Introduction

Arizona's food industry operates within a highly dynamic environment shaped by population growth, tourism inflow, urban expansion, and rapidly evolving consumer preferences. From restaurants and cloud kitchens to distributors and food brands, businesses face constant pressure to maintain supply continuity while controlling costs and meeting customer expectations. However, one of the most persistent challenges remains fragmented visibility across menus, pricing, demand patterns, and supplier performance. These blind spots often result in inaccurate forecasting, delayed pricing adjustments, inventory waste, and missed regional opportunities. Leveraging Food industry data extraction Arizona enables businesses to systematically collect, structure, and analyze food-related data from online sources, helping them replace assumptions with intelligence. By transforming unstructured menu data, delivery platform insights, and consumption trends into actionable datasets, companies gain end-to-end visibility across their supply chain. This data-driven clarity empowers decision-makers to anticipate disruptions, align procurement with demand, and respond faster to market changes—ultimately building more resilient and profitable food operations across Arizona.

Localized Pricing Intelligence That Prevents Margin Erosion

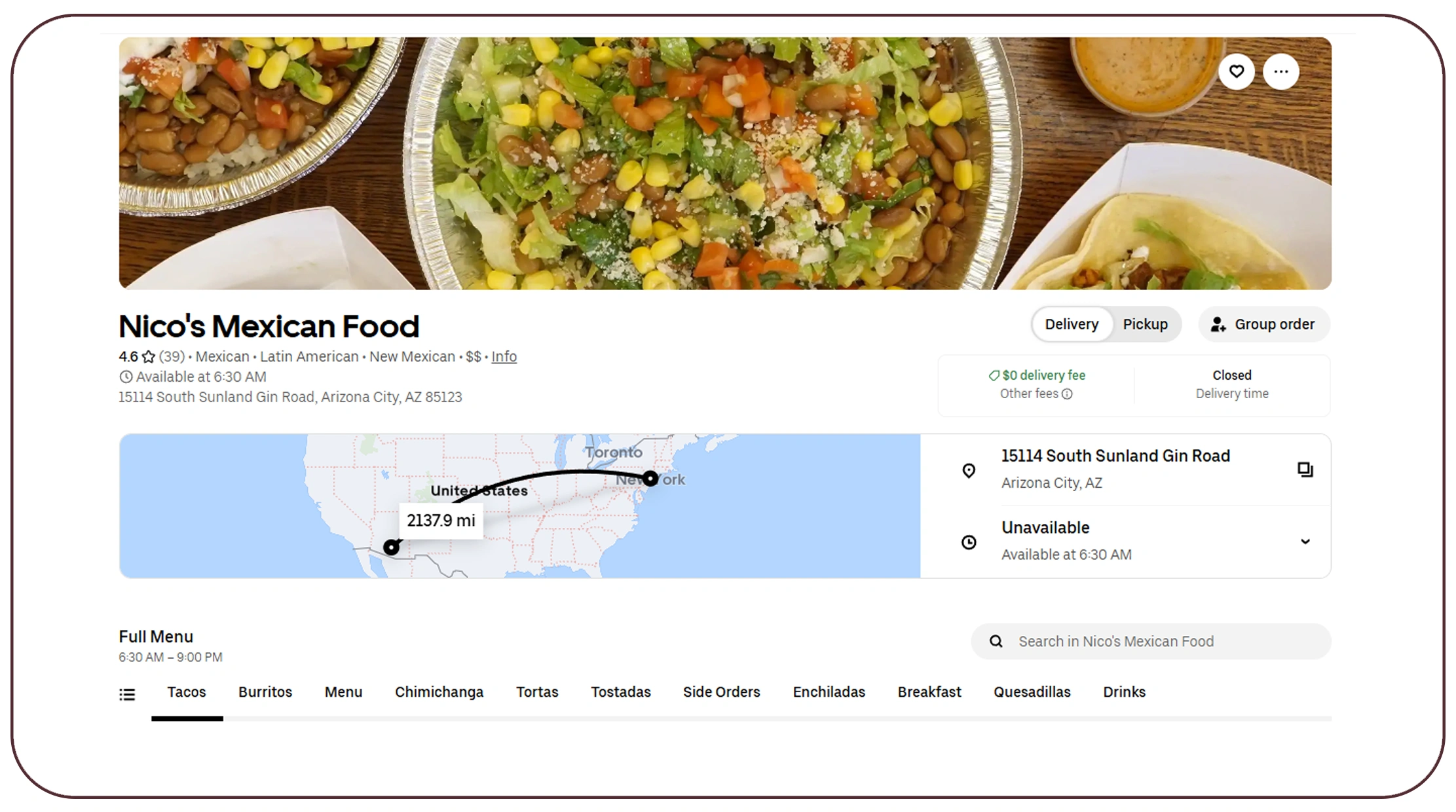

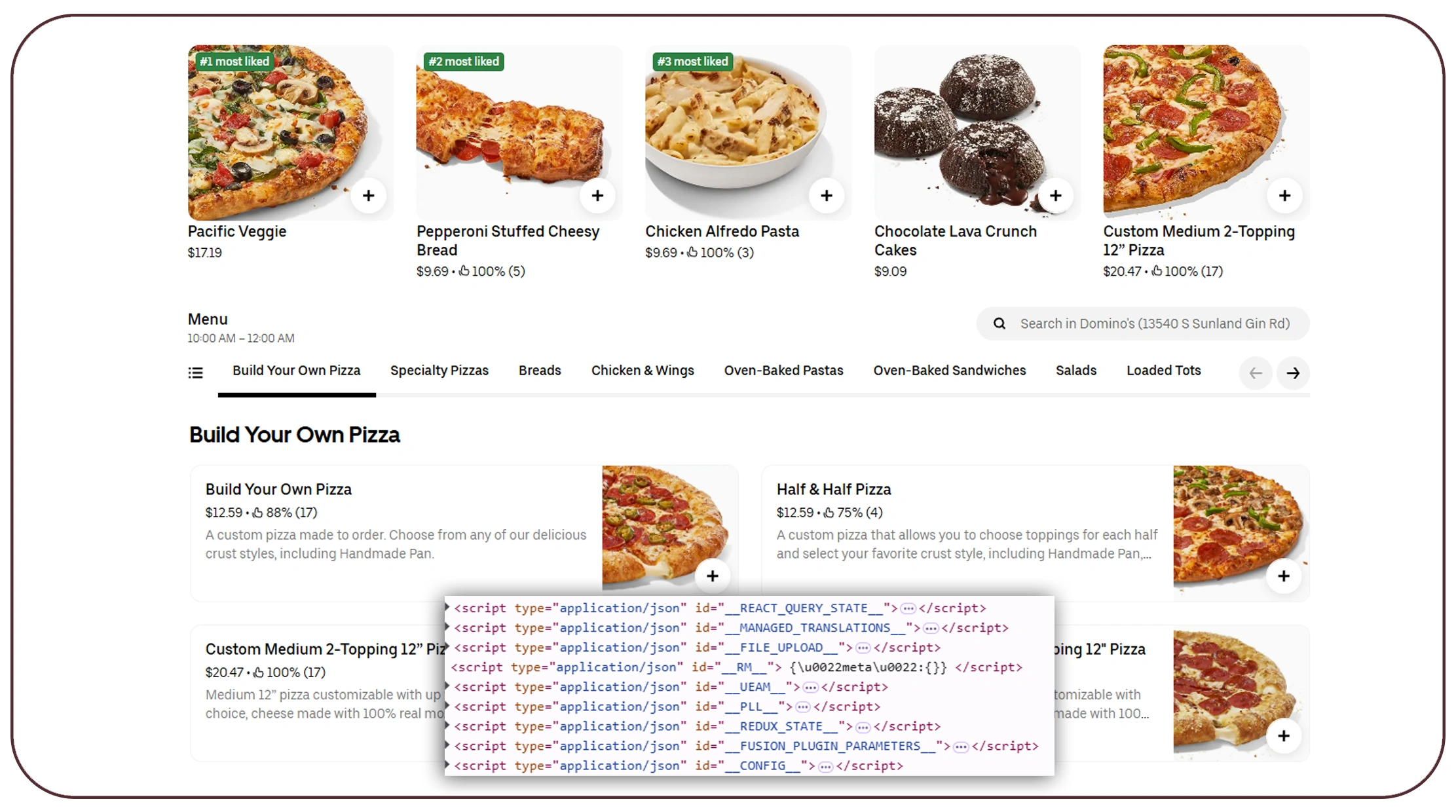

Price volatility is a defining characteristic of the food industry, particularly in regional markets like Arizona where demand varies significantly across cities, neighborhoods, and tourist hubs. Many businesses rely on outdated pricing audits or sporadic competitor checks, making it difficult to keep pace with frequent menu updates. By adopting Scrape restaurant menu prices in Arizona, businesses gain continuous visibility into pricing fluctuations across restaurants, cuisines, and locations. This localized intelligence allows pricing teams to benchmark effectively, detect abnormal price changes, and understand competitive positioning in real time.

