Introduction

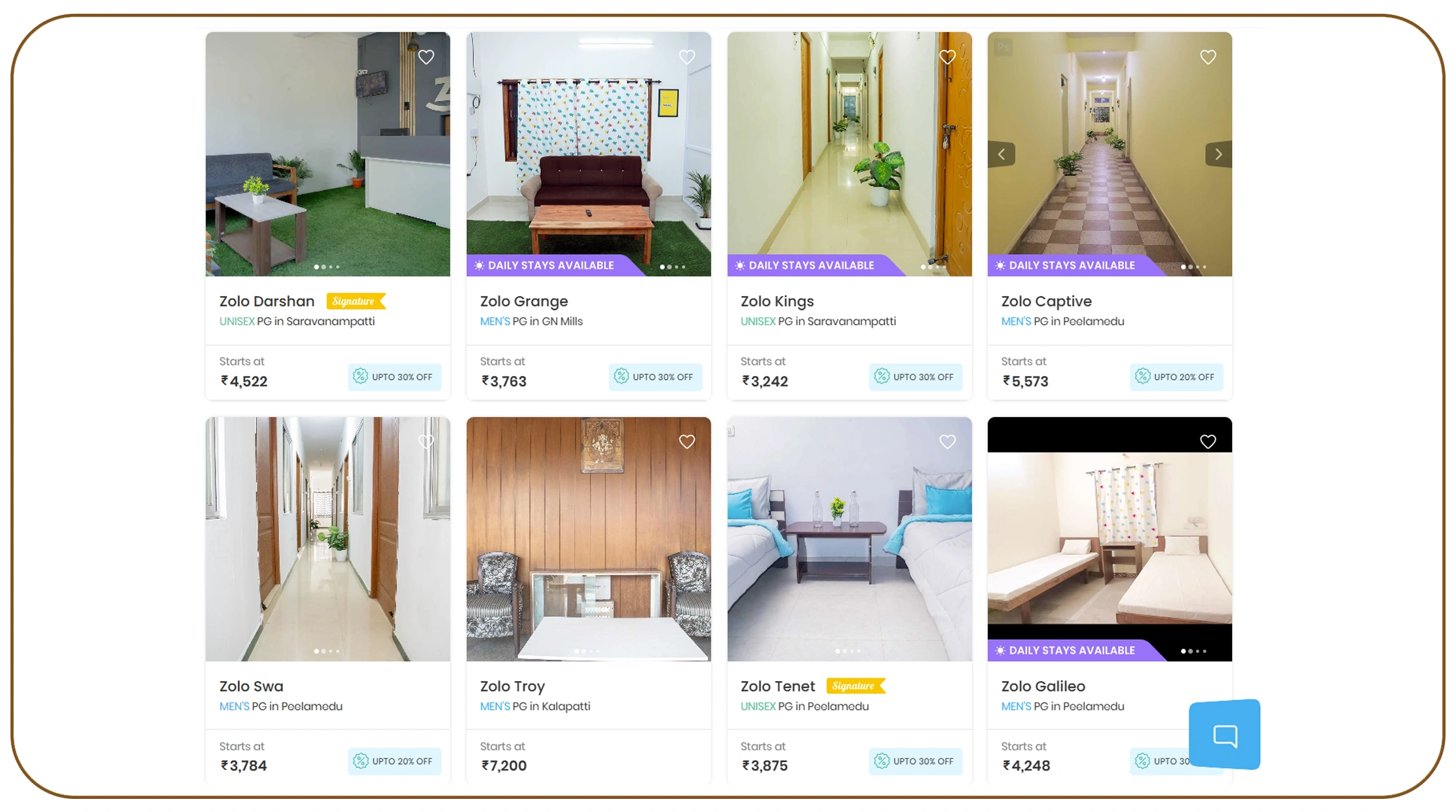

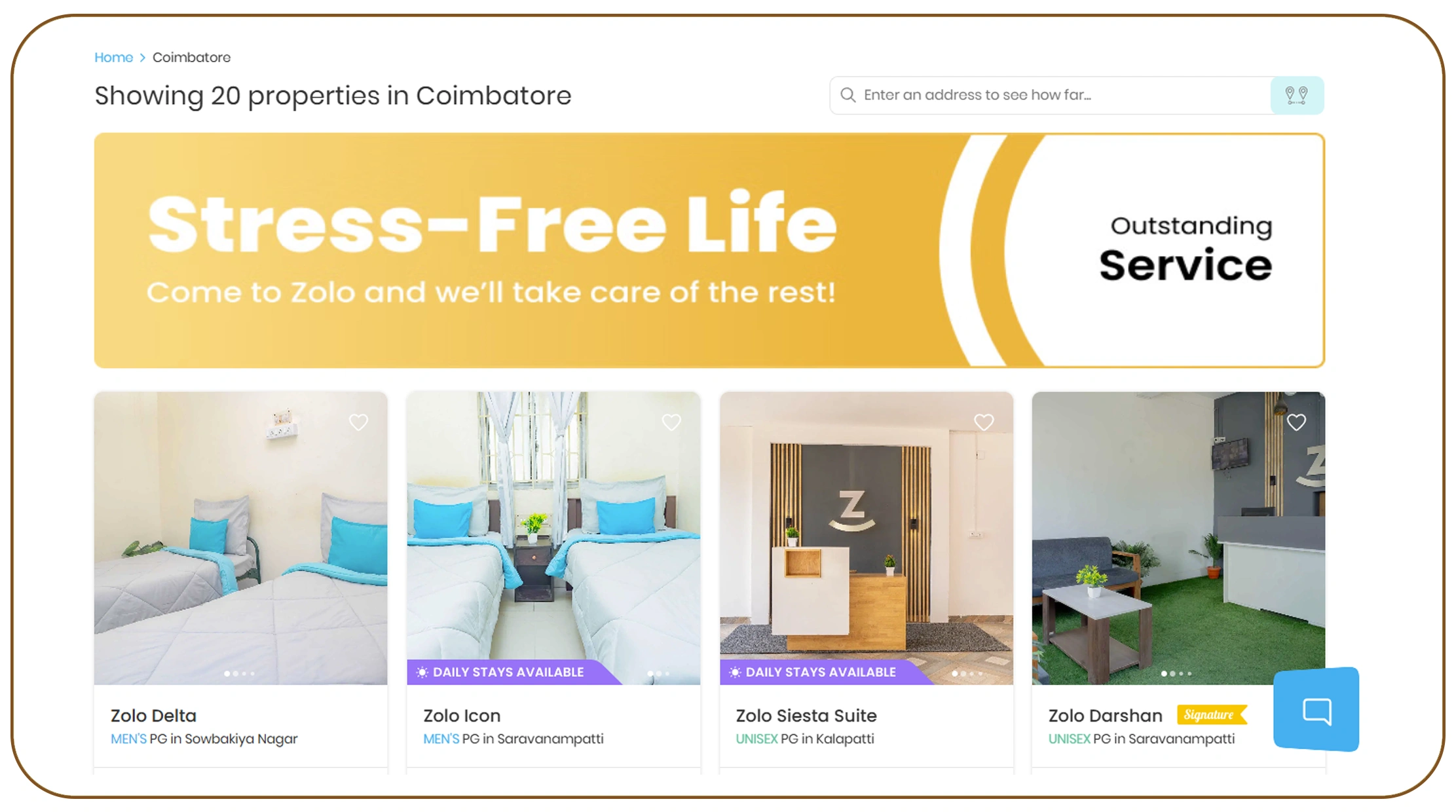

Canada’s rental housing market has undergone significant volatility between 2020 and 2026. From pandemic-driven vacancy spikes to record-breaking rent surges in 2023–2024, investors have faced rapidly changing conditions. In such an environment, data-backed decisions are critical. Leveraging Zolo housing data extraction for rental market research allows investors to move beyond assumptions and access structured insights into pricing, demand, and property performance trends.

