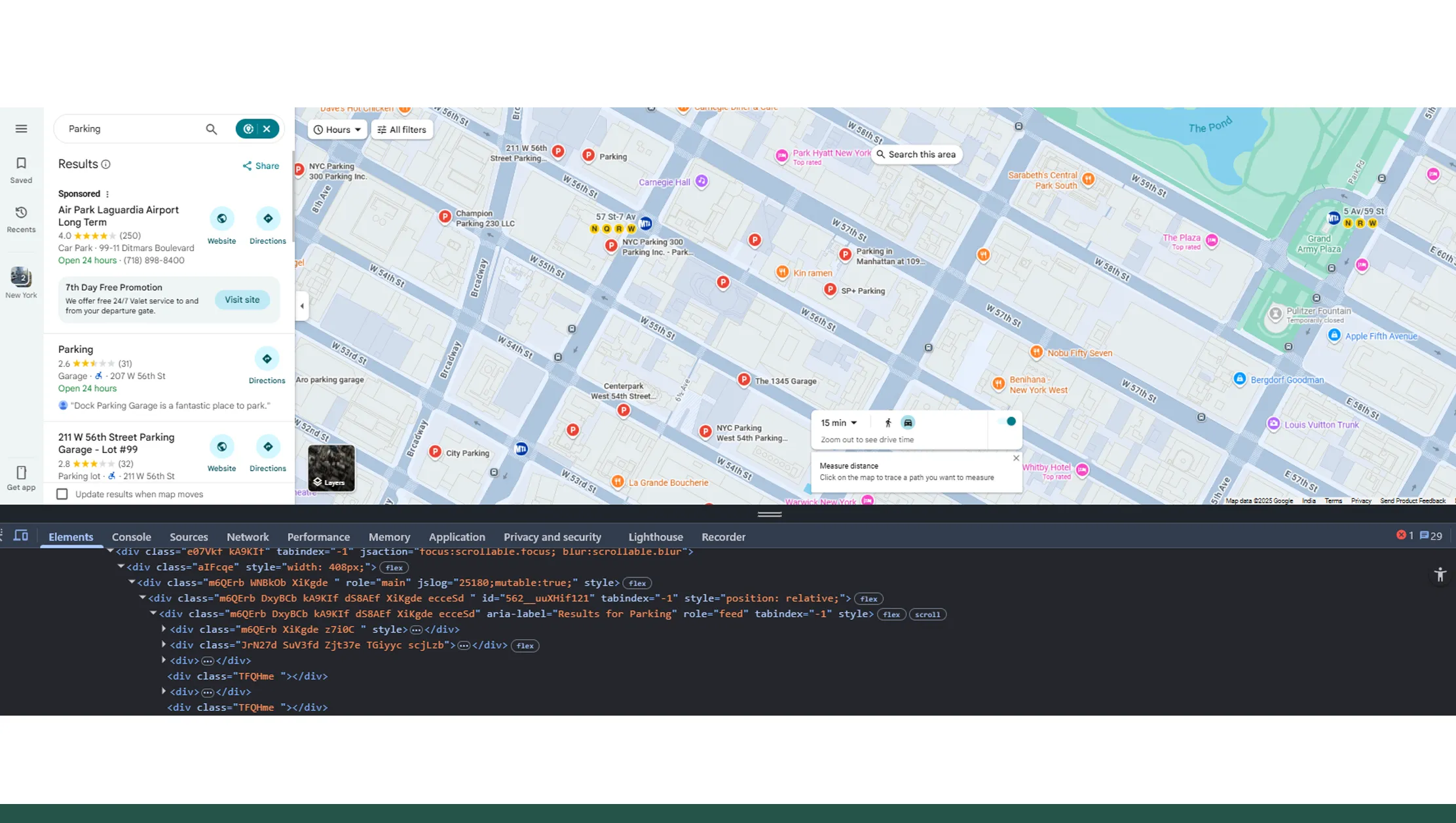

Automating Location Data Collection at Scale

Manual data collection from maps is inefficient and error-prone. By leveraging a Google Maps Scraper, retailers can automate large-scale extraction of location attributes such as store names, addresses, ratings, reviews, hours, and geo-coordinates. Automation ensures data freshness, consistency, and scalability across thousands of locations.

Between 2020 and 2026, automated scraping reduced data collection costs by over 45% while improving accuracy by nearly 30%. Continuous monitoring allows retailers to track competitor moves, store closures, and rating changes in near real time.

| Year | Locations Tracked | Data Refresh Frequency | Accuracy Improvement (%) |

|---|---|---|---|

| 2020 | 5,000 | Monthly | 12 |

| 2022 | 15,000 | Weekly | 19 |

| 2024 | 40,000 | Daily | 26 |

| 2026 | 75,000 | Real-Time | 31 |

Automated scraping transforms Google Maps into a live intelligence source that supports agile retail decision-making.

Enhancing Revenue Strategies with Location-Based Pricing Intelligence

Location intelligence extends beyond site selection—it also informs pricing strategies. By integrating Price Monitoring with location data, retailers can compare pricing patterns across regions, cities, and competitive zones. This helps brands optimize pricing based on local demand, income levels, and competitor positioning.

From 2020 to 2026, retailers using location-based price intelligence improved margin optimization by approximately 18%. Google Maps data combined with pricing analytics reveals how proximity to premium locations or high-competition areas influences price sensitivity.

| Year | Regional Price Variance (%) | Margin Improvement (%) | Conversion Rate Uplift (%) |

|---|---|---|---|

| 2020 | 9 | 6 | 4 |

| 2022 | 12 | 9 | 7 |

| 2024 | 16 | 13 | 11 |

| 2026 | 21 | 18 | 15 |

This approach allows retailers to align pricing strategies with local market realities, driving higher profitability and customer satisfaction.

Why Choose Real Data API?

Real Data API delivers enterprise-grade solutions designed to transform raw location data into structured, actionable intelligence. With Extract google maps location intelligence data for retail growth, businesses gain scalable access to accurate, real-time datasets tailored to expansion, competition, and pricing use cases. The platform ensures compliance, automation, and seamless integration with analytics tools, reducing operational complexity.

By leveraging Live Crawler Services, retailers can continuously monitor location changes, competitor movements, and market shifts without manual intervention. Real Data API empowers organizations to focus on strategic insights rather than data collection challenges, enabling faster decisions, improved accuracy, and long-term competitive advantage.

Conclusion

Location intelligence has become a cornerstone of modern retail strategy, enabling data-driven expansion, competitive benchmarking, and revenue optimization. By transforming Google Maps data into structured insights, retailers gain a clear view of where to grow, how to compete, and when to act. Real Data API supports this transformation with scalable, reliable solutions built for enterprise needs.

Organizations looking to accelerate retail growth, enhance decision-making, and stay ahead of competitors can unlock powerful insights through Enterprise Web Crawling. Get started today with Real Data API and turn location data into your next growth advantage!