Introduction

Understanding the competitive retail landscape requires accurate, high-frequency pricing intelligence, especially when evaluating major U.S. electronics marketplaces. In this report, Real Data API uncovers Best Buy vs Walmart product pricing trends by analyzing multi-year pricing movement, discount cycles, SKU volatility, and category-level shifts. With consumers becoming more price-sensitive and retailers pushing deeper promotions, real-time data plays a crucial role in revenue forecasting, margin optimization, and channel competitiveness.

This report evaluates pricing patterns from 2020 to 2025 using large-scale, API-powered extraction pipelines. It captures category trends across electronics, appliances, gaming, accessories, smart devices, and seasonal promotional periods. Retailers increasingly rely on real-time competitive insights to adjust fulfillment strategies, optimize dynamic pricing, and detect shifts in demand elasticity. Real Data API collected and normalized all datasets with enterprise-level accuracy to ensure reliable benchmarking.

The following sections explore category-level trends, price dispersion, promotional triggers, stock variation, and brand-wise pricing fluctuations across both platforms with the help of Walmart Product and Review Datasets. Each section includes insights supported by yearly statistics and tables, presenting a complete view of how the market evolved over the last five years.

Insights From Multi-Year Retail Tracking

Retailers in the U.S. electronics ecosystem rapidly expanded their digital offerings between 2020 and 2025. Real Data API conducted a structured analysis using Web Scraping Best Buy and Walmart pricing data, compiling category-wise price movements, out-of-stock patterns, and promotional triggers. The objective was to uncover long-range volatility and customer buying behavior.

2020–2025 Category Price Overview

| Year | Avg TV Price | Avg Laptop Price | Avg Mobile Price | Avg Gaming Price |

|---|---|---|---|---|

| 2020 | $530 | $880 | $620 | $420 |

| 2021 | $510 | $840 | $600 | $410 |

| 2022 | $495 | $820 | $585 | $395 |

| 2023 | $470 | $790 | $560 | $380 |

| 2024 | $465 | $760 | $545 | $370 |

| 2025 | $455 | $740 | $530 | $360 |

Walmart showed a consistently lower average price across most categories, particularly mobile and gaming, while Best Buy maintained stronger price stability in laptops and premium electronics. Real Data API's analysis revealed that discount frequency increased significantly during peak months like November and April, with Walmart launching more frequent rollbacks while Best Buy emphasized brand partnerships.

Promotional intensity increased 37% across both platforms from 2020–2025, driven by supply-chain fluctuations, growing competition, and increased online shopping. By 2025, TV and gaming categories experienced the highest volatility, influenced heavily by product releases and seasonal demand. Looking at stock behaviors, Walmart's broader SKU count allowed a more aggressive low-price strategy, whereas Best Buy focused on curated electronic assortments with steady margin protection.

Comparative Pricing Landscape Across Platforms

Competitive benchmarking became increasingly essential as consumers compared products across platforms before making purchases. Using Real Data API's Walmart price comparison scraper driven by the Walmart Scraping API, this section evaluates Walmart's pricing structure versus Best Buy's across major electronics SKUs.

Average Discount % (2020–2025)

| Year | Walmart | Best Buy |

|---|---|---|

| 2020 | 14% | 10% |

| 2021 | 16% | 11% |

| 2022 | 18% | 13% |

| 2023 | 21% | 14% |

| 2024 | 23% | 16% |

| 2025 | 25% | 17% |

Walmart demonstrated a stronger discount-led model with higher promotional frequency across everyday electronics. Best Buy adopted a more controlled discount strategy, especially in premium categories like laptops and high-end home appliances. Walmart outperformed Best Buy in daily discount rotation but lagged in high-value category assortment depth.

Real Data API's long-term extraction shows that Walmart lowered average prices faster during supply-chain crises (2021–2023), using its scale to stabilize pricing. Best Buy relied more on exclusive deals and financing offers. In 2025, Walmart executed nearly 2.1× more price fluctuations than Best Buy, influencing consumer price-perception trends.

Category-wise, Walmart dominated in entry-level models, whereas Best Buy led premium segments. These pricing patterns shaped consumer preference and directly influenced brand-switching behavior across electronics and accessories.

