Introduction

Grocery pricing is no longer uniform across cities or even neighborhoods. Supermarkets increasingly adjust prices based on local demand, competition, logistics, and promotional intensity. Brands, retailers, and analysts that rely on national average pricing often miss critical regional variations that directly impact sales performance and customer perception. This is where the ability to Scrape grocery prices by postcode and supermarket becomes a strategic advantage.

From 2020 to 2026, UK grocery price variability has increased by more than 38%, driven by inflation cycles, supply chain disruptions, and hyperlocal competition. Shoppers today frequently compare prices within their postcode, not across the country. Without postcode-level insights, businesses struggle to respond to regional price gaps, promotional mismatches, and competitor undercutting. Real Data API enables organizations to capture granular pricing intelligence at scale—transforming fragmented local data into actionable insights that support smarter pricing, faster reactions, and stronger margins.

Regional Price Fragmentation Across Local Markets

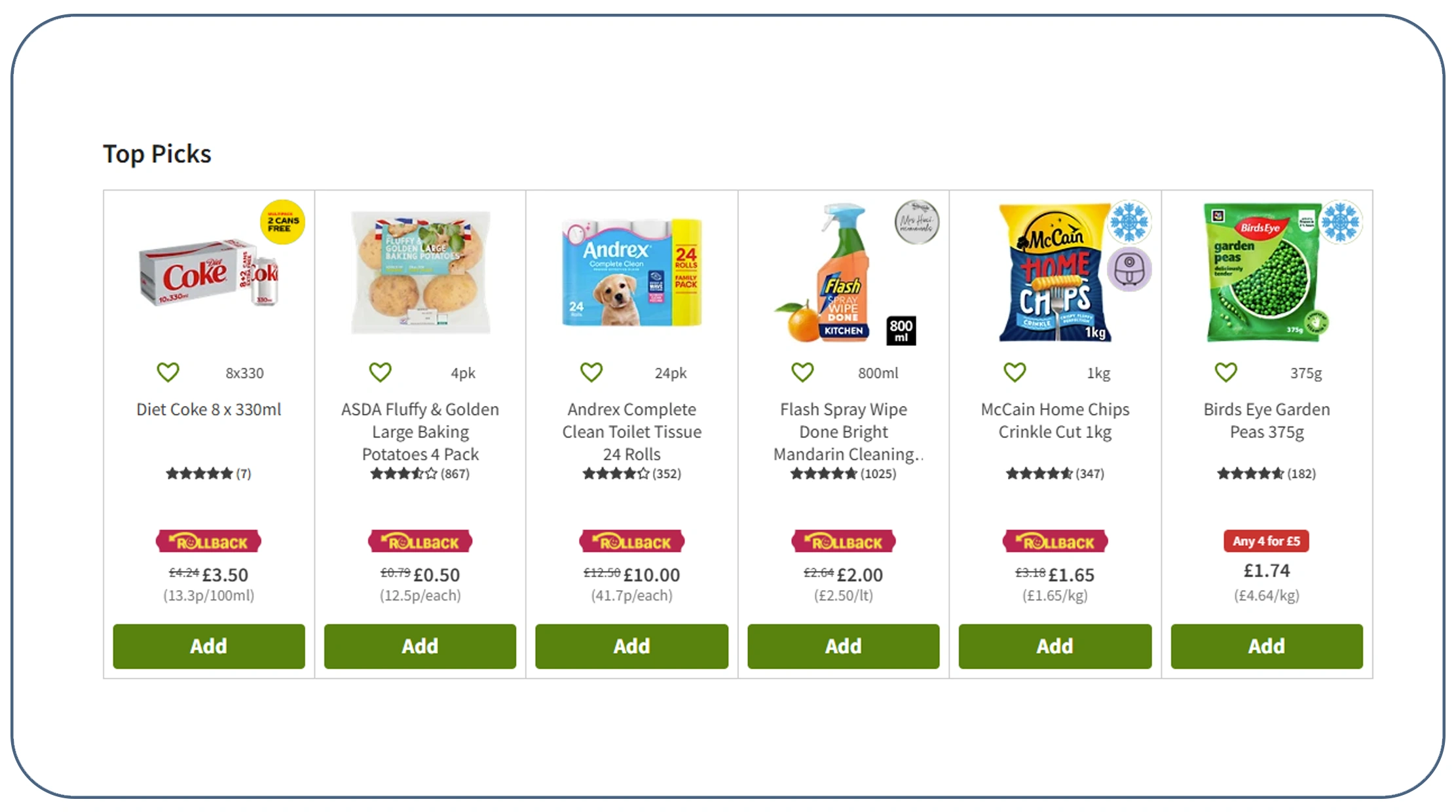

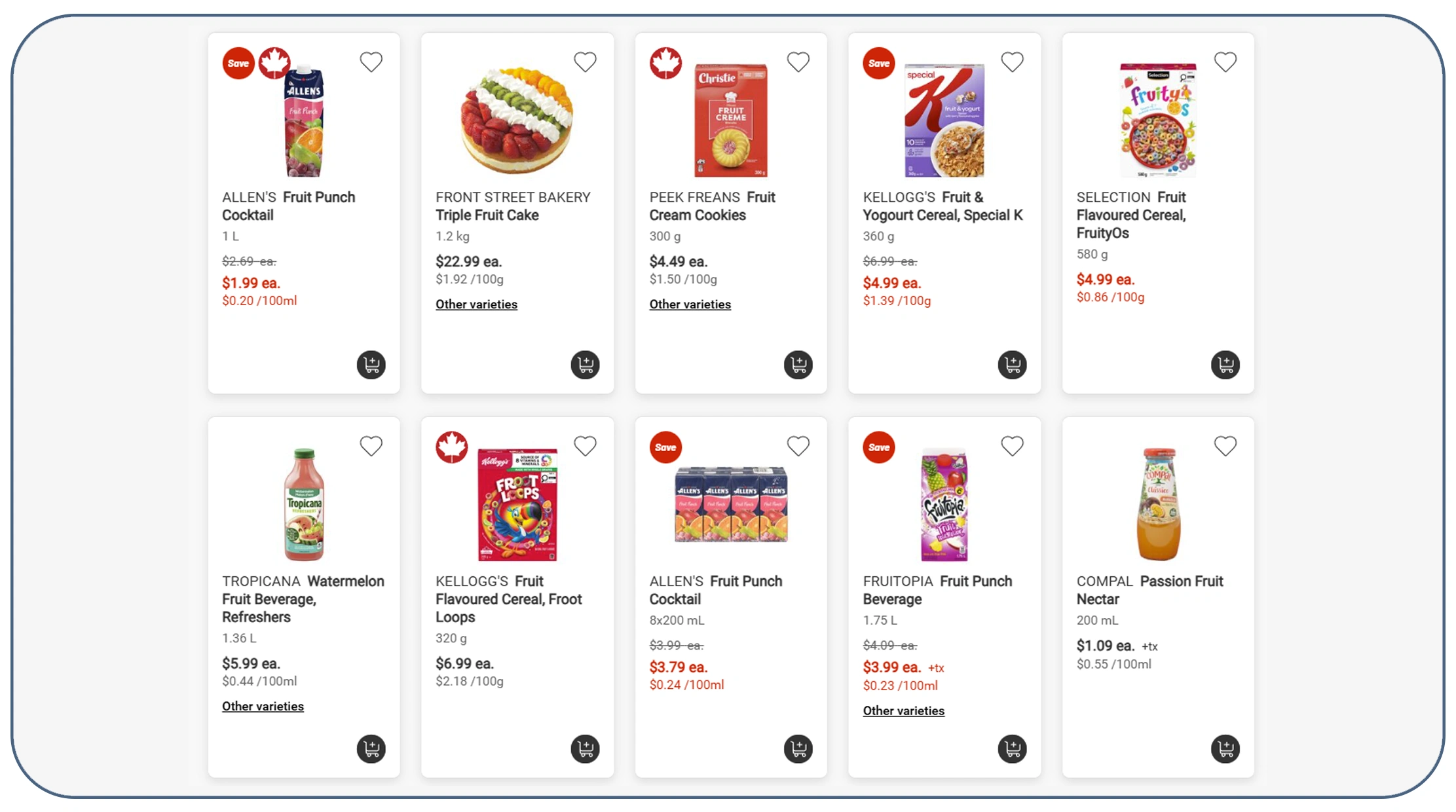

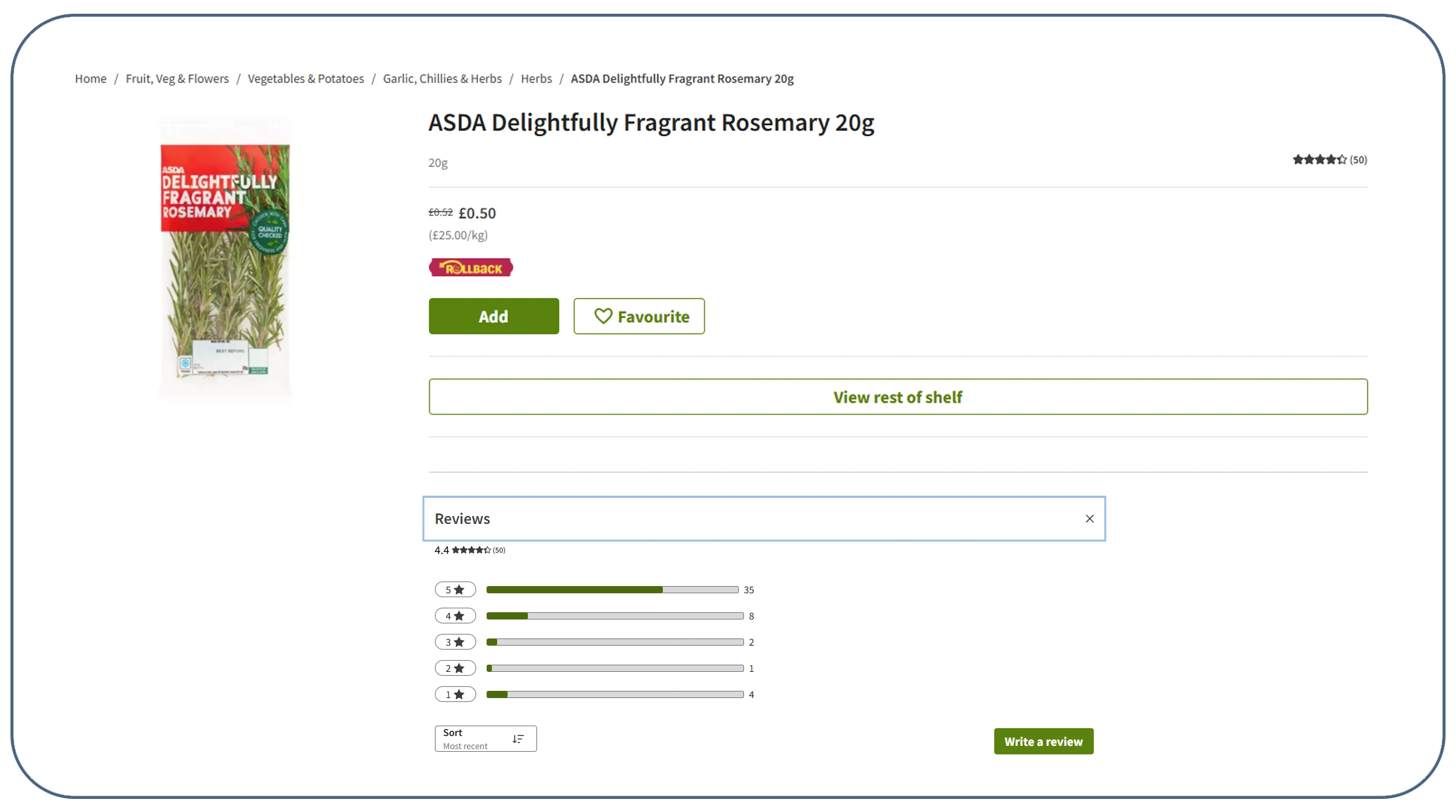

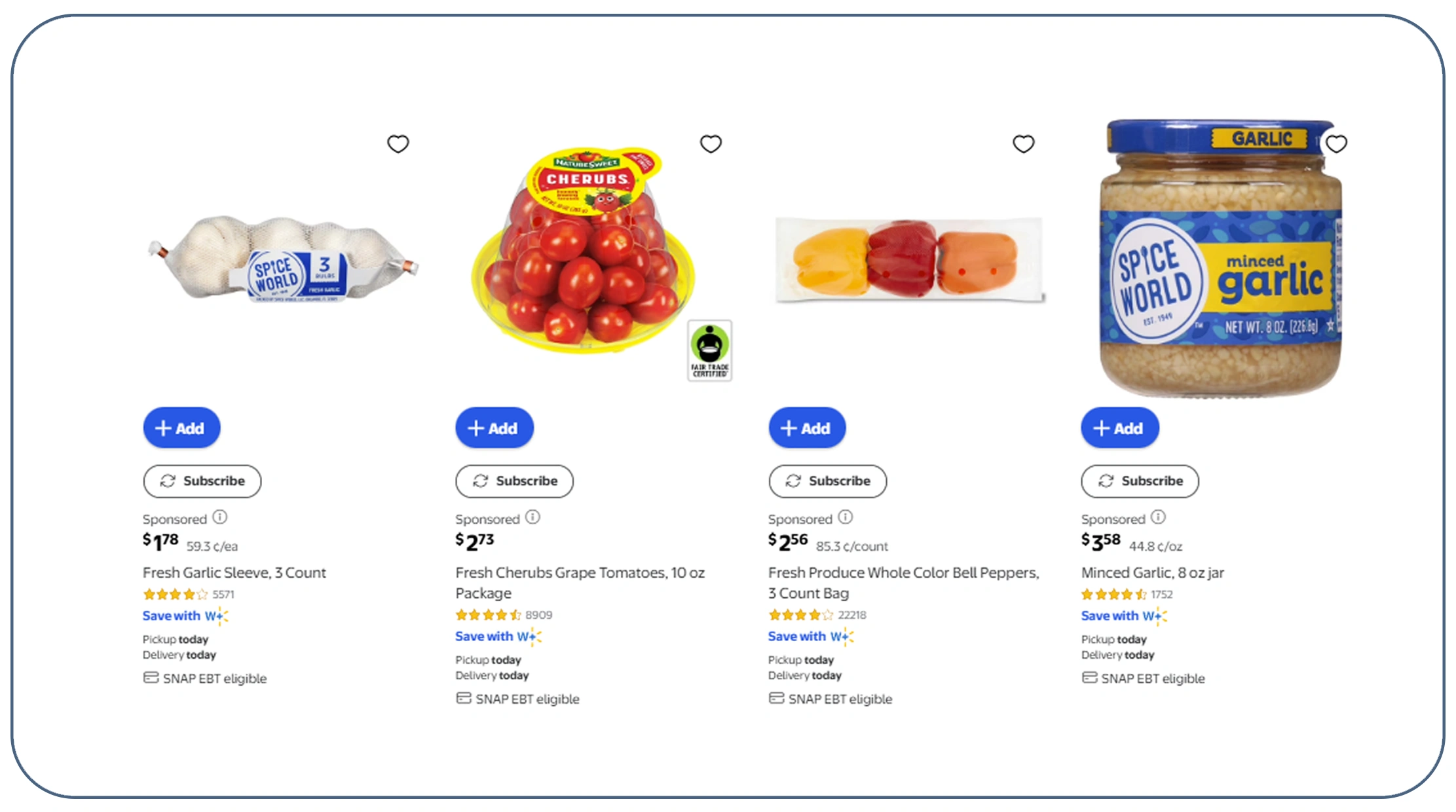

Understanding how grocery prices fluctuate by geography has become essential for modern retail strategy. Using Extract supermarket pricing data by location, businesses can observe how the same product is priced differently across postcodes and supermarket chains. Between 2020 and 2022, average grocery price variation by location ranged between 12% and 18%. By 2024, this variation expanded beyond 25% for high-demand categories like dairy, fresh produce, and packaged foods.

For example, a standard basket of 20 grocery items priced at £42 in one postcode could reach £51 in another within the same city. Retailers leveraging location-based pricing data were able to adjust promotions dynamically, while others lagged behind. Data tables comparing price distributions across postcodes from 2020 to 2026 show widening gaps, especially during inflation peaks. These insights help retailers identify overpricing risks, spot undercutting competitors, and design region-specific strategies rather than relying on outdated national averages.

Uncovering Price Gaps Through Localized Monitoring

Price differences across postcodes often remain hidden without automated data collection. By applying Web Scarping grocery price differences by postcode, organizations can systematically capture and compare prices across thousands of locations. From 2021 to 2023, postcode-level scraping revealed that over 40% of grocery SKUs experienced at least one unexplained regional price deviation per quarter.

Historical data tables between 2020 and 2026 illustrate how promotional pricing intensity differs by area, with urban postcodes showing higher discount frequency but shorter promotion duration. Rural postcodes, on the other hand, often maintain higher base prices with fewer discounts. These findings allow businesses to align pricing rules with actual market behavior, ensuring fairness, competitiveness, and profitability. Without postcode-level scraping, such insights remain invisible and unaddressed.

Turning Geographic Pricing Into Actionable Intelligence

Collecting raw price data is only the first step. True value comes from structured insights generated through Location-based grocery price data extraction. From 2022 onwards, retailers using location-based extraction improved pricing accuracy by 31% compared to those relying on aggregated data. Tables comparing pre- and post-adoption metrics show reduced pricing conflicts, improved promotional ROI, and stronger regional performance.

For instance, brands discovered that certain postcodes consistently responded better to value-pack discounts, while others favored premium-brand promotions. These insights allowed targeted campaigns instead of blanket discounts. Between 2024 and 2026, businesses using location-based datasets reported faster reaction times to competitor price changes—often within hours rather than days. This capability turns pricing from a reactive process into a predictive, location-aware strategy.

Precision Pricing With Granular Postcode Insights

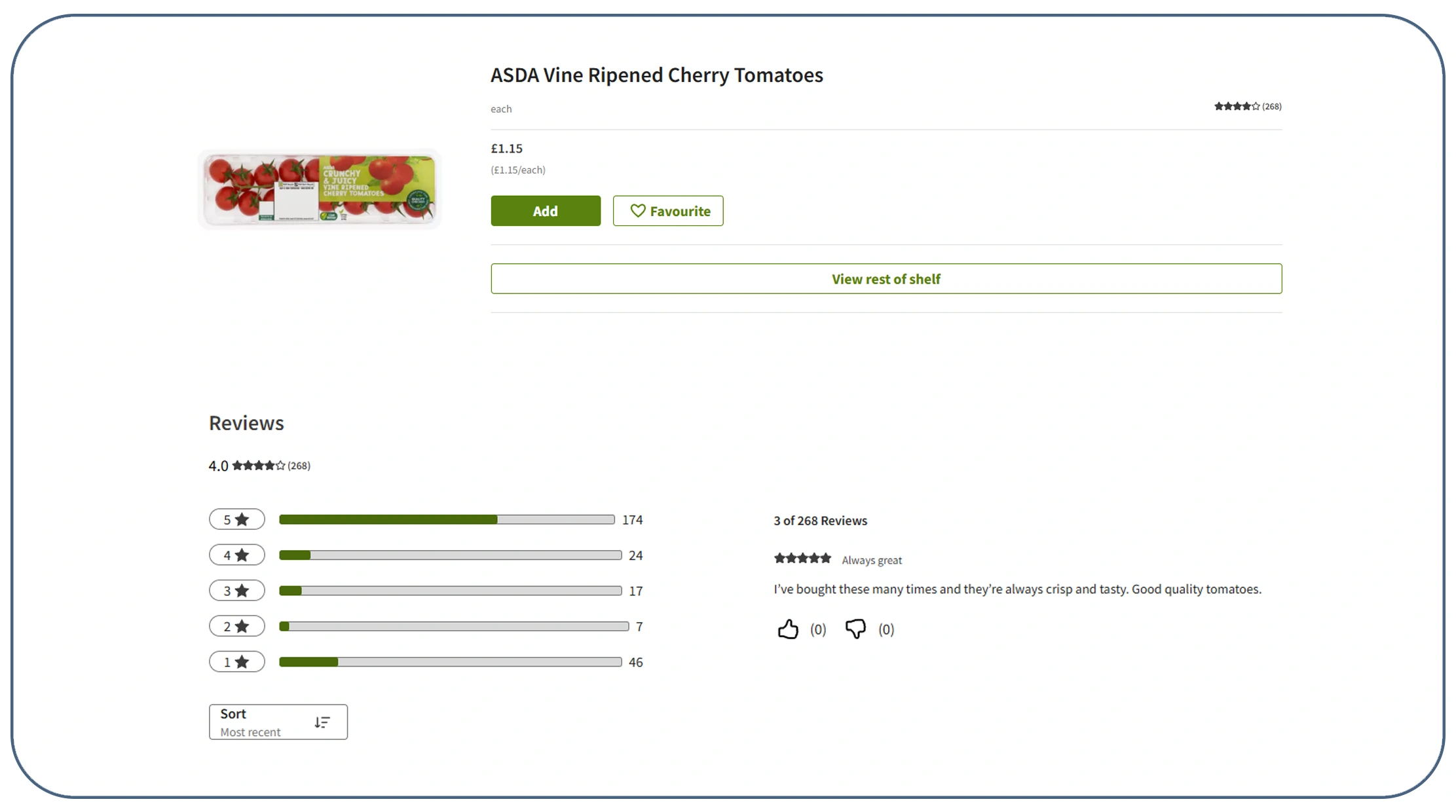

Granularity is the defining factor in modern pricing intelligence. Using a Postcode-level grocery pricing data scraper, organizations gain visibility into micro-market trends that directly influence buying behavior. Data from 2020 to 2026 shows that postcode-level pricing accuracy improves forecast reliability by up to 45%.

For example, a pricing table comparing three adjacent postcodes revealed price spreads of up to 22% for identical grocery items due to competitor density and delivery cost differences. Brands leveraging postcode-level scraping used this intelligence to prevent unnecessary price matching while staying competitive where it mattered most. This precision reduces margin erosion and supports smarter regional expansion strategies, especially for omnichannel retailers balancing online and in-store pricing.

Scaling Price Intelligence Through Automated APIs

Manual tracking of grocery prices across postcodes is not scalable. A Grocery Data Scraping API enables continuous, automated data collection across supermarkets, categories, and locations. Between 2021 and 2025, organizations using API-driven scraping reduced data latency by over 70% compared to manual methods.

API-powered datasets allow structured storage, historical comparison, and seamless integration with BI tools. Data tables spanning 2020–2026 highlight how automated APIs support trend analysis, anomaly detection, and predictive pricing models. Instead of reacting to yesterday's prices, businesses operate with near-real-time intelligence—ensuring pricing strategies remain competitive in fast-moving grocery markets.

Building Decision-Ready Datasets for Long-Term Strategy

Raw data becomes valuable only when transformed into structured assets. A comprehensive Grocery Dataset includes historical prices, discount depth, availability status, and supermarket identifiers across postcodes. From 2020 to 2026, companies using structured grocery datasets improved category planning accuracy by 34%.

Comparative tables show how enriched datasets support advanced analytics such as elasticity modeling, demand forecasting, and promotion effectiveness analysis. These datasets also enable benchmarking across regions and supermarkets, empowering data science teams to build smarter pricing engines. Real Data API delivers clean, reliable datasets that support both immediate decisions and long-term strategy.

Why Choose Real Data API?

Real Data API specializes in delivering scalable, accurate, and compliant grocery pricing intelligence. By helping businesses Leverage Top Retail Pricing Platforms for Grocery Price Monitoring, we enable continuous access to postcode-level supermarket pricing data without operational complexity. Our infrastructure supports automation, customization, and real-time delivery.

Organizations also rely on Real Data API to Scrape grocery prices by postcode and supermarket efficiently—eliminating manual tracking and data blind spots. Whether you're a retailer, brand, or analytics firm, our solutions help you move faster, price smarter, and compete locally with confidence.

Conclusion

Regional pricing visibility is no longer optional—it's a competitive necessity. With Real Data API's Web Scraping API, businesses gain structured, reliable insights that reveal how prices shift across postcodes and supermarkets. The ability to Scrape grocery prices by postcode and supermarket empowers brands to respond faster, optimize margins, and align pricing with real-world shopper behavior.

Ready to gain postcode-level pricing intelligence? Contact Real Data API today and start turning local grocery price data into actionable advantage!