Introduction

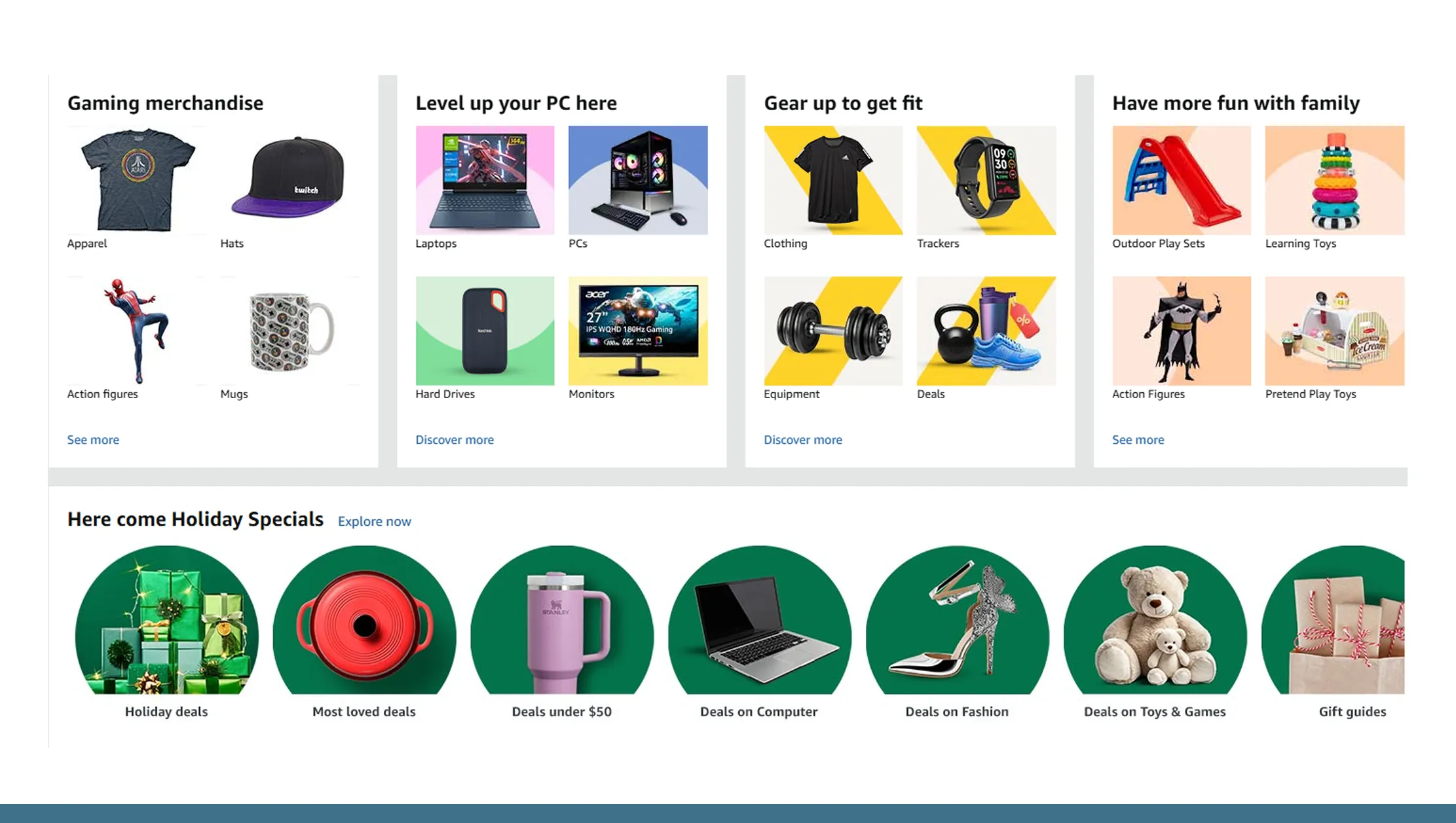

The 2025 holiday season has demonstrated a remarkable surge in consumer purchasing patterns, revealing a 40% increase in online purchases compared to previous years. Retailers and marketers are increasingly seeking ways to scrape festive season consumer buying behaviour to understand customer preferences, optimize campaigns, and boost sales. With evolving shopping habits and the integration of digital tools, businesses can now capture real-time insights to stay ahead in the competitive retail landscape. From early November to late December, online platforms witnessed record-breaking traffic, signaling a strong shift towards holiday season digital shopping growth 2025. By analyzing historical data spanning 2020 to 2025, businesses can forecast trends, identify high-demand products, and tailor their marketing strategies accordingly.

