Introduction

India’s online fashion economy has transformed rapidly over the last decade, driven by marketplaces like Amazon, Flipkart, Myntra, Nykaa, and Meesho. Brands, sellers, and analysts now rely on structured intelligence to understand pricing trends, product demand, seasonal fashion cycles, and consumer sentiment. Learning how to get scraped data from e-commerce websites in India has become a strategic advantage for companies aiming to stay competitive in the fashion domain.

From ethnic wear sales spikes during festive seasons to beauty product trends influenced by social commerce, data is at the core of every decision. A reliable E-Commerce Data Scraping API enables businesses to collect publicly available product listings, prices, ratings, and availability at scale, while maintaining consistency and accuracy. As India’s fashion e-commerce GMV continues to grow year over year, structured scraped data is no longer optional—it is foundational to growth, optimization, and innovation.

Mapping the Indian Fashion Commerce Landscape

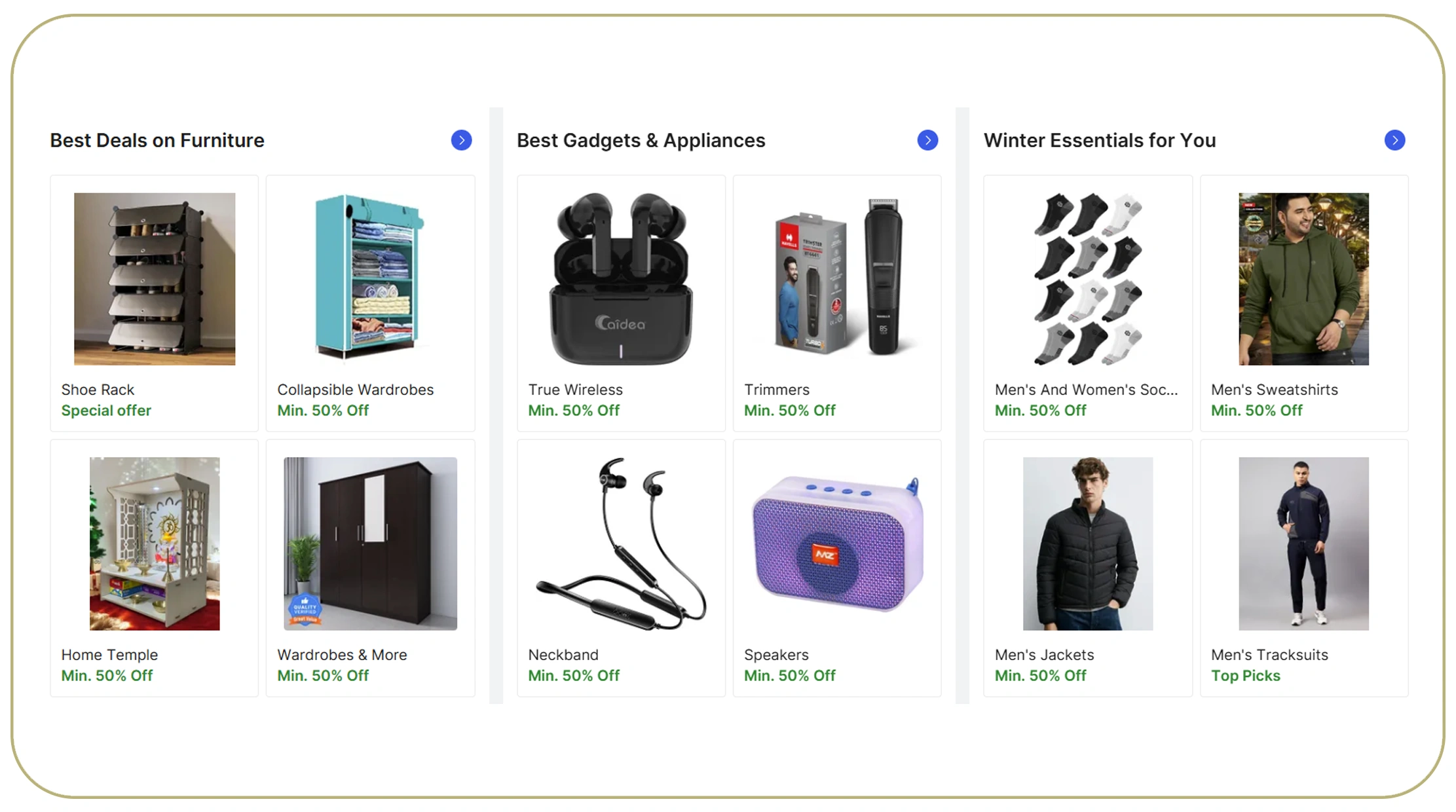

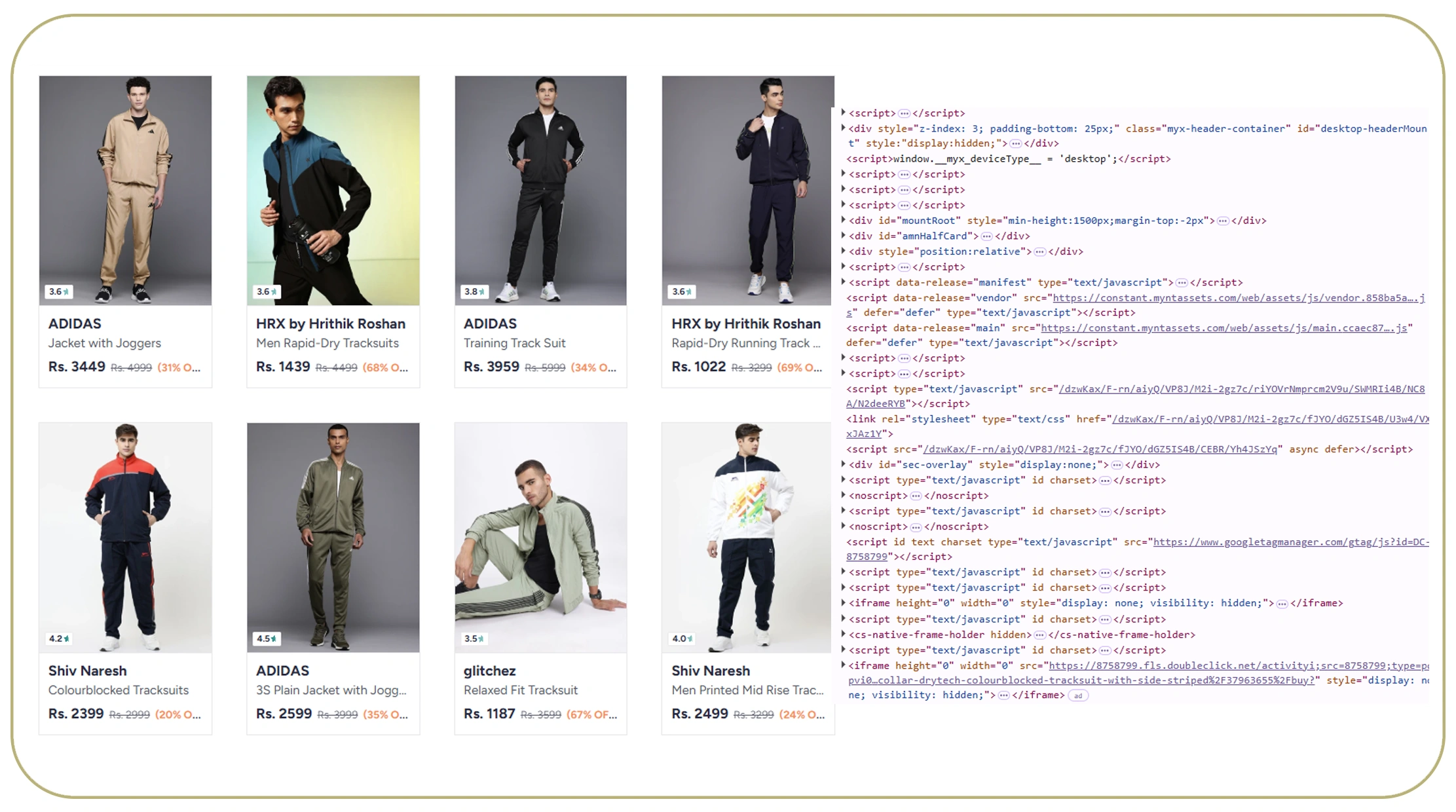

The Indian fashion e-commerce ecosystem is highly fragmented yet deeply interconnected. Platforms such as Myntra and Nykaa focus on curated fashion and beauty, while Amazon, Flipkart, Meesho, and ShopClues offer mass-market apparel across price bands. To analyze these ecosystems efficiently, an Indian e-commerce marketplace data scraper plays a crucial role by systematically collecting structured data across categories, brands, and sellers.

Between 2020 and 2026, fashion listings in India grew exponentially due to mobile-first adoption and regional seller onboarding. Scraped data helps track SKU growth, seller concentration, and category saturation across marketplaces.

Fashion Marketplace Growth Snapshot (2020–2026)

| Year | Estimated Fashion SKUs (Millions) | Active Sellers |

|---|---|---|

| 2020 | 18 | 450,000 |

| 2022 | 32 | 720,000 |

| 2024 | 55 | 1.1 Million |

| 2026 | 75+ | 1.6 Million |

By aggregating product-level data, businesses can identify gaps in size availability, regional fashion demand, and private-label expansion strategies. This structured visibility is essential for brands operating across Amazon, Flipkart, Myntra, and Nykaa.