Arizona Average Menu Price Movement (2020–2026)

| Year | Average Menu Price ($) | Annual Change |

|---|---|---|

| 2020 | 10.80 | — |

| 2021 | 11.60 | +7.4% |

| 2022 | 12.85 | +10.8% |

| 2023 | 13.75 | +7.0% |

| 2024 | 14.55 | +5.8% |

| 2025 | 15.15 | +4.1% |

| 2026 | 15.85 | +4.6% |

With real-time pricing insights, businesses can protect margins, reduce reactive decision-making, and introduce data-backed pricing strategies that reflect actual market behavior rather than assumptions.

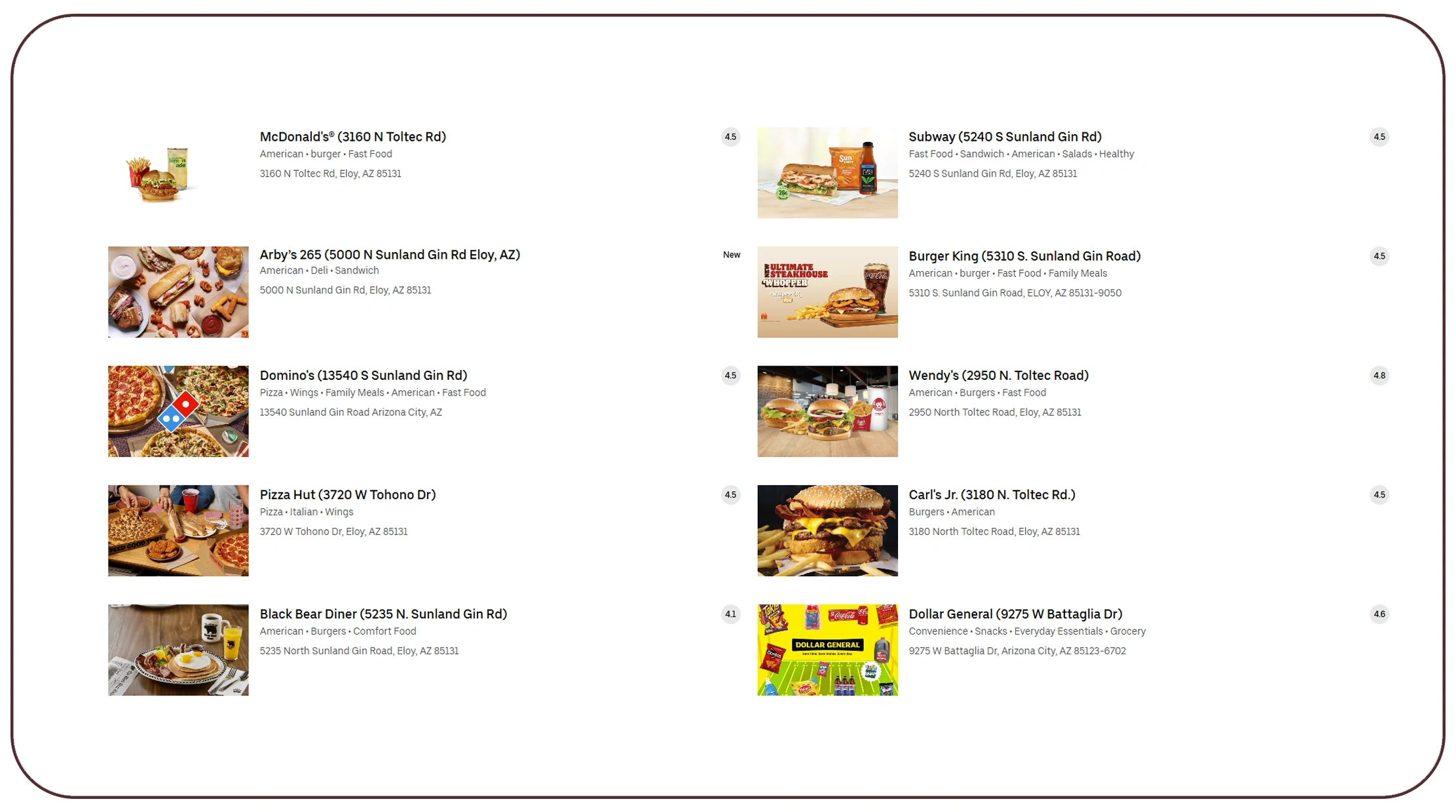

Delivery Platform Insights That Reveal True Demand

Online food delivery platforms have become a core revenue channel for Arizona's food ecosystem. Yet many businesses lack structured access to the data generated across these platforms, leading to blind spots in understanding consumer behavior. Using Extract Arizona food delivery data, companies can analyze order frequency, peak demand windows, average basket sizes, and cuisine popularity by region. These insights help businesses align supply planning, staffing, and promotions with real customer demand instead of historical averages.

Arizona Food Delivery Growth Trends

| Year | Total Orders (Millions) | Avg Order Value ($) |

|---|---|---|

| 2020 | 44 | 23.20 |

| 2021 | 58 | 25.10 |

| 2022 | 71 | 26.90 |

| 2023 | 80 | 28.40 |

| 2024 | 89 | 29.90 |

| 2025 | 98 | 31.40 |

| 2026 | 107 | 33.00 |

Delivery data intelligence enables proactive planning, helping businesses avoid stockouts during demand spikes and reduce waste during low-demand periods.