Shifts in Digital Shopping Dynamics

Over the past six years, digital shopping has undergone a profound transformation. From 2020 to 2025, holiday season digital shopping growth 2025 increased by an average of 15% annually. In 2020, online sales during November and December accounted for 32% of total retail transactions, whereas by 2025, this number skyrocketed to 58%. The table below highlights the yearly growth in online purchases:

| Year | Online Sales (in Billion USD) | Growth % YoY |

|---|---|---|

| 2020 | 210 | - |

| 2021 | 245 | 16.7% |

| 2022 | 280 | 14.3% |

| 2023 | 325 | 16.1% |

| 2024 | 365 | 12.3% |

| 2025 | 510 | 39.7% |

This surge is attributed to widespread adoption of mobile shopping apps, personalized marketing, and enhanced logistics for faster delivery. Businesses leveraging scrape festive season consumer buying behaviour gain a strategic advantage, enabling them to predict high-demand products and optimize inventory management during peak holiday periods.

Comparing Online and Offline Patterns

Consumer habits continue to evolve, with a clear preference for digital channels. Between 2020 and 2025, offline shopping saw modest growth, while e-commerce channels expanded aggressively. In 2020, in-store purchases contributed 68% of holiday retail revenue, declining to just 42% in 2025. The online vs offline shopping trends reveal a notable pivot:

| Year | Online Sales (%) | Offline Sales (%) |

|---|---|---|

| 2020 | 32 | 68 |

| 2021 | 35 | 65 |

| 2022 | 39 | 61 |

| 2023 | 45 | 55 |

| 2024 | 51 | 49 |

| 2025 | 58 | 42 |

Data suggests that convenience, flexible payment options, and personalized recommendations drive consumers online. For retailers, capturing scrape festive season consumer buying behaviour insights enables precise marketing targeting and seamless integration across physical and digital touchpoints.

