Introduction

Spices are among the most price-sensitive and demand-volatile categories in the global food market. Factors such as seasonal harvest cycles, export-import costs, climate conditions, and rapidly changing online competition make margin consistency a persistent challenge for brands and distributors. Between 2020 and 2026, average online spice prices fluctuated by more than 35%, with some SKUs experiencing quarterly swings of over 20%. Without granular, real-time visibility, businesses often react too late—resulting in margin erosion or lost sales.

This is where Spice pricing trends analysis via e-commerce scraper becomes essential. By continuously tracking prices, availability, and competitive movements across online platforms, brands gain clarity into real market dynamics rather than relying on delayed reports or assumptions. Real Data API empowers businesses to replace guesswork with actionable intelligence, enabling smarter pricing decisions, improved sourcing strategies, and consistent margins even in highly volatile spice categories.

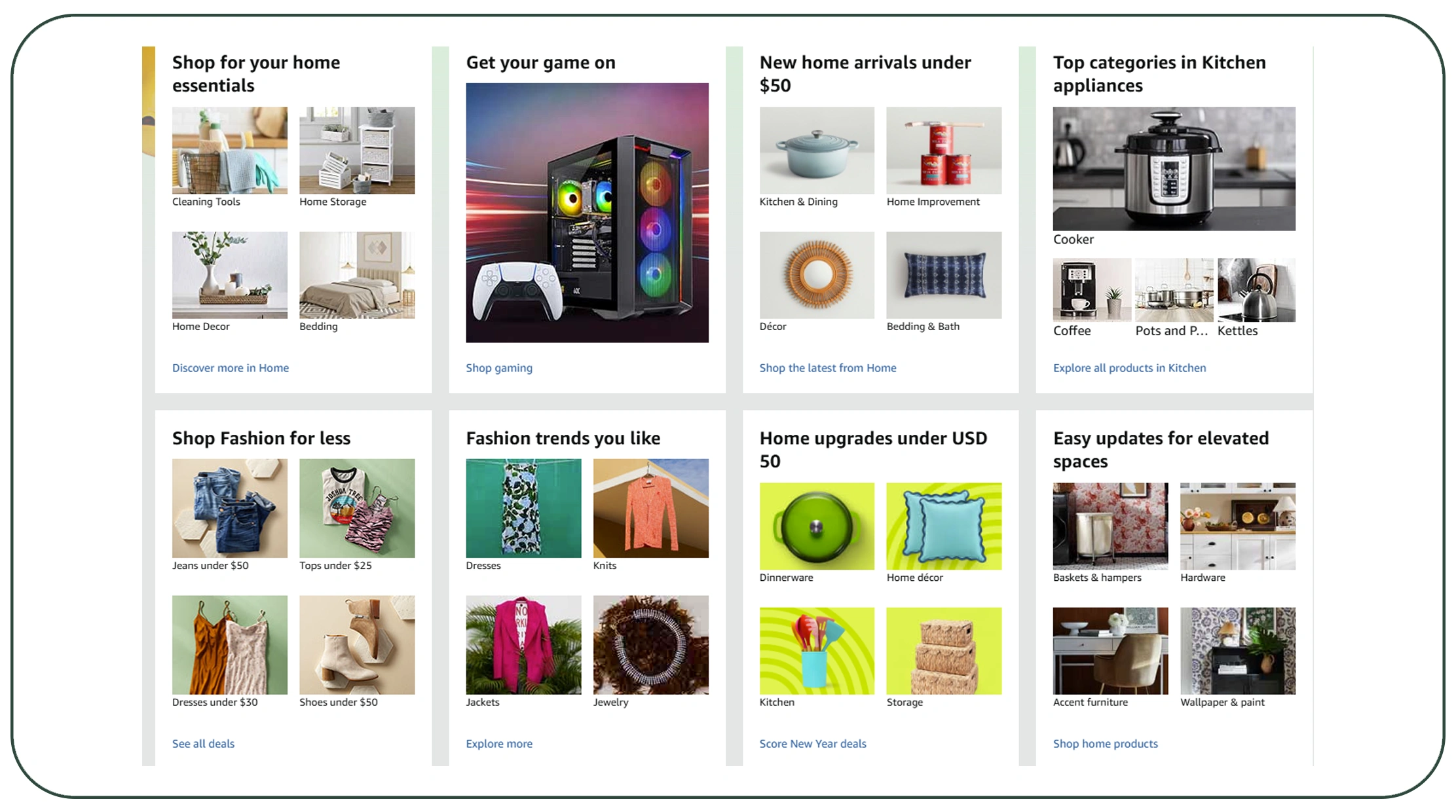