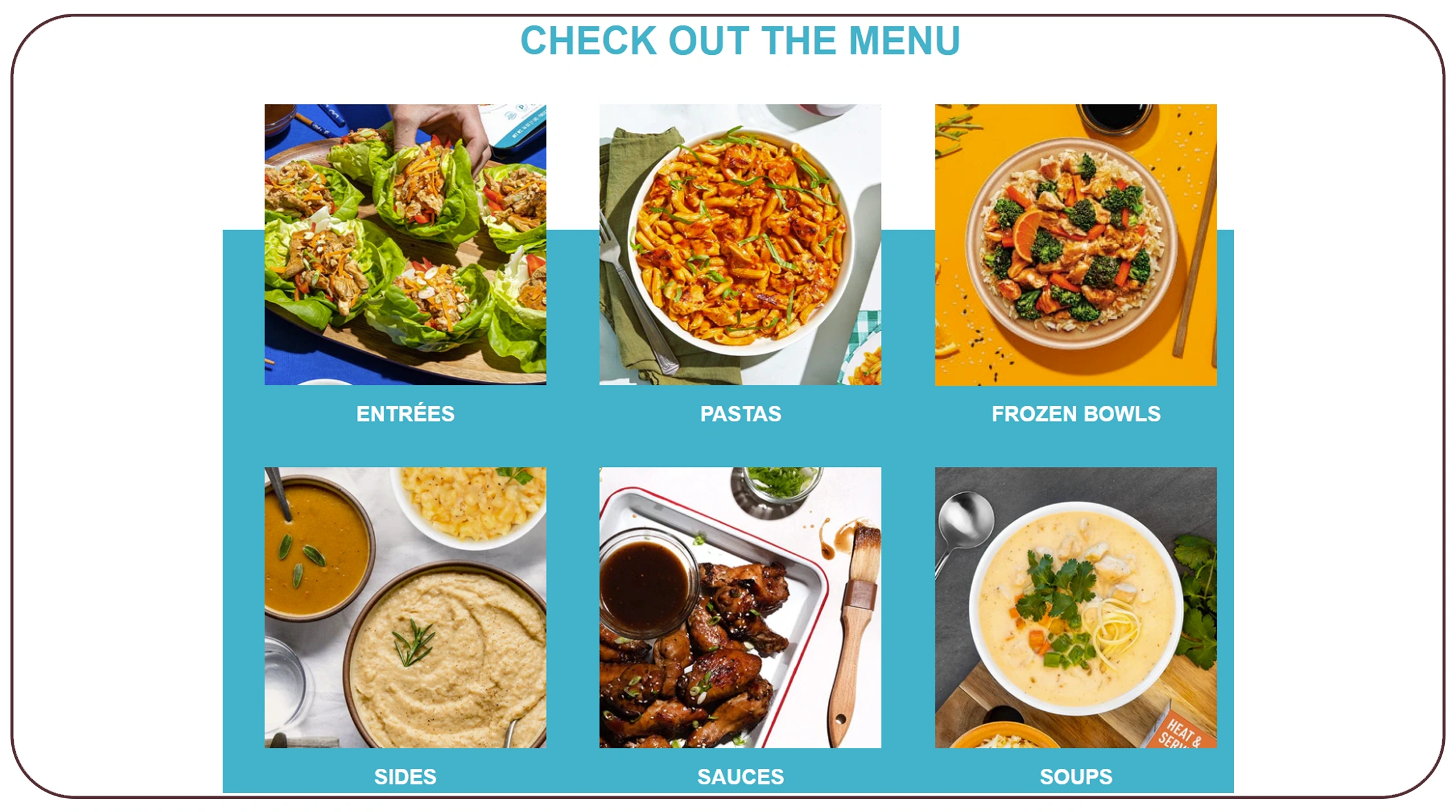

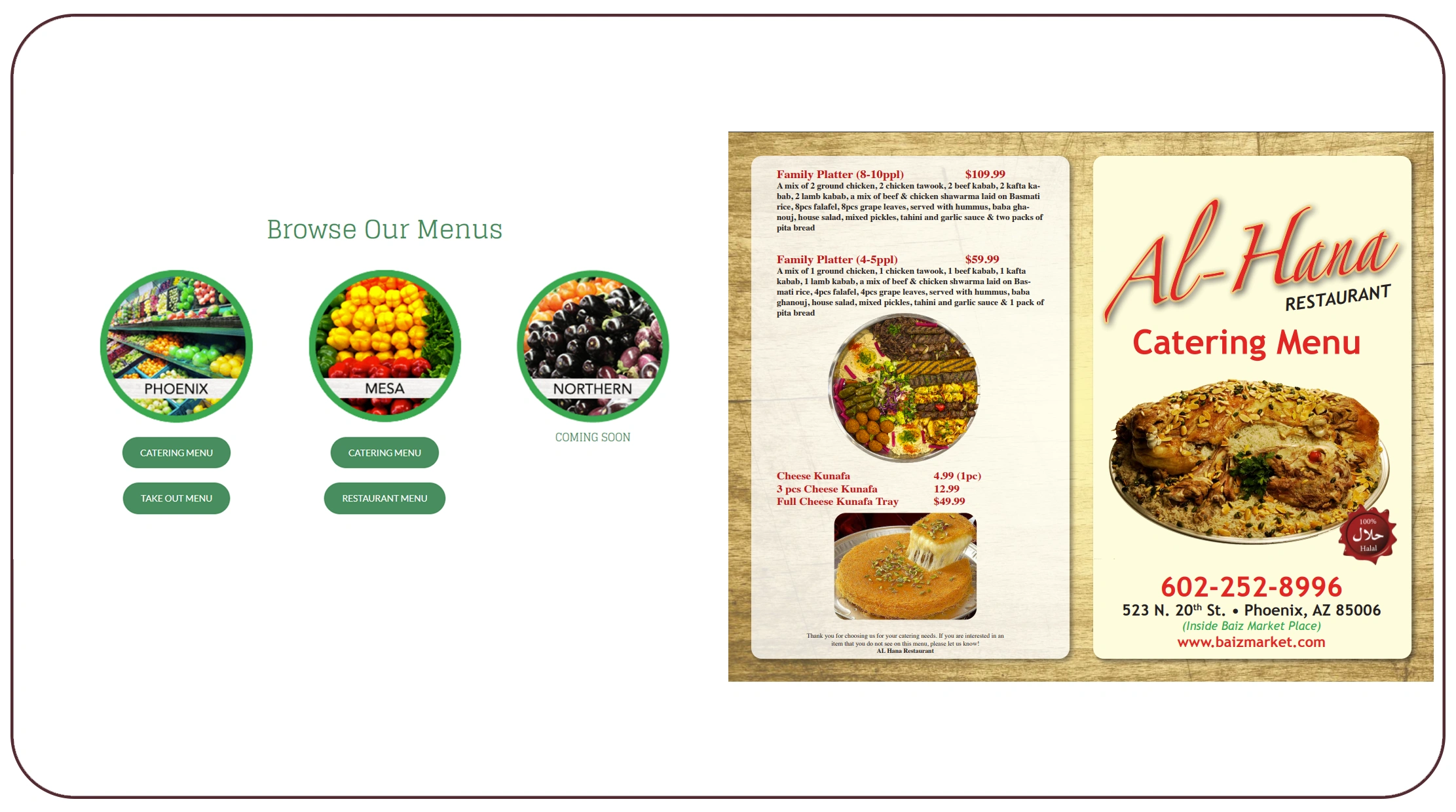

Eliminating Menu Inconsistencies Across Locations

For multi-location food brands and franchise operators, maintaining consistency across menus and pricing remains a persistent challenge. Manual updates, regional adjustments, and platform-specific variations often result in discrepancies that confuse customers and complicate operations. Implementing an Arizona food menu and pricing data scraper creates a centralized, automated view of menu items, prices, and availability across all locations and platforms.

Operational Efficiency Improvements

| Metric | 2020 | 2026 |

|---|---|---|

| Menu inconsistencies | 24% | 6% |

| Update turnaround time | 5–7 days | Same-day |

| Manual audit hours | 160/month | 25/month |

Centralized menu intelligence improves governance, strengthens brand consistency, and ensures faster rollout of pricing and promotional updates across Arizona markets.

Consumption Pattern Analysis That Reduces Supply Chain Waste

Arizona's diverse demographic mix and seasonal tourism create rapidly shifting food consumption patterns. Without real-time insight, businesses often overstock declining items or miss opportunities tied to emerging preferences. Through Web Scraping Food consumption trends Arizona, companies track changes in dietary habits, cuisine demand, portion preferences, and ingredient usage across regions. This enables supply teams to align procurement decisions with real market demand.

Arizona Food Consumption Share by Category

| Category | 2020 | 2026 |