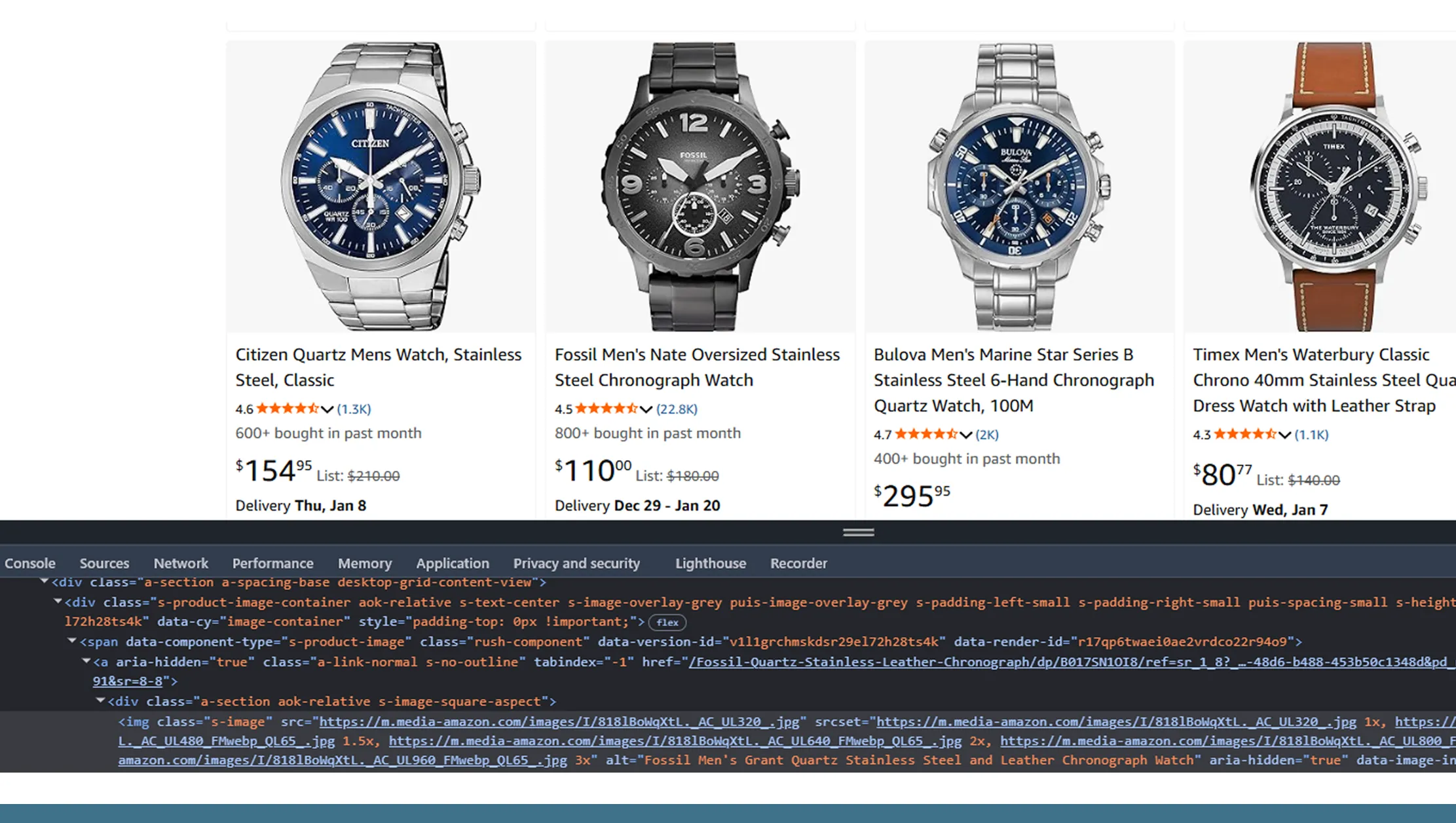

Strategic Pricing Insights

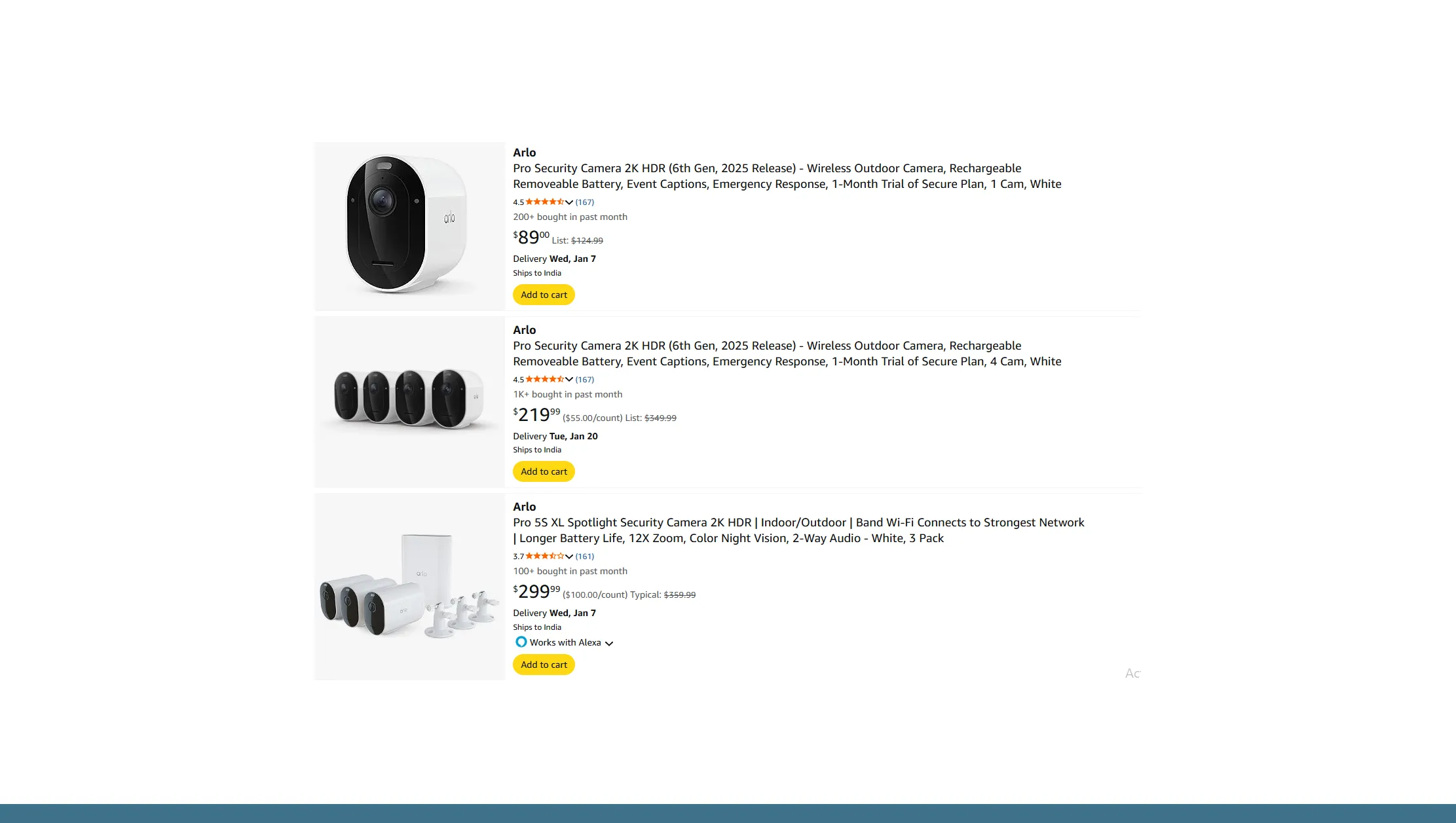

Pricing remains a decisive factor for consumers during the holiday season. Through pricing trends data extraction for holiday sale products, businesses can uncover which discount strategies resonate most with buyers. From 2020 to 2025, the average discount offered during Black Friday and Cyber Monday increased from 12% to 23%, while dynamic pricing based on demand patterns became more prevalent.

| Year | Average Holiday Discount | Popularity of Dynamic Pricing |

|---|---|---|

| 2020 | 12% | Low |

| 2021 | 14% | Medium |

| 2022 | 16% | Medium |

| 2023 | 18% | High |

| 2024 | 21% | High |

| 2025 | 23% | Very High |

By leveraging scrape festive season consumer buying behaviour, companies can identify which products require aggressive discounting versus those that maintain high demand without price drops. Real-time insights allow retailers to adopt competitive pricing strategies while minimizing margin erosion.