Capturing Live Market Shifts in Fashion Retail

Fashion is inherently dynamic—prices, discounts, and inventory levels change daily. Platforms like Meesho and Shopsy are especially discount-driven, making time-sensitive intelligence critical. Through real-time Indian marketplace data extraction, businesses can monitor price drops, stock replenishment, and trending products as they happen.

From 2020 to 2026, the frequency of price changes in fashion categories increased significantly, particularly during flash sales and festive events. Real-time extraction allows brands to react instantly rather than relying on outdated reports.

Price Volatility Trends in Fashion (2020–2026)

| Year | Avg. Monthly Price Changes | Flash Sale Events |

|---|---|---|

| 2020 | 6–8 | 45 |

| 2022 | 10–12 | 80 |

| 2024 | 14–16 | 120 |

| 2026 | 18+ | 160+ |

This data supports competitive repricing, promotion planning, and demand forecasting. Fashion brands leveraging live data streams are better positioned to win visibility on Amazon, Flipkart, and Myntra during high-traffic periods.

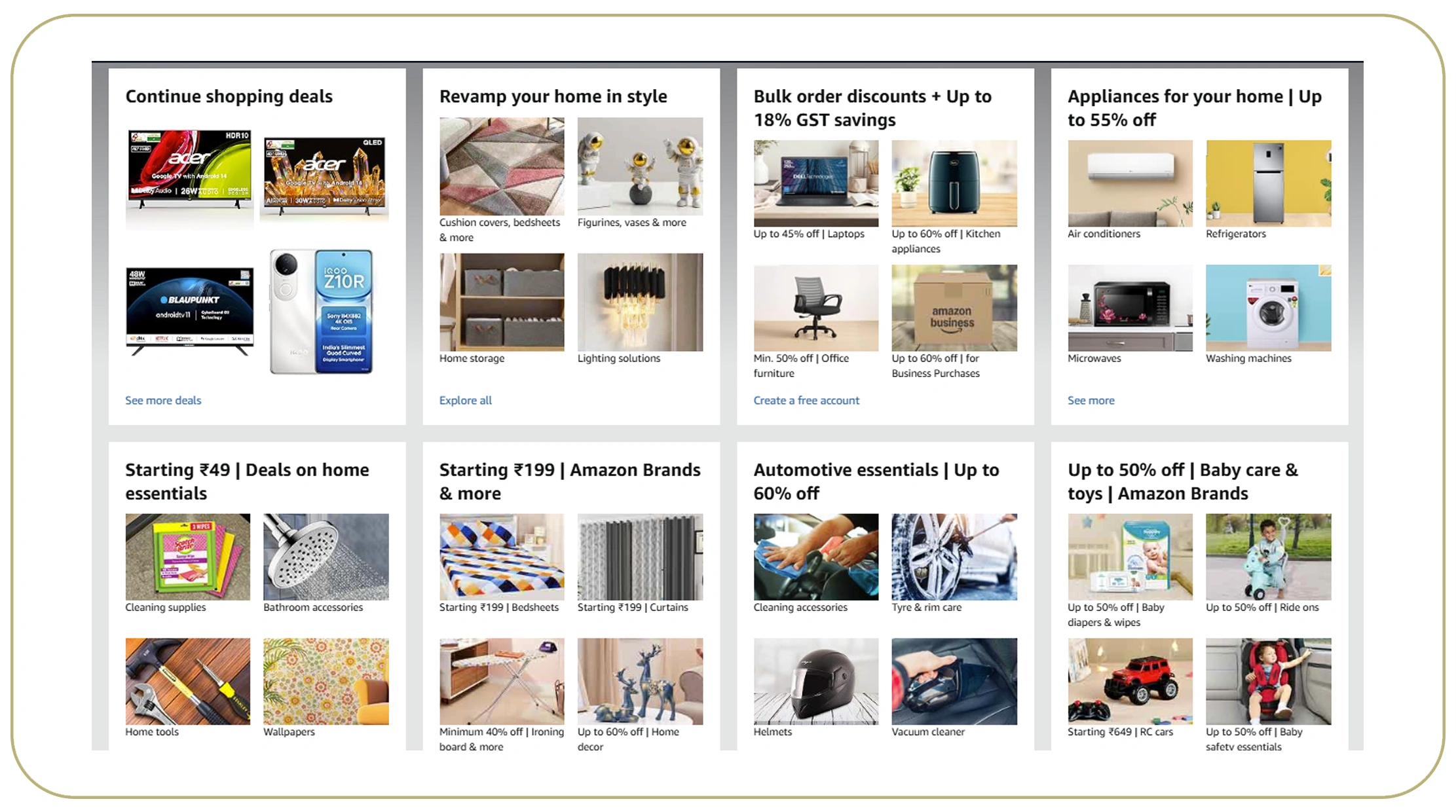

Structuring Large-Scale Fashion Intelligence

Fashion data is scattered across product pages, category listings, and seller profiles. The ability to Extract Indian e-commerce websites at scale allows companies to consolidate fragmented information into unified datasets. This is especially important for multi-category platforms like Tata CLiQ and JioMart, which blend fashion with lifestyle and essentials.