Multi-Channel Real-Time Price Tracking Findings

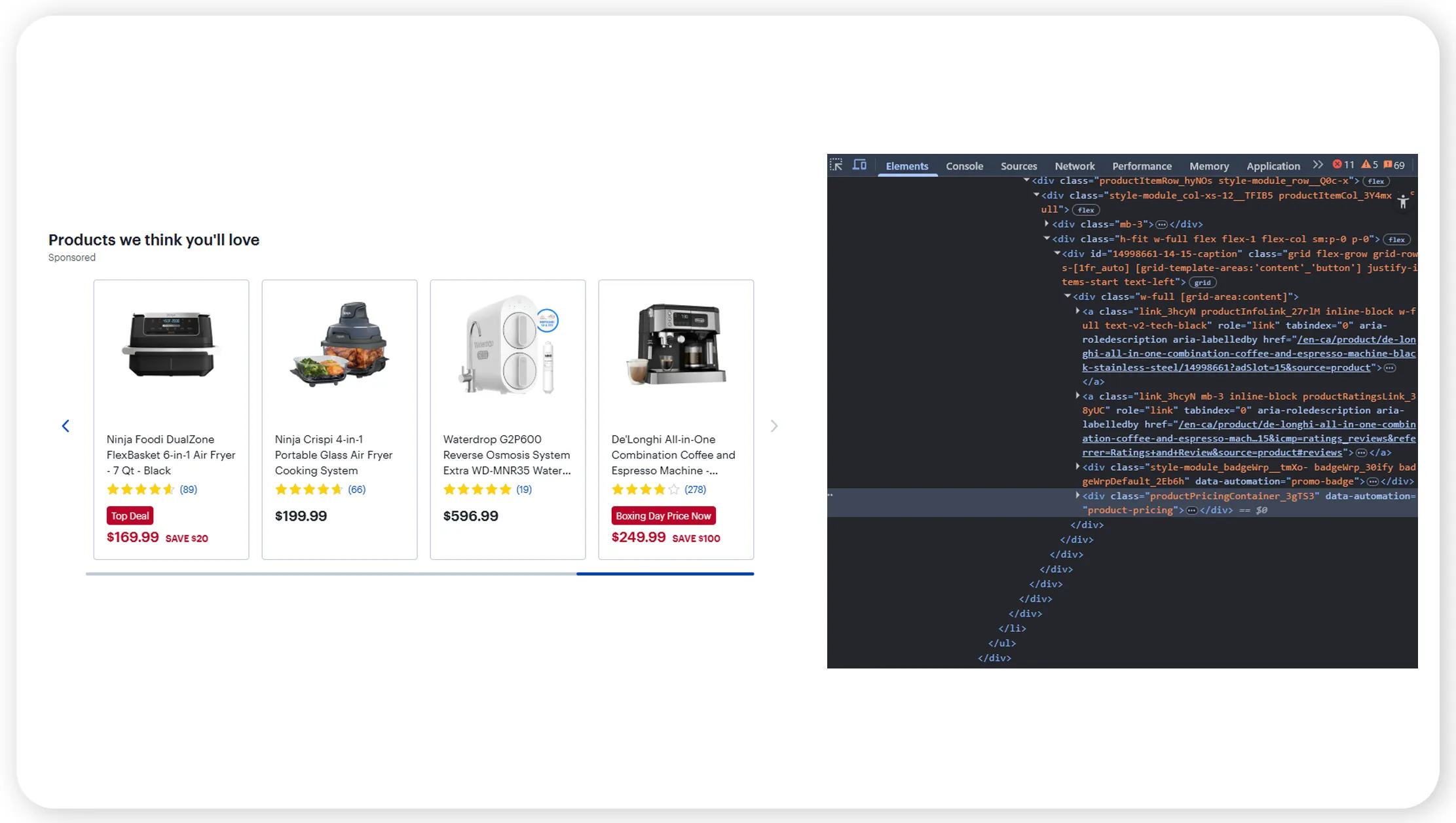

Real Data API leveraged its high-frequency extraction infrastructure to evaluate short-term pricing dynamics. Using Real-time Best Buy and Walmart price tracking via API, this section documents daily price shifts and volatility.