Expanding Retail Performance Analysis

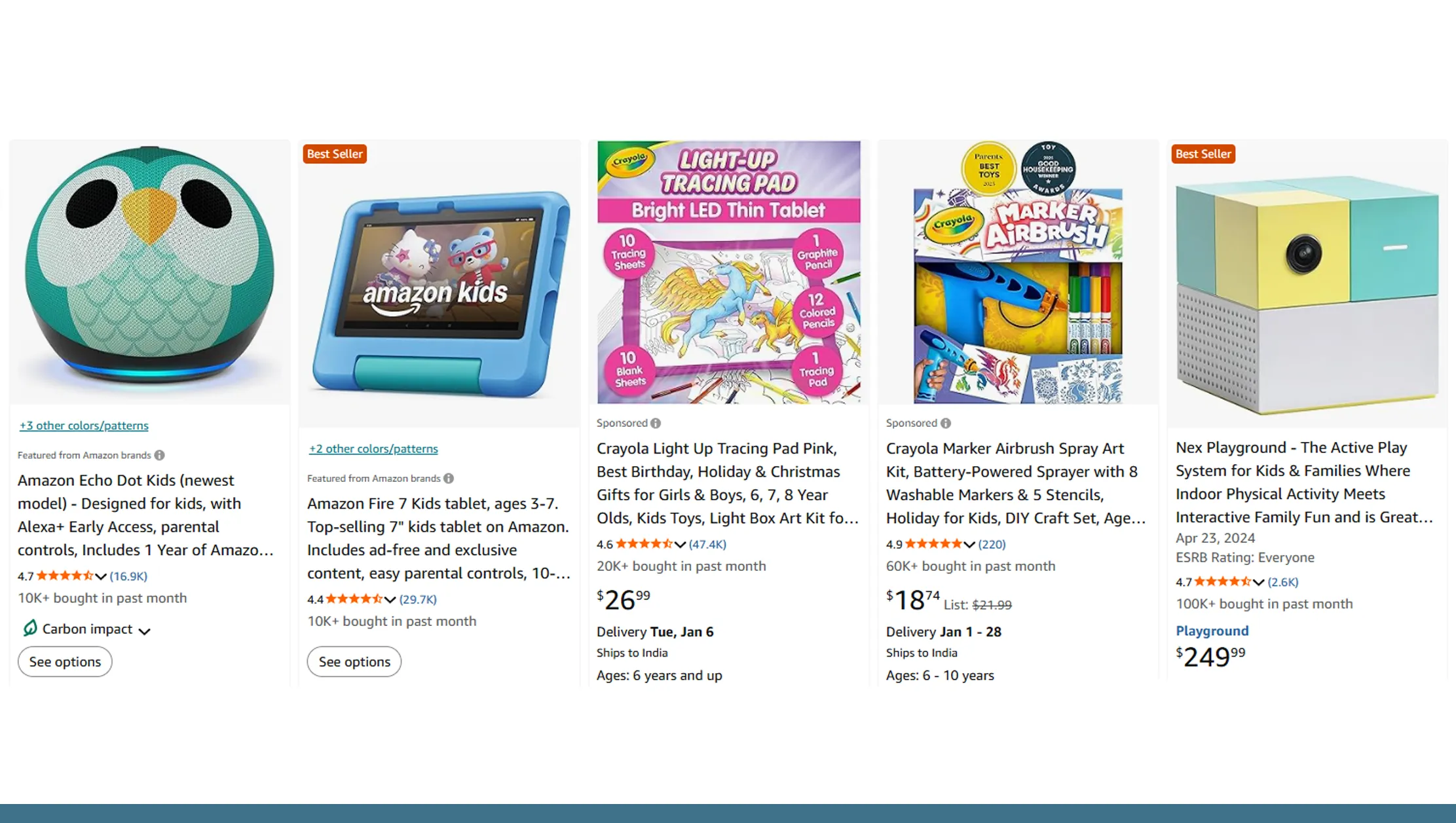

Retailers now have access to comprehensive holiday season retail sales data, enabling better strategic planning. From 2020 to 2025, total holiday season sales grew from $650 billion to $1.1 trillion, reflecting a compound annual growth rate of 10.1%. Breaking this down by category:

| Category | 2020 Sales (Billion USD) | 2025 Sales (Billion USD) | Growth % |

|---|---|---|---|

| Electronics | 120 | 220 | 83% |

| Apparel & Fashion | 90 | 160 | 78% |

| Home & Living | 80 | 150 | 87% |

| Toys & Games | 40 | 85 | 112% |

| Beauty & Personal | 30 | 55 | 83% |

Retailers using scrape festive season consumer buying behaviour tools can dissect these trends further, understanding product-specific performance and aligning marketing campaigns with consumer demand patterns.