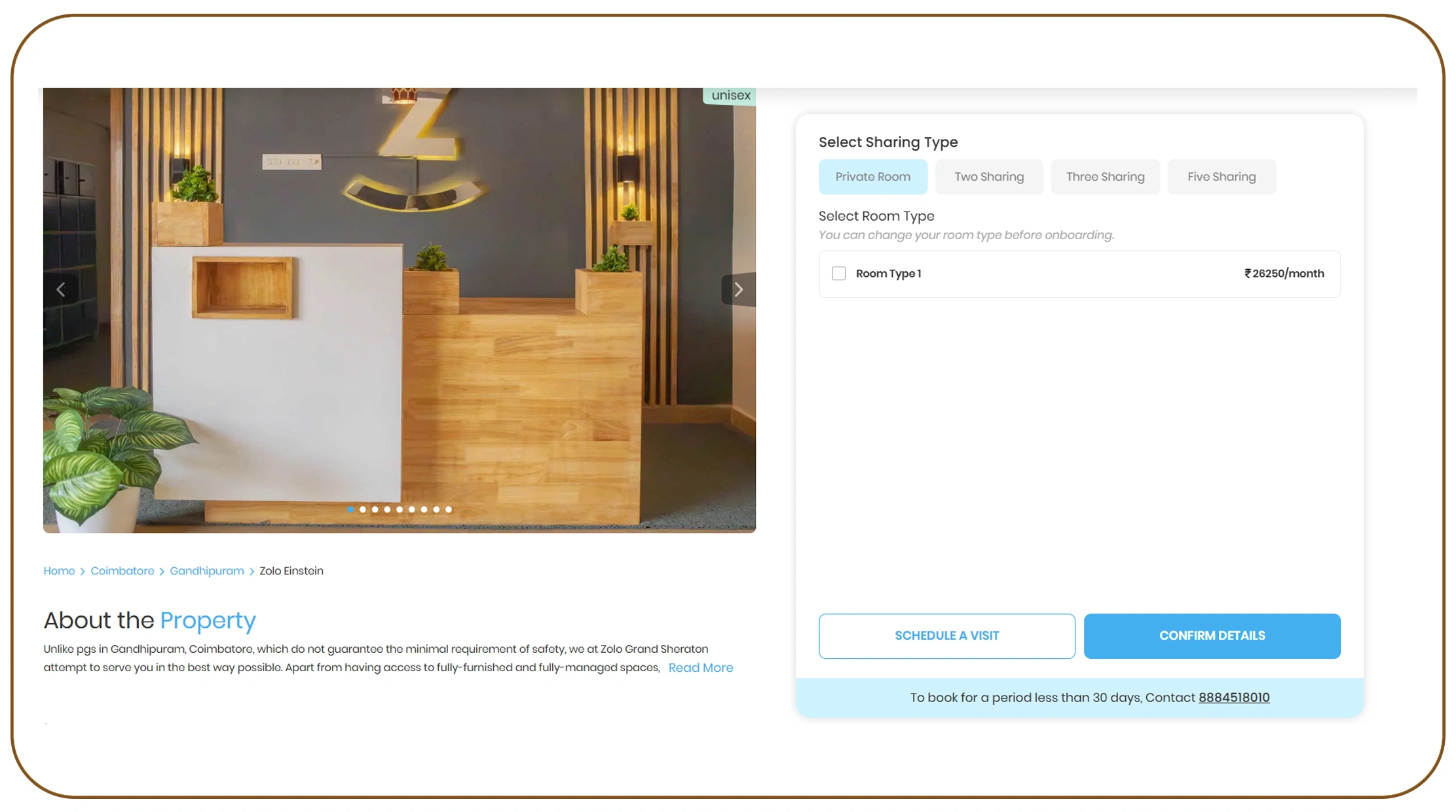

Using the Zolo Data Scraping API, real estate professionals can systematically collect rental listings, historical pricing movements, neighborhood-level inventory data, and property attributes. This automated approach eliminates manual research limitations and provides large-scale datasets for predictive modeling.

Between 2020 and 2026, average rental prices in major Canadian cities increased by 18–35%, depending on region. Investors who used structured data analysis were better positioned to adjust rental rates, identify high-growth corridors, and mitigate vacancy risks.

In this blog, we explore how automated extraction tools help investors reduce uncertainty, strengthen portfolio strategy, and maximize long-term return on investment (ROI).

Pricing Intelligence for Smarter Acquisition Decisions

Understanding rental price positioning is fundamental for ROI optimization. Investors who extract Zolo rental listings for pricing insights gain clarity into market averages, property type comparisons, and neighborhood-level pricing differentials.

From 2020–2026, Canadian urban rental prices showed steady upward momentum after a temporary dip in 2020. Toronto, Vancouver, and Calgary experienced notable rebounds between 2022 and 2024.

Average Monthly Rent by Property Type (CAD)

| Year | 1-Bedroom | 2-Bedroom | 3-Bedroom |

|---|---|---|---|

| 2020 | 1,850 | 2,350 | 2,900 |

| 2022 | 1,920 | 2,480 | 3,050 |

| 2024 | 2,150 | 2,750 | 3,300 |

| 2026* | 2,300 | 2,950 | 3,550 |

| *Projected | |||

By analyzing listing-level data, investors can determine whether a property is underpriced or overvalued relative to local benchmarks. Pricing intelligence reduces acquisition risk and ensures projected rental yields align with real-time market dynamics.

Structured listing extraction also enables comparison across micro-markets, allowing portfolio diversification strategies based on verified performance metrics.

Monitoring Live Market Conditions

Rental demand fluctuates seasonally and regionally. A real-time Zolo property data scraper provides ongoing visibility into listing activity, availability, and occupancy trends.