|---|---|---|

| Plant-based foods | 7% | 19% |

| Mexican cuisine | 23% | 27% |

| Health-focused meals | 11% | 22% |

| Traditional fast food | 35% | 18% |

Consumption intelligence allows organizations to optimize sourcing, minimize waste, and respond proactively to evolving consumer expectations.

Real-Time Data Pipelines That Strengthen Supply Chains

Disconnected systems and delayed reports often leave supply chain teams reacting after disruptions occur. A robust Food Data Scraping API provides continuous access to pricing, availability, and demand signals from multiple online sources. These real-time pipelines feed dashboards, trigger alerts, and support analytics platforms, ensuring stakeholders always operate with current data.

Supply Chain Performance Metrics

| KPI | Before API | After API |

|---|---|---|

| Stockout incidents | 15/month | 4/month |

| Forecast accuracy | 72% | 94% |

| Supplier response time | Reactive | Proactive |

API-driven intelligence reduces uncertainty, enabling faster decisions and stronger operational resilience across Arizona's food supply chain.

Turning Raw Information Into Actionable Intelligence

Raw data alone cannot solve supply chain challenges unless it is structured, validated, and contextualized. A comprehensive Food Dataset transforms scraped data into analytics-ready formats that integrate seamlessly with BI tools, ERP systems, and forecasting models. Businesses can analyze historical trends, compare suppliers, simulate pricing scenarios, and evaluate long-term demand shifts.

Business Impact of Structured Food Data