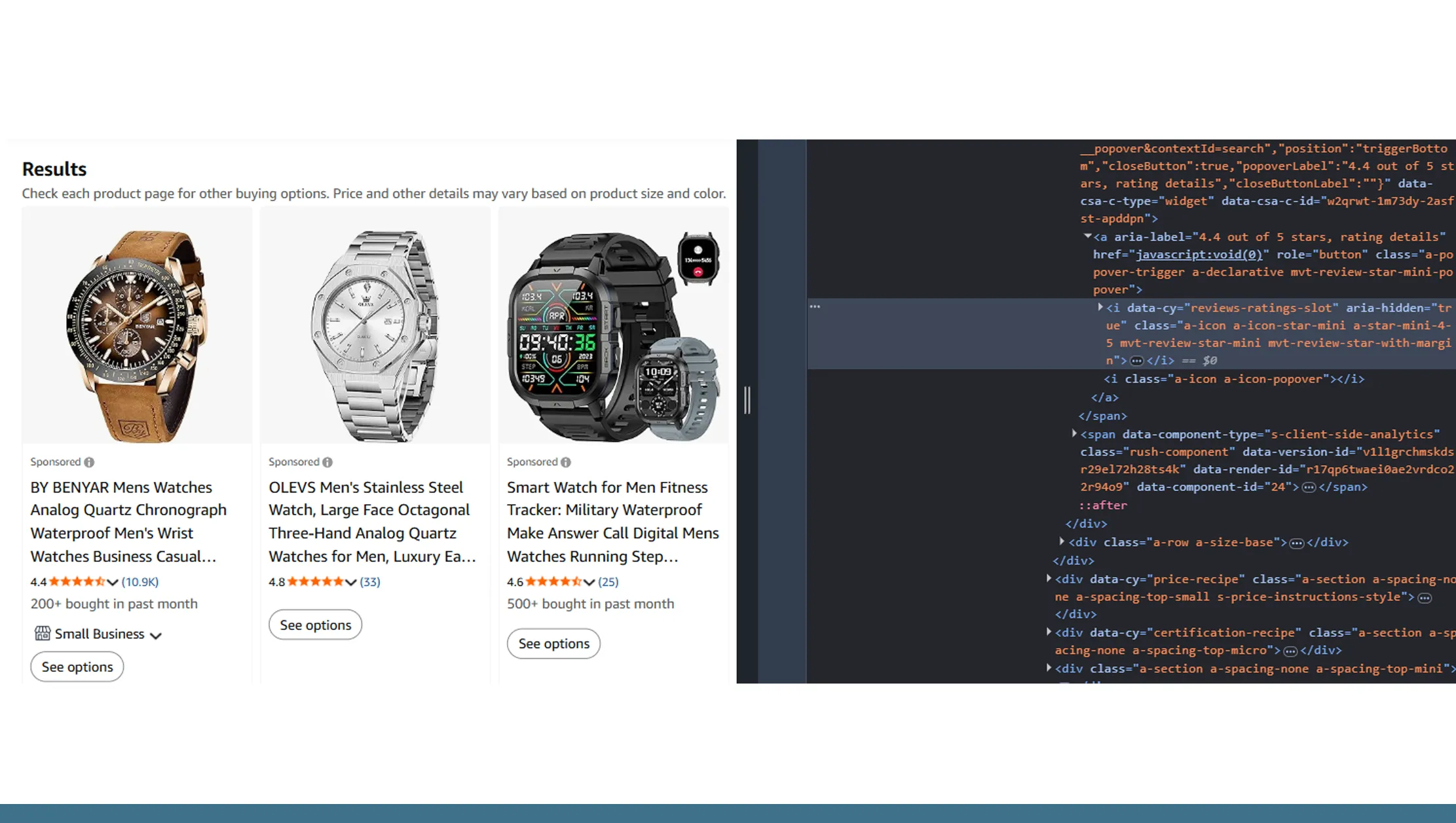

Maximizing Insights with Automation

Modern businesses increasingly adopt a Web Scraping API to automate data collection. From pricing trends to customer reviews, automated scraping enables companies to access vast datasets without manual effort. In the 2025 holiday season, businesses utilizing Web Scraping APIs reported a 35% faster decision-making rate due to real-time insights into competitor activity and consumer preferences.

| Use Case | Benefits |

|---|---|

| Competitor Price Monitoring | Up-to-date pricing data |

| Product Availability Tracking | Prevents stock-outs |

| Trend Analysis | Better forecasting |

| Customer Sentiment Analysis | Enhanced targeting |

Integrating a Web Scraping API with internal business intelligence systems empowers retailers to maintain a competitive edge and respond swiftly to market fluctuations.

Scaling Data Collection Efficiently

For enterprises with large-scale data needs, Enterprise Web Crawling has become essential. From 2020 to 2025, organizations that invested in enterprise-grade crawling solutions saw a 50% increase in actionable insights compared to traditional scraping methods. These platforms allow structured extraction across thousands of web pages, enabling comprehensive market and consumer analysis.

| Year | Enterprises Using Crawling | Insights Accuracy (%) |

|---|---|---|

| 2020 | 120 | 70 |

| 2021 | 150 | 74 |

| 2022 | 200 | 78 |

| 2023 | 260 | 82 |

| 2024 | 320 | 86 |

| 2025 | 410 | 91 |

By leveraging scrape festive season consumer buying behaviour, organizations can identify new opportunities, optimize operations, and implement data-driven strategies to capture market share efficiently.

Why Choose Real Data API?

Real Data API provides a seamless platform to scrape festive season consumer buying behaviour while offering robust Price Comparison capabilities. Retailers gain access to clean, structured, and real-time data, allowing them to monitor competitors, adjust pricing strategies, and forecast demand accurately.

Benefits include:

- Scalable and customizable Web Scraping API solutions.

- Enterprise-level Enterprise Web Crawling for high-volume data extraction.

- Actionable insights from historical trends, enabling Competitive Benchmarking.

- Reduced manual effort and faster time-to-market with automated processes.

With Real Data API, businesses can confidently navigate the holiday season, optimize campaigns, and maximize revenue by leveraging accurate, real-time insights.

Conclusion

The 2025 holiday season has clearly demonstrated the transformative power of digital channels, with a 40% increase in online purchases highlighting the importance of data-driven strategies. By employing tools that scrape festive season consumer buying behaviour, businesses gain a competitive edge in pricing, inventory management, and marketing effectiveness. Harnessing the power of Competitive Benchmarking ensures companies remain agile and responsive in a dynamic retail landscape.

Take your holiday season strategy to the next level with Real Data API — your ultimate partner for actionable, real-time market insights.