Between 2020 and 2026, the average number of attributes per fashion product listing nearly doubled, including fabric details, fit type, sustainability tags, and regional sizing information.

Growth in Fashion Product Attributes

| Year | Avg. Attributes per SKU |

|---|---|

| 2020 | 8 |

| 2022 | 12 |

| 2024 | 18 |

| 2026 | 22+ |

Extracted data enables trend analysis across colors, fabrics, and styles, helping brands align collections with real consumer preferences visible on Myntra, Nykaa, and Flipkart.

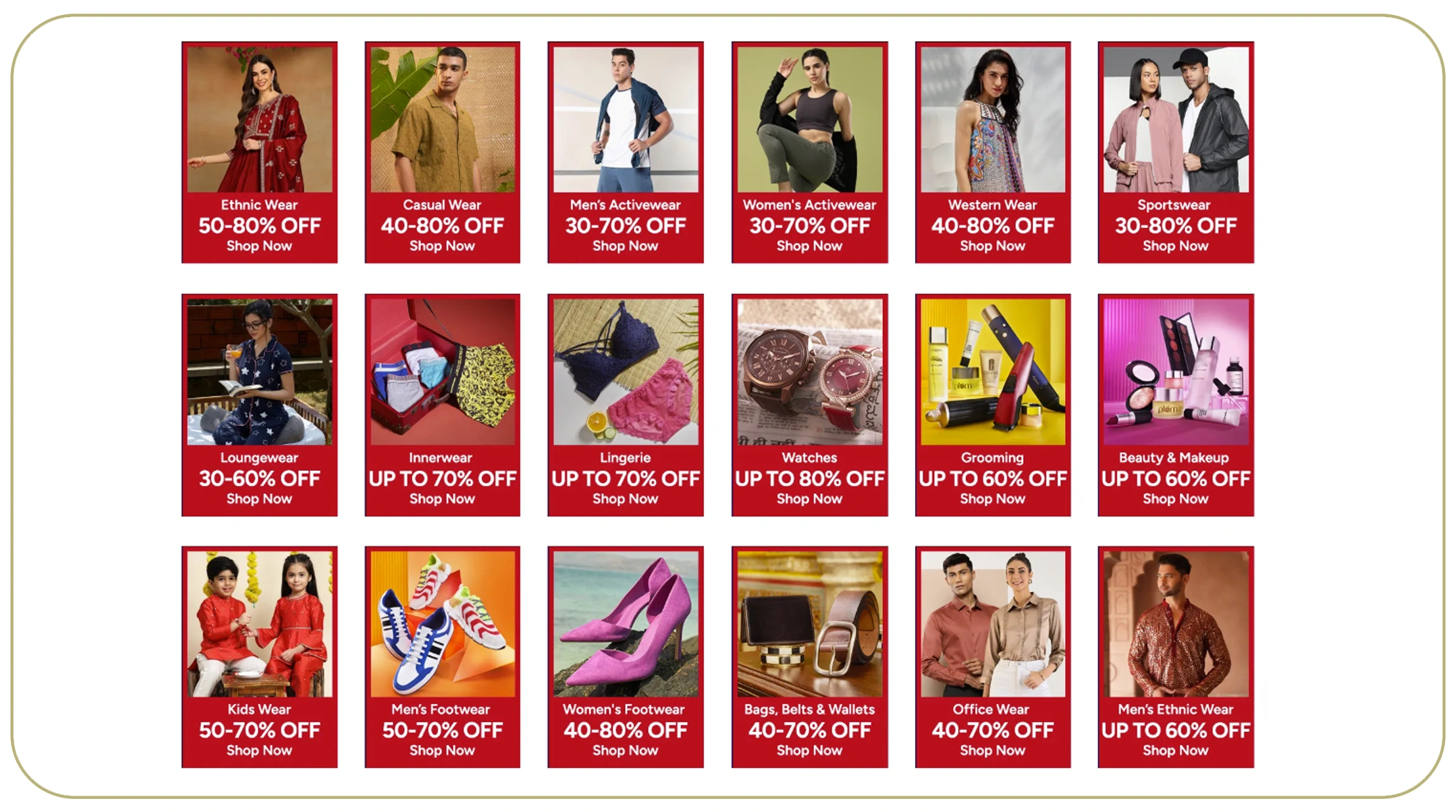