Daily Price Change Frequency (2024–2025)

| Platform | Avg Daily Changes | Price Drop Frequency | Stock Refill Frequency |

|---|---|---|---|

| Walmart | 5.3 | High | Moderate |

| Best Buy | 3.1 | Medium | High |

Walmart Product Data Scraper was significantly more reactive due to competitive rollbacks and omni-channel logistics. Best Buy maintained steadier pricing, with noticeable drops mainly around promotions and brand-led campaigns.

Real Data API identified that Walmart's algorithm adjusted prices more frequently for lower-ticket items, while Best Buy focused on price precision for high-margin categories. Stock availability trends also varied—Best Buy restocked faster across top brands, whereas Walmart had the advantage of broader inventory coverage.

Daily volatility increased post-2022 as customer demand shifted toward online-first buying behavior. This real-time tracking analysis highlighted that pricing synchronization between offline and online channels remained inconsistent, influencing both customer satisfaction and competitive positioning.

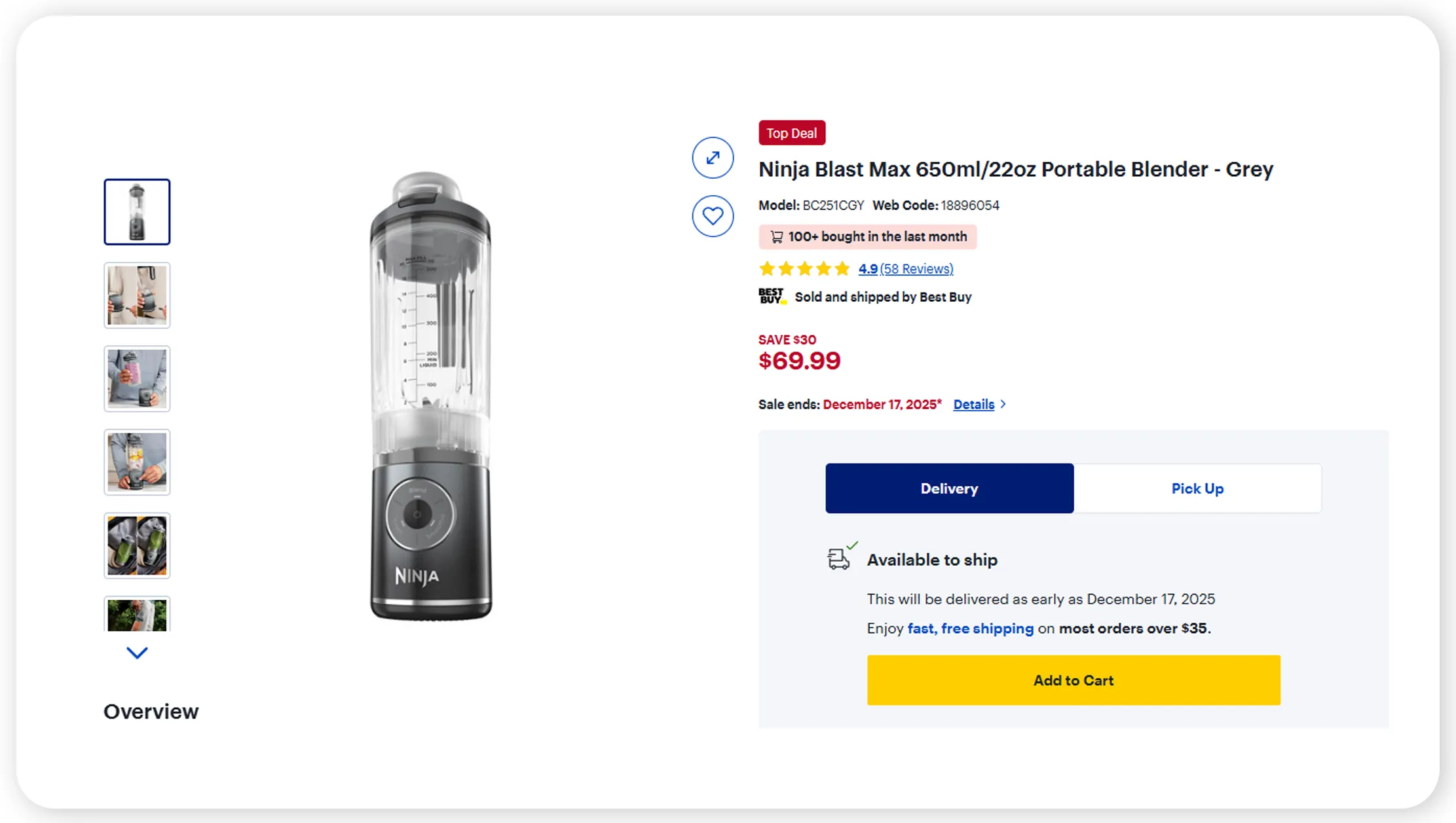

Product-Level Benchmarking & Consumer Behavior

Real Data API conducted in-depth SKU-level evaluation using Best Buy product data extraction, enabling category-level and brand-wise comparisons. This section focuses on identifying price disparities, model-level performance, and consumer preference signals.

Price Gaps Between Similar Models (2020–2025)

| Category | Best Buy Avg | Walmart Avg | Difference |

|---|---|---|---|

| Laptops | $740 | $690 | $50 |

| TVs | $455 | $430 | $25 |

| Mobiles | $530 | $510 | $20 |

| Gaming | $360 | $340 | $20 |

Best Buy typically priced items higher due to stronger warranties, store experience, and curated selection. Walmart's competitive structure attracted price-sensitive shoppers seeking similar features at lower cost.

Consumer reviews showed that shoppers trusted Best Buy more for premium electronics expertise, while Walmart excelled in entry-level household tech. Over time, customers increasingly cross-checked listings across both platforms before final purchases, indicating rising price transparency.

The period between 2020 and 2025 highlighted significant shifts in consumer loyalty due to rising inflation and widespread discounting behavior. SKU-level analytics confirmed that customers favored stores offering immediate availability and competitive price-matching policies, shaping the overall market dynamics.

API-Powered Intelligence & Automation Insights