Between 2020 and 2026, vacancy rates varied significantly due to migration patterns and urban recovery. Investors who tracked real-time listings were able to anticipate tightening supply conditions.

Vacancy Rate Trends (Major Canadian Cities)

| Year | Toronto | Vancouver | Calgary |

|---|---|---|---|

| 2020 | 3.4% | 3.2% | 5.0% |

| 2022 | 2.1% | 1.9% | 3.8% |

| 2024 | 1.5% | 1.3% | 2.9% |

| 2026* | 1.2% | 1.0% | 2.5% |

| *Projected | |||

Lower vacancy rates often correlate with upward rent pressure. By automating listing updates, investors can detect shifts before they appear in quarterly reports.

This live monitoring approach enables rapid pricing adjustments, targeted marketing strategies, and proactive tenant retention efforts.

Understanding Rent Volatility and Seasonal Trends

Rental markets are cyclical. Investors who Scrape rent fluctuations data via Zolo API gain insight into monthly and annual price shifts.

From 2020 to 2026, rent volatility increased due to economic shifts and housing shortages. Seasonal rent spikes were most prominent in Q2 and Q3 annually.

Average Rent Growth (%)

| Year | National Avg. Growth |

|---|---|

| 2020 | -4% (Pandemic Dip) |

| 2022 | +6% |

| 2024 | +9% |

| 2026* | +7% |

| *Projected | |

By analyzing rent fluctuation patterns, investors can forecast revenue projections more accurately. Identifying consistent seasonal spikes allows for lease renewals and new tenant pricing strategies aligned with peak demand.

Historical volatility data also helps assess long-term sustainability of rent growth in specific neighborhoods, preventing overestimation of ROI potential.

Building Comprehensive Pricing Models

Data aggregation becomes powerful when investors utilize a Web Scraping Zolo rental pricing dataset to model predictive performance scenarios.

Between 2020–2026, property investors increasingly adopted analytics tools to forecast rental yield based on historical pricing and occupancy trends.

Projected Rental Yield Comparison

| Property Type | 2020 Yield | 2024 Yield | 2026 Est. |

|---|---|---|---|

| Condo | 4.2% | 4.8% | 5.1% |

| Townhouse | 4.5% | 5.0% | 5.4% |

| Detached | 3.8% | 4.3% | 4.7% |

Dataset modeling supports:

- ROI scenario planning

- Break-even occupancy calculations

- Rent optimization modeling

- Risk sensitivity analysis

By transforming scraped listings into structured pricing datasets, investors enhance long-term strategic planning and portfolio resilience.

Leveraging Large-Scale Market Intelligence

A structured Real Estate Dataset provides macro-level insights beyond individual listings.

Between 2020 and 2026, migration-driven housing demand reshaped suburban rental markets. Investors who analyzed broader datasets captured early signals of neighborhood growth.

Population & Rental Demand Growth

| Year | Urban Growth | Suburban Growth |

|---|---|---|

| 2020 | +1.1% | +2.4% |

| 2023 | +1.8% | +3.2% |

| 2026* | +2.0% | +3.5% |

| *Projected | ||

Comprehensive datasets allow comparison of rental growth, price elasticity, and demand shifts across regions.

Investors leveraging aggregated market intelligence can rebalance portfolios based on performance metrics rather than anecdotal trends.

Automating Portfolio Analytics for Long-Term ROI

Automation transforms raw data into operational intelligence. Using a Web Scraping Real Estate Data API, investors can integrate extracted data directly into dashboards and forecasting systems.

From 2020–2026, automated analytics improved portfolio forecasting accuracy by up to 30%.

Forecast Accuracy Improvements

| Year | Manual Analysis | Automated API |

|---|---|---|

| 2020 | 65% | 72% |

| 2023 | 70% | 85% |

| 2026* | 74% | 90% |

| *Projected | ||

Automated dashboards enable investors to:

- Monitor property-level rent performance

- Track vacancy exposure

- Compare neighborhood ROI

- Predict cash flow under various scenarios

With API-driven analytics, decision-making becomes proactive rather than reactive, strengthening long-term capital efficiency.

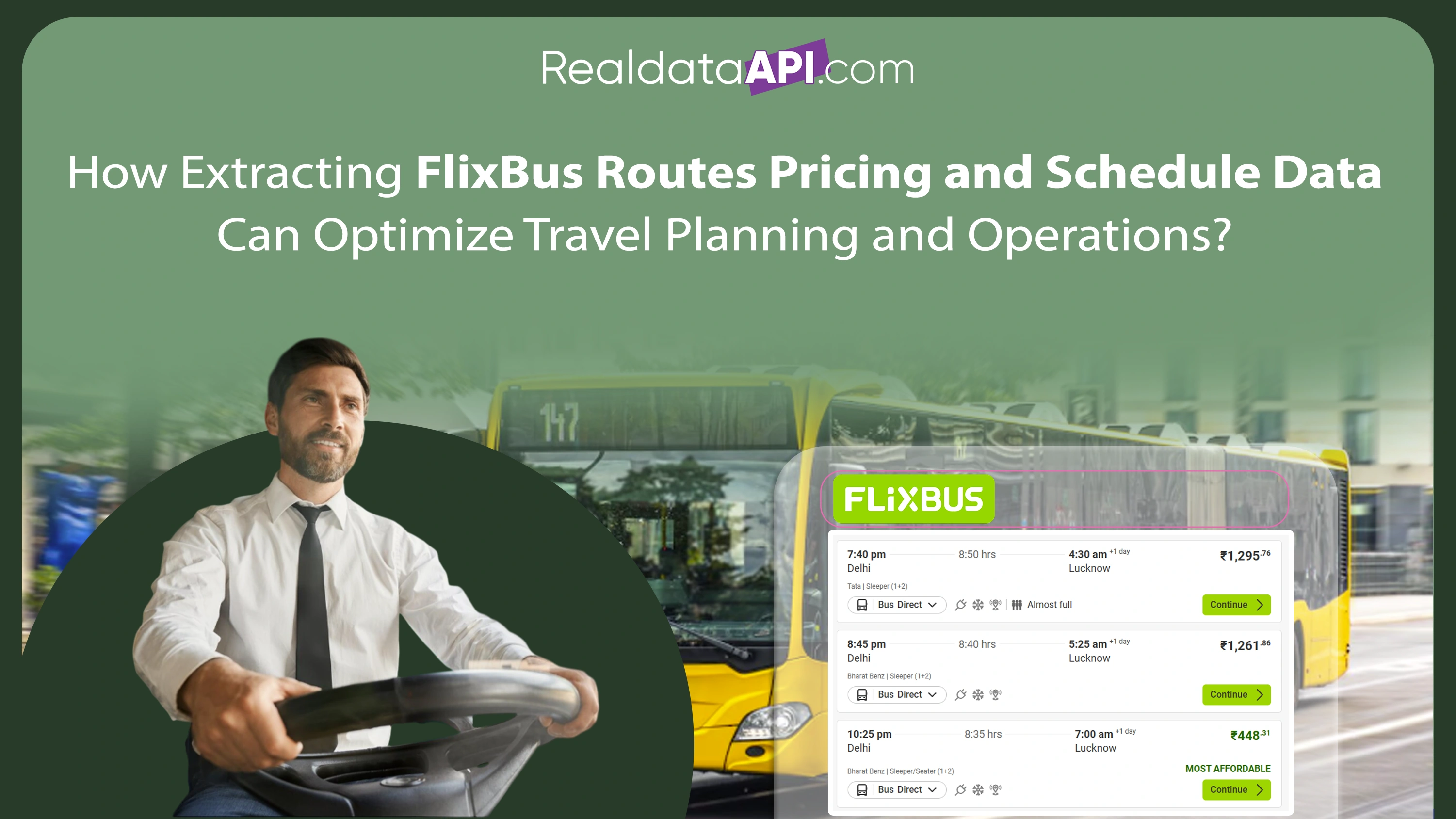

Why Choose Real Data API?

Real Data API delivers enterprise-grade extraction infrastructure, including Instant Data Scraper solutions designed for scalable real estate intelligence. Through advanced automation, investors can implement Zolo housing data extraction for rental market research with structured outputs ready for analytics and forecasting tools.

Key advantages include:

- Real-time listing extraction

- Customizable filters by city and property type

- Clean CSV/JSON datasets

- Scalable cloud infrastructure

- Dedicated technical support

Real Data API ensures secure, compliant, and high-accuracy data pipelines tailored for rental market research.

Conclusion

The Canadian rental market between 2020 and 2026 has demonstrated how quickly conditions can shift. Investors who rely on structured data consistently outperform those who depend on outdated reports.

By implementing Zolo housing data extraction for rental market research, real estate professionals gain deeper visibility into pricing trends, vacancy shifts, rent volatility, and long-term ROI potential.

If you’re ready to reduce investment risk and maximize returns, partner with Real Data API today and leverage Zolo housing data extraction for rental market research to power smarter real estate decisions.