| Use Case | Measurable Outcome |

|---|---|

| Demand forecasting | 31% waste reduction |

| Pricing optimization | 14% margin improvement |

| Supplier benchmarking | 11% procurement savings |

Structured datasets empower strategic planning, helping businesses move from reactive operations to predictive, data-driven decision-making.

Why Choose Real Data API?

Real Data API delivers enterprise-grade data solutions tailored to the food ecosystem. Designed for Market Research and operational intelligence, the platform ensures Food industry data extraction Arizona is accurate, scalable, and compliant. With customizable data pipelines, historical depth, and real-time monitoring, Real Data API enables businesses to uncover hidden patterns, respond faster to volatility, and strengthen supply chain resilience. From restaurants and distributors to food brands and analysts, Real Data API provides the intelligence foundation needed to compete effectively in Arizona's evolving food market.

Conclusion

Supply chain blind spots no longer have to limit growth or profitability. By leveraging Web Scraping API solutions built for Food industry data extraction Arizona, businesses gain the real-time visibility needed to anticipate disruptions, optimize pricing, and align supply with demand. Data-driven food intelligence replaces uncertainty with clarity, enabling smarter decisions at every stage of the supply chain.

Connect with Real Data API today to transform Arizona food data into a competitive advantage and build a more resilient, future-ready food operation!