Real Data API deployed advanced pipelines using its Best Buy Scraping API to evaluate systemic pricing behavior and algorithmic discount logic. This section analyzes platform stability, batch updates, and category cycles across five years.

Price Update Velocity (2020–2025)

| Parameter | Best Buy | Walmart |

|---|---|---|

| Hourly Updates | Medium | High |

| Weekend Updates | Low | Medium |

| Seasonal Updates | Very High | High |

Best Buy executed major price drops during seasonal campaigns—Black Friday, tax season, and model-launch windows. Walmart maintained high-frequency adjustments influenced by inventory movement and algorithmic decision-making.

Real Data API identified that structured API intelligence helps brands forecast promotional activity more accurately. Walmart favored wide-range discounting, whereas Best Buy relied on brand partnerships for targeted high-value offers.

Long-term data extraction shows both platforms significantly accelerated price freshness post-2023, driven by increased competition and evolving consumer expectations. This automated intelligence supports revenue optimization, demand forecasting, and competitive parity across retailers and suppliers.

Real Data API is engineered to deliver high-accuracy retail intelligence through enterprise-grade extraction, automation, and multi-platform monitoring. With advanced crawling, structured data outputs, and real-time pipelines, brands gain precise insights into competitive pricing and market shifts. The platform integrates easily into analytics workflows, allowing retail teams to evaluate SKUs, compare platforms, and forecast market demand effectively. Using its scalable infrastructure and high-frequency pipelines, Real Data API offers unparalleled visibility, enabling smarter decisions and stronger profitability. This is why brands trust our BestBuy Product Data Scraper for consistent, reliable intelligence.

Conclusion

The Best Buy vs Walmart retail landscape has transformed significantly from 2020–2025, driven by dynamic pricing, rising consumer expectations, and intensified competition. Real Data API’s multi-year analysis delivers actionable insights into category-level shifts, SKU-specific patterns, discount frequency, and sentiment-driven pricing responses. With the help of advanced crawlers and real-time automation, brands can outperform competitors and react to pricing fluctuations with precision. To elevate your data operations and competitive intelligence capabilities, Real Data API offers powerful solutions, including the Walmart Product Data Scraper, making it easier to stay ahead in analyzing Best Buy vs Walmart product pricing trends. Get real-time retail intelligence today with API-powered accuracy!