Introduction

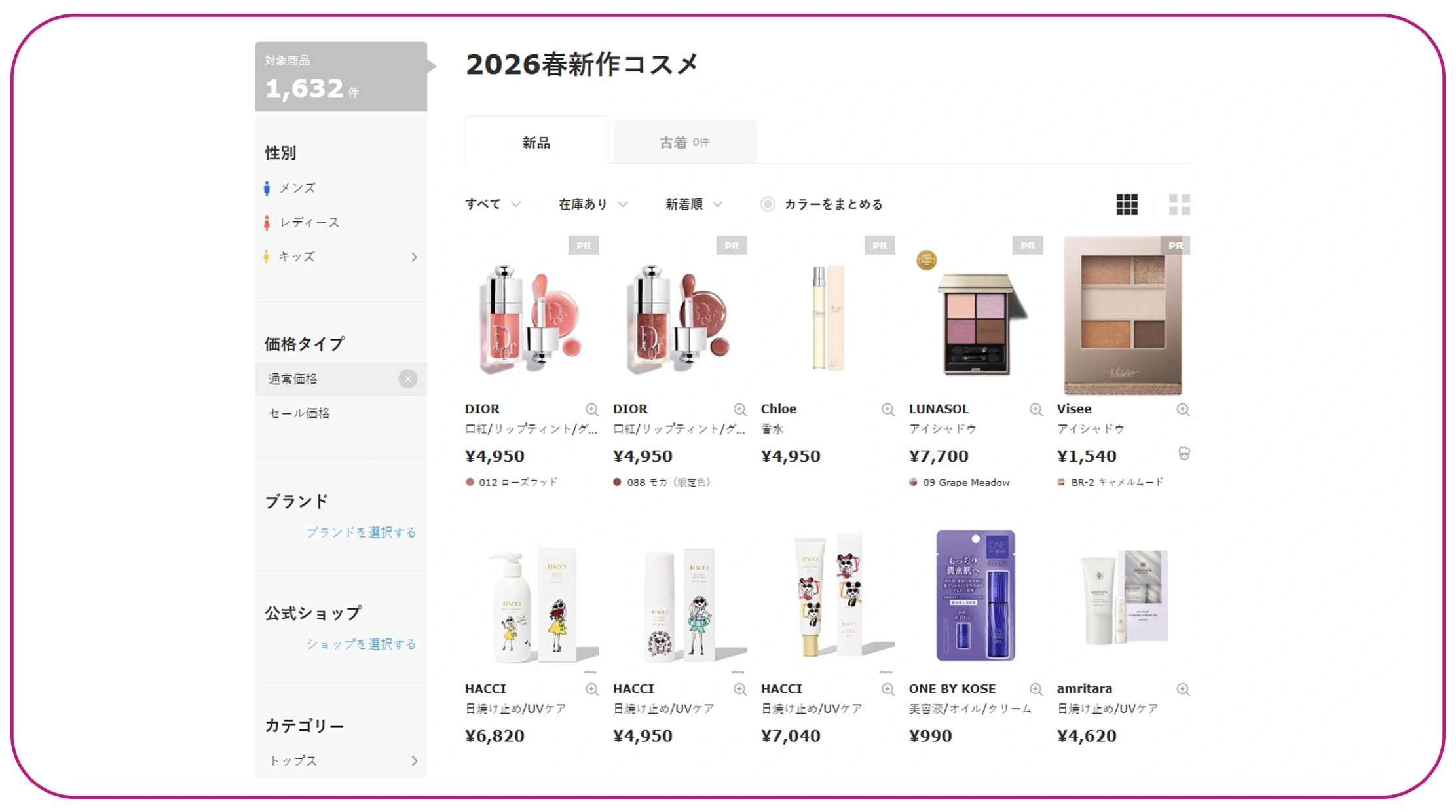

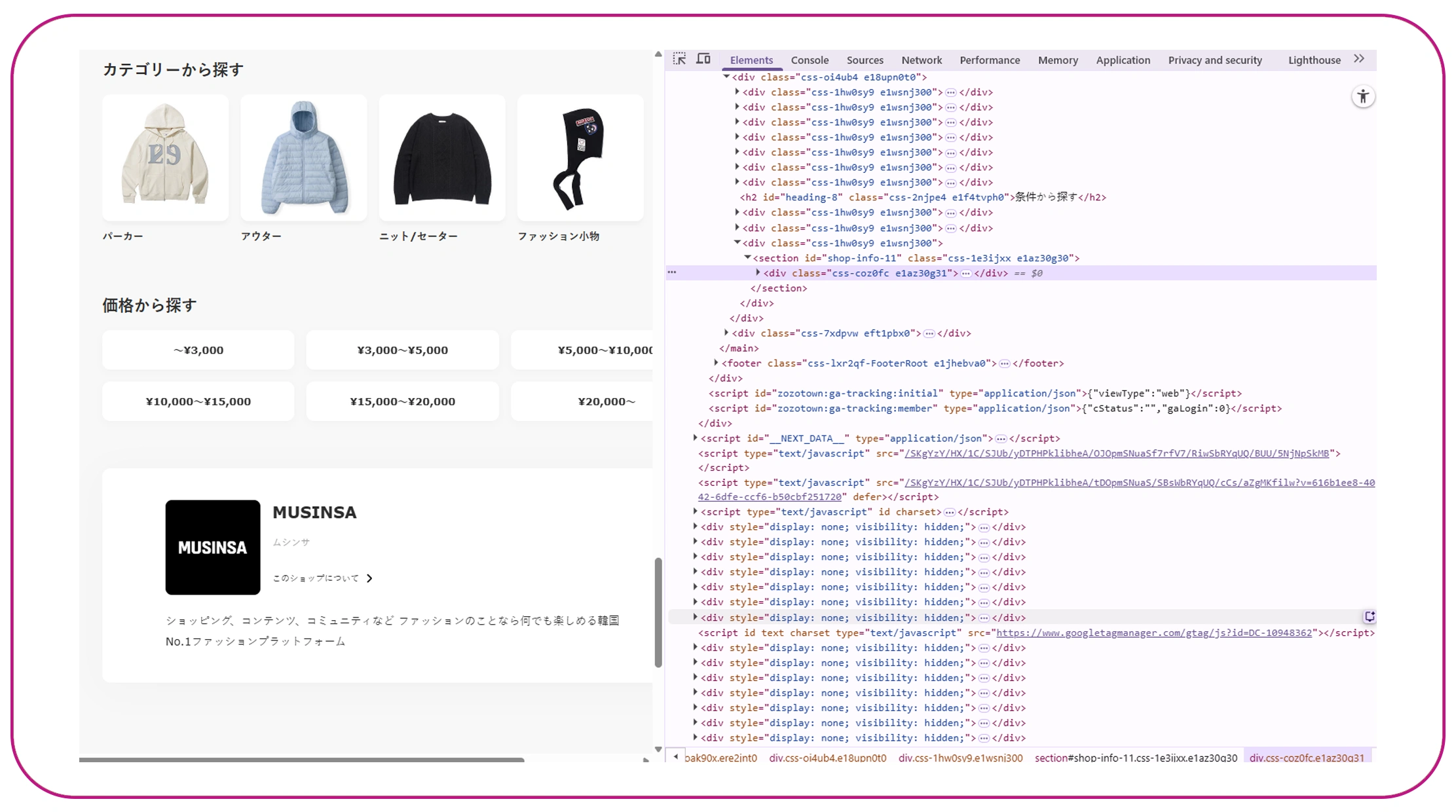

Japan's online fashion market has witnessed rapid digital acceleration since 2020, with eCommerce fashion sales projected to surpass ¥25 trillion by 2026. Platforms like ZOZOTOWN dominate the online apparel ecosystem, offering thousands of brands and real-time consumer trend signals. For fashion startups aiming to reduce risk and improve decision-making, the ability to extract ZOZOTOWN fashion trends data in Japan is no longer optional—it's strategic.

By leveraging the ZOZOTOWN Scraping API, startups can track pricing shifts, category growth, seasonal demand spikes, and brand performance metrics across 2020–2026. Access to structured datasets helps founders validate product ideas, optimize inventory levels, and identify micro-trends before competitors react. Instead of relying on guesswork or delayed market reports, data extraction provides immediate visibility into Japan's evolving fashion preferences.

In this blog, we'll explore how startups can harness structured trend intelligence, pricing analytics, and competitive benchmarking tools to make smarter, data-backed business decisions in Japan's dynamic apparel landscape.

Market Pattern Analysis Through Structured Data

To compete effectively in Japan, startups must understand category-level growth and shifting style preferences. A Japanese apparel and fashion data scraper allows businesses to collect historical and real-time product data across men's, women's, streetwear, and luxury categories.

Between 2020 and 2026, Japan's fashion eCommerce penetration increased from 18% to an estimated 32%. Streetwear saw a 24% surge during 2021–2023, while sustainable apparel categories grew by nearly 19% annually. Tracking these shifts enables startups to align production with demand signals.

Category Growth Snapshot (2020–2026 Projection)

| Category | 2020 | 2023 | 2026 (Projected) |

|---|---|---|---|

| Streetwear | +8% | +24% | +30% |

| Sustainable Wear | +5% | +19% | +27% |

| Luxury Apparel | +6% | +12% | +18% |

| Casual Basics | +10% | +15% | +20% |

By analyzing such data in paragraph insights, startups can determine which categories demonstrate consistent upward momentum. This reduces product launch risk and ensures better capital allocation.

Structured extraction tools help monitor SKU volumes, brand entries, and listing frequency trends, giving startups clarity about saturation levels and whitespace opportunities in Japan's fashion market.

Competitive Pricing Intelligence

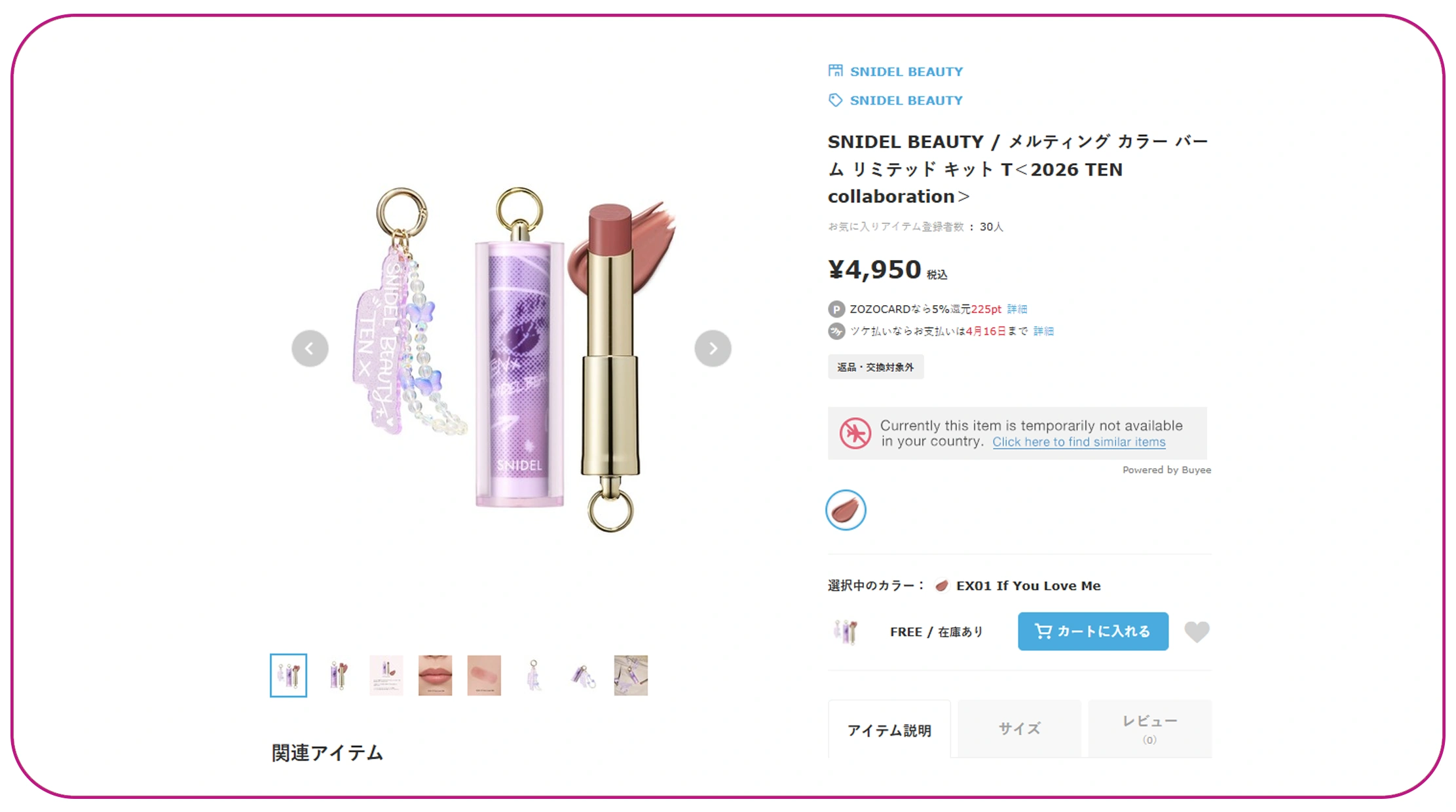

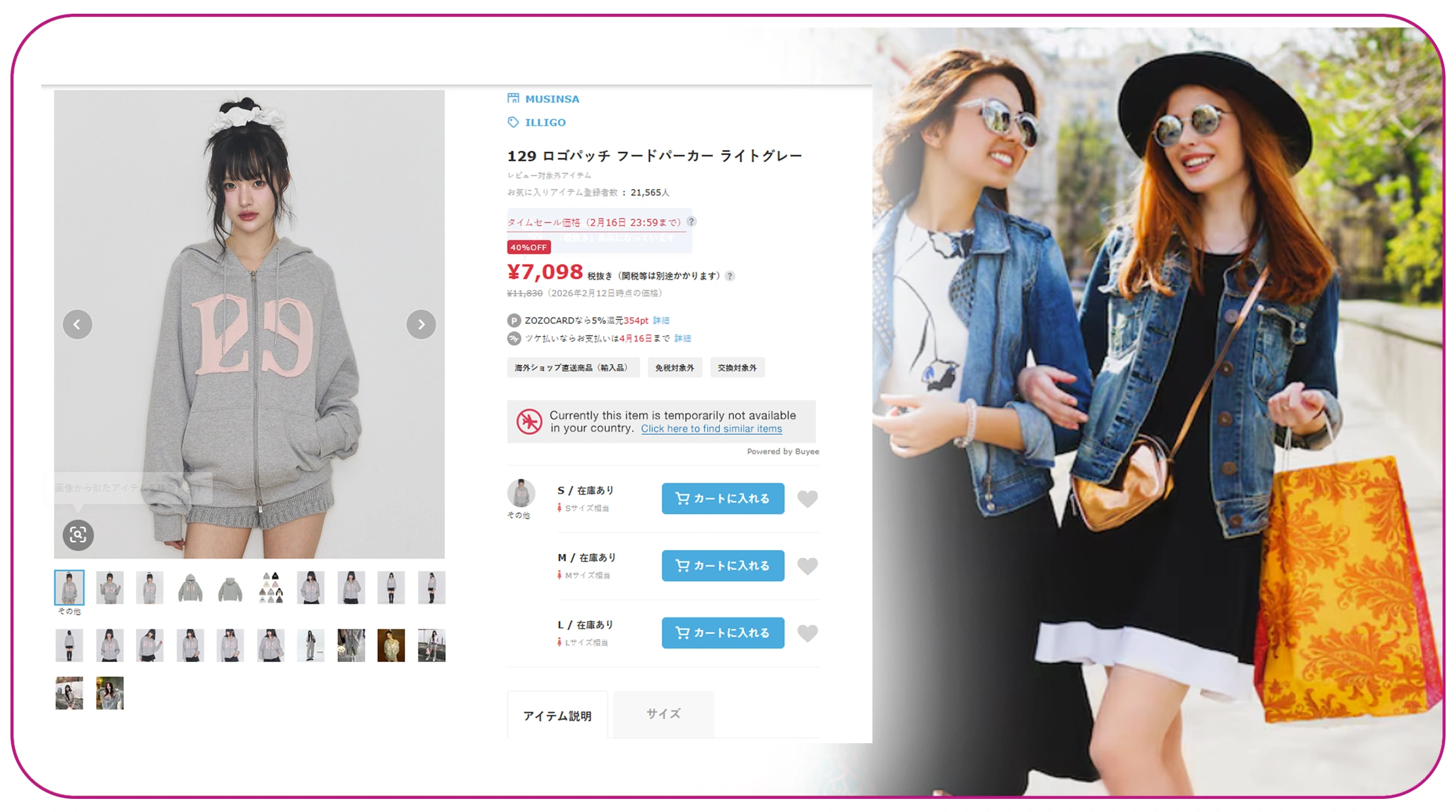

Pricing volatility between 2020 and 2026 has significantly impacted apparel profitability. Inflationary pressures and supply chain fluctuations caused average apparel price shifts of 6–12% across categories. A ZOZOTOWN apparel pricing data extractor helps startups track these changes accurately.

Price benchmarking allows startups to compare brand positioning within similar segments. For instance, mid-range streetwear brands saw average prices rise from ¥6,800 in 2020 to ¥8,200 in 2024, while premium brands maintained a narrower 5% price adjustment window.

Average Apparel Price Trends (¥)

| Segment | 2020 | 2022 | 2024 | 2026 (Est.) |

|---|---|---|---|---|

| Budget Casual | 3,500 | 3,900 | 4,200 | 4,500 |

| Mid-Range Street | 6,800 | 7,600 | 8,200 | 8,900 |

| Premium Fashion | 12,000 | 12,800 | 13,500 | 14,200 |

Startups can identify pricing gaps where demand remains strong but competition is limited. With proper analysis, brands avoid overpricing or underpricing products.

Detailed price trend monitoring also supports promotional strategy optimization, ensuring discount campaigns align with historical peak buying cycles.

Inventory and Stock Visibility

Stock-outs cost retailers up to 8% in lost revenue annually. To mitigate this, startups can Scrape ZOZOTOWN fashion price and stock data to monitor availability trends across competitors.

Between 2020 and 2023, limited-edition releases experienced stock depletion within 48–72 hours. Meanwhile, staple apparel categories showed restock cycles every 30–45 days. Understanding these patterns allows startups to design smarter replenishment models.

Stock Turnover Patterns (2020–2026)

| Category | Avg. Stock-Out Time | Restock Frequency |

|---|---|---|

| Limited Drops | 2–3 Days | Seasonal |

| Casual Basics | 15–20 Days | Monthly |

| Outerwear | 25–30 Days | Quarterly |

Inventory intelligence helps startups predict demand spikes during seasonal shifts such as spring collections and autumn launches.

With structured scraping solutions, founders can identify high-performing SKUs and adjust procurement cycles accordingly. This leads to improved sell-through rates and reduced dead inventory costs.

Data-Driven Market Forecasting

Long-term growth forecasting becomes more accurate when startups use Web Scraping ZOZOTOWN API for fashion market intelligence data. Trend analytics between 2020 and 2026 indicate growing consumer preference for minimalist aesthetics and eco-friendly brands.

Market intelligence insights show:

- 22% rise in searches for sustainable labels (2021–2024)

- 18% increase in oversized silhouette demand

- 15% growth in gender-neutral apparel listings

Search & Listing Growth Trends

| Trend Category | 2020 | 2023 | 2026 (Projected) |

|---|---|---|---|

| Sustainable Brands | +4% | +22% | +35% |

| Oversized Styles | +6% | +18% | +25% |

| Gender-Neutral | +3% | +15% | +28% |

Such data empowers startups to align branding, messaging, and product pipelines with verified market demand.

Predictive modeling based on scraped datasets improves merchandising decisions and ensures data-backed expansion into new subcategories.

Leveraging Structured Industry Data

Access to comprehensive Fashion & Apparel Datasets provides startups with broader visibility beyond isolated product listings.

From 2020–2026, over 12,000 new fashion brands entered Japanese online marketplaces. Without structured datasets, analyzing this scale manually is nearly impossible.

These datasets typically include:

- SKU metadata

- Brand popularity metrics

- Consumer ratings trends

- Category penetration levels

Brand Entry & Rating Growth (2020–2026)

| Metric | 2020 | 2023 | 2026 (Est.) |

|---|---|---|---|

| New Brand Entries | 1,200 | 2,800 | 3,500 |

| Avg. Product Ratings | 4.1 | 4.3 | 4.5 |

| SKU Volume Increase | +9% | +21% | +30% |

These insights help startups identify partnership opportunities and competitive saturation thresholds.

With comprehensive datasets, decision-makers gain macro and micro visibility into Japan's evolving fashion ecosystem.

Visualizing Insights for Strategy Execution

Raw data alone isn't sufficient—visual analytics matter. A centralized Fashion Dashboard transforms extracted information into actionable insights.

From 2020–2026, companies adopting dashboard-driven analytics improved forecasting accuracy by up to 28%. Visualization tools help track:

- Price fluctuation charts

- Stock-out frequency graphs

- Category growth heatmaps

- Brand ranking metrics

Forecasting Accuracy Improvements

| Year | Manual Analysis | Dashboard-Based |

|---|---|---|

| 2020 | 62% Accuracy | 70% |

| 2023 | 68% Accuracy | 85% |

| 2026 | 72% (Est.) | 90% (Est.) |

Dashboards allow founders to react quickly to micro-trends and optimize supply chains in real time.

By integrating extraction pipelines with visualization systems, startups can transform data into growth strategies.

Why Choose Real Data API?

Real Data API delivers enterprise-grade Fashion Scraping API solutions tailored for Japanese fashion intelligence. Businesses can seamlessly extract ZOZOTOWN fashion trends data in Japan with structured, scalable, and compliant data pipelines.

Key advantages include:

- Automated real-time extraction

- Scalable cloud infrastructure

- Clean, structured JSON/CSV outputs

- Dedicated technical support

- Custom dashboard integrations

By combining automation with advanced analytics, Real Data API empowers startups to make confident, data-driven decisions in Japan's competitive fashion landscape.

Conclusion

Data is redefining fashion entrepreneurship. Startups that strategically extract ZOZOTOWN fashion trends data in Japan gain visibility into pricing, stock, and category movements from 2020 to 2026.

Instead of relying on assumptions, founders can use structured intelligence to optimize product launches, pricing strategies, and inventory cycles.

If you're ready to transform your fashion startup with actionable insights, start today with Real Data API and extract ZOZOTOWN fashion trends data in Japan to stay ahead of the competition.