Understanding Online Price Volatility Across Platforms

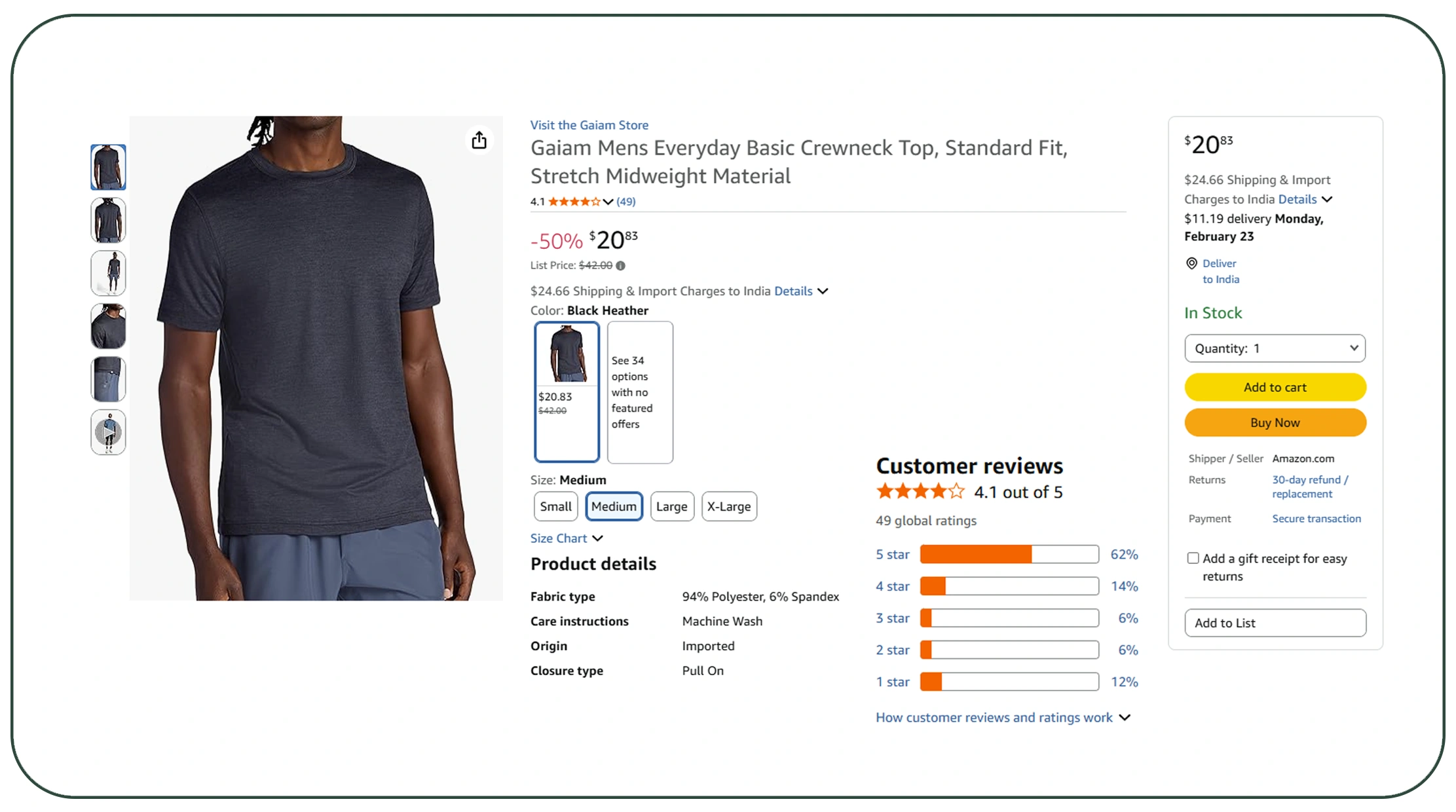

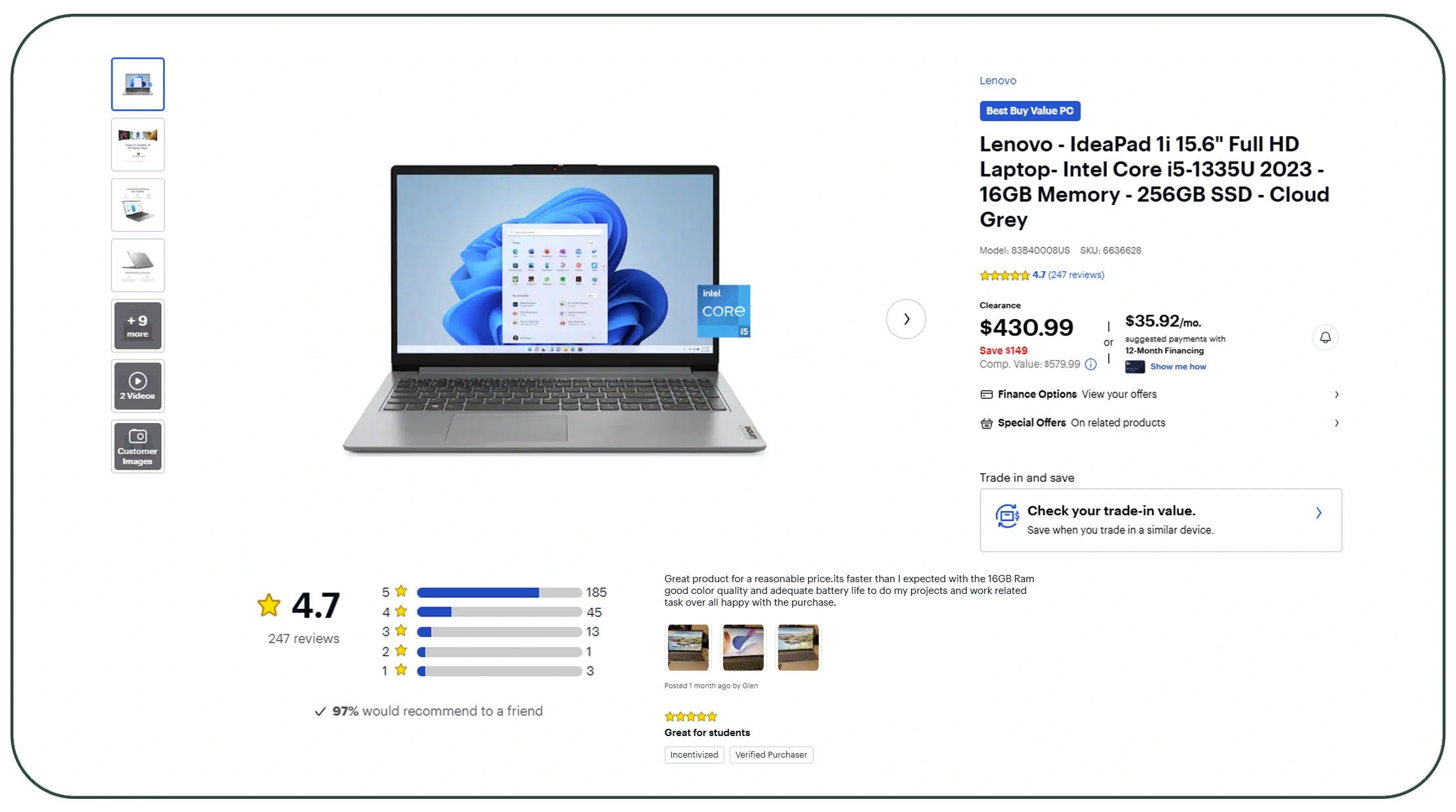

Online spice pricing varies significantly across platforms, sellers, and time periods. Using Scrape spice prices from e-commerce websites, businesses can uncover how the same turmeric, cumin, or chili powder SKU may be priced differently across marketplaces on the same day. Data from 2020–2022 showed average cross-platform price differences of 18%, which expanded to nearly 27% by 2025 due to increased competition and private-label expansion.

Historical pricing tables reveal that during peak demand seasons, such as festive periods, certain spices experienced price spikes of 30–40% within weeks. Brands that monitored these changes in real time were able to adjust pricing rules dynamically, while others absorbed margin losses. Tracking multi-year trends from 2020 to 2026 also highlights how inflation and logistics disruptions amplified volatility. This insight helps brands predict future pricing behavior rather than reacting after margins are impacted.

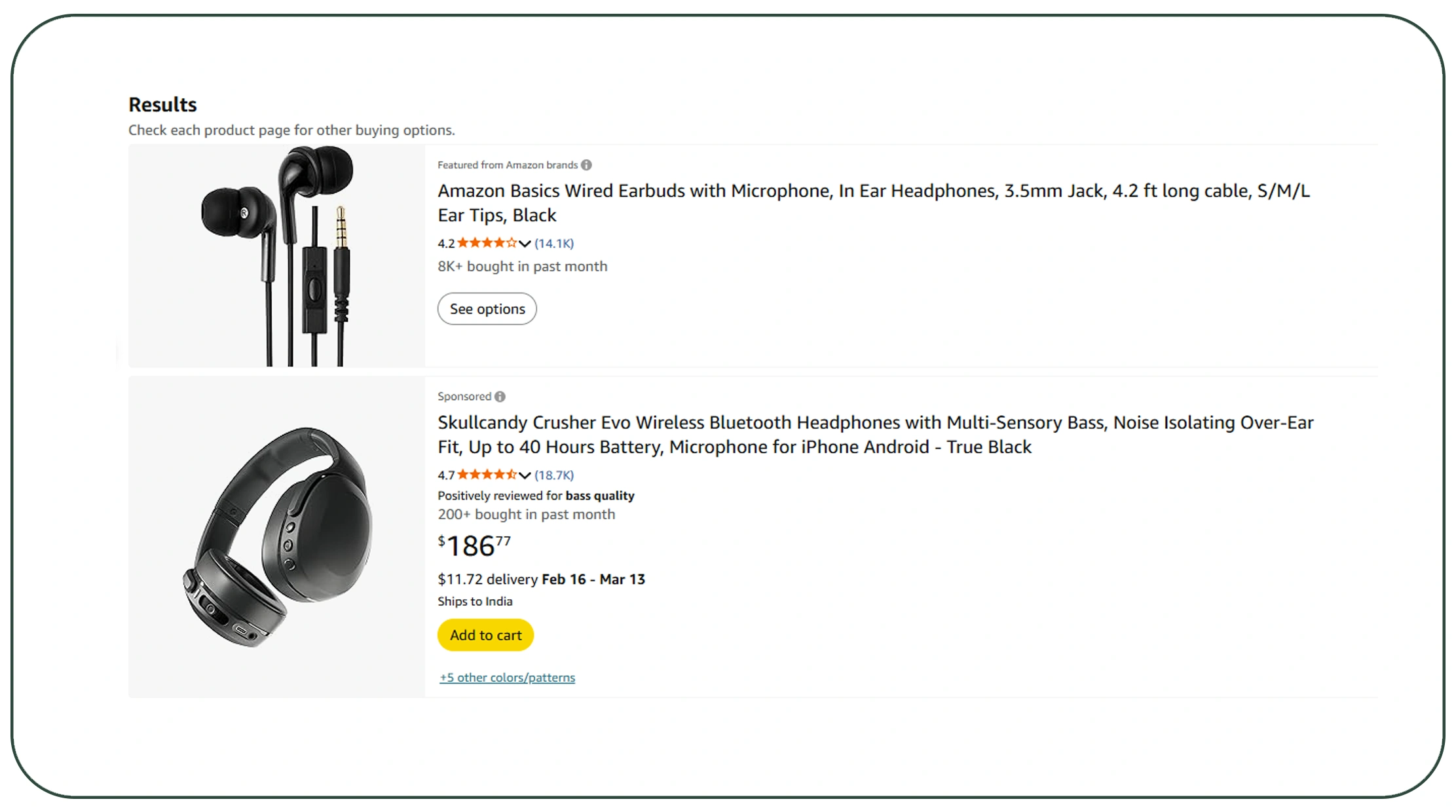

Capturing Accurate Listings and Price Signals

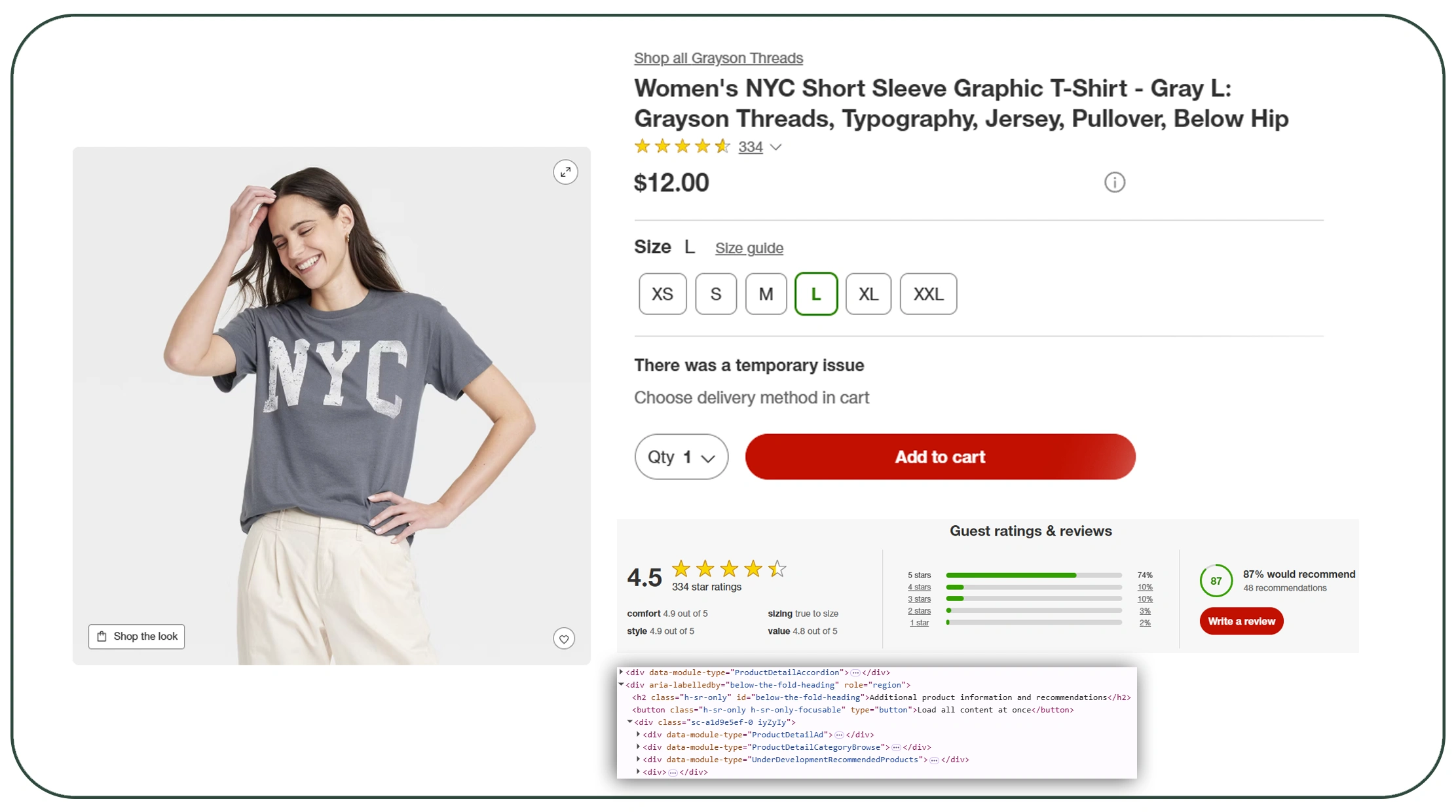

Accurate product-level data is the foundation of effective pricing strategy. By leveraging Extract online spices product listings and prices, organizations gain visibility into how products are positioned, bundled, and discounted across platforms. Between 2021 and 2024, analysis of extracted listings showed that over 42% of spice products changed pack size or labeling without clear price-per-unit adjustments—misleading both consumers and brands.

Structured tables comparing product titles, pack weights, and prices revealed hidden cost discrepancies. For example, a 200g pack priced lower than a 150g pack during promotions often created artificial price pressure. Businesses using detailed listing extraction were able to normalize prices per gram or ounce, ensuring fair comparison. From 2020 to 2026, this level of accuracy improved pricing confidence and reduced unnecessary discounting driven by incomplete data.

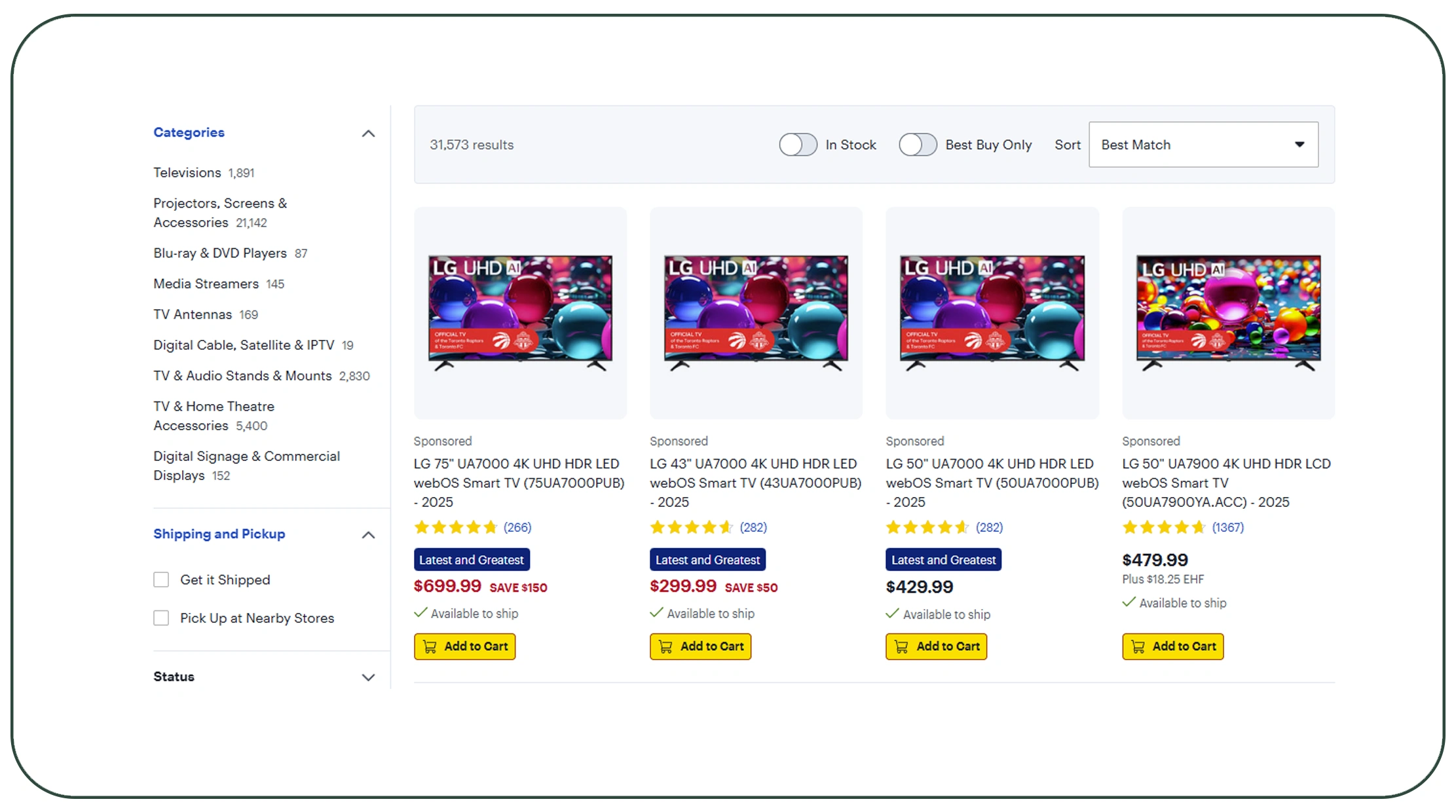

Building Marketplace-Wide Pricing Intelligence

Marketplace-level insights are critical when competition intensifies. Through Web Scraping spices data from e-commerce marketplaces, Real Data API enables comprehensive visibility across sellers, brands, and regions. Data collected between 2022 and 2026 shows that marketplace-exclusive sellers frequently initiate aggressive discounts, triggering price wars that impact branded products.

By analyzing multi-year tables of seller activity, brands identified patterns such as frequent undercutting by new entrants or seasonal discounting by bulk sellers. These insights helped established brands decide when to hold pricing steady and when to match competition strategically. Marketplace-wide scraping also revealed that customer ratings and reviews often offset higher prices, allowing premium brands to maintain margins despite competitive pressure.

Managing SKU Complexity in Packaged Spices

Packaged spices present unique challenges due to SKU proliferation—different weights, blends, and packaging formats. Using Packaged Spices SKU data extraction, businesses can track SKU-level performance with precision. From 2020 to 2023, data showed that nearly 55% of margin losses occurred at the SKU level due to inconsistent pricing across pack sizes.

Tables comparing SKU-level pricing from 2020 to 2026 highlighted that smaller pack sizes often carried disproportionately high discounts, negatively impacting blended margins. Brands that monitored SKU-level trends were able to rebalance pricing across pack formats and eliminate redundant SKUs. This granular visibility enabled smarter assortment planning and improved profitability without reducing competitiveness.

Identifying Pricing Gaps Through Comparative Analysis

Understanding how prices compare across platforms and sellers is essential for margin stability. Through Price Comparison, Real Data API helps brands benchmark their products against competitors in real time. From 2021 to 2025, comparative pricing tables revealed that brands were often underpricing by 10–15% in markets where they held strong brand loyalty.

By analyzing year-over-year comparisons from 2020 to 2026, businesses identified optimal pricing corridors that balanced volume and margin. This approach prevented unnecessary discounting and allowed premium positioning where justified. Comparative analysis also helped identify regions or platforms where aggressive pricing was required to remain competitive—ensuring resources were allocated efficiently.

Scaling Intelligence With Automated Data Infrastructure

Manual tracking cannot keep up with the pace of e-commerce. An E-Commerce Data Scraping API enables automated, scalable, and continuous data collection across platforms and timeframes. From 2020 to 2026, organizations adopting API-driven scraping reduced pricing response times by over 65% and improved forecasting accuracy by nearly 40%.

API-powered datasets support historical trend analysis, anomaly detection, and integration with pricing engines. Tables generated from multi-year data allow teams to visualize long-term trends, seasonality, and price elasticity. This infrastructure transforms raw data into a strategic asset—supporting both daily pricing decisions and long-term margin planning.

Why Choose Real Data API?

Real Data API specializes in delivering accurate, scalable, and decision-ready datasets for complex product categories. Our E-Commerce Dataset solutions are designed to capture high-frequency price changes, SKU-level details, and marketplace dynamics with precision. Businesses rely on our expertise to implement Spice pricing trends analysis via e-commerce scraper without operational overhead.

We offer customizable data feeds, robust APIs, and compliance-focused scraping methodologies. Whether you're a spice brand, distributor, or analytics firm, Real Data API helps you turn volatile pricing data into structured insights—empowering smarter decisions and stronger margins.

Conclusion

Inconsistent margins are no longer an unavoidable reality in the spice industry. With Real Data API's Web Scraping Services, businesses gain the clarity needed to navigate volatile markets confidently. By applying Spice pricing trends analysis via e-commerce scraper, brands can anticipate price movements, respond strategically to competition, and protect profitability across platforms.

Ready to stabilize margins with real-time spice pricing intelligence? Contact Real Data API today and transform e-commerce data into competitive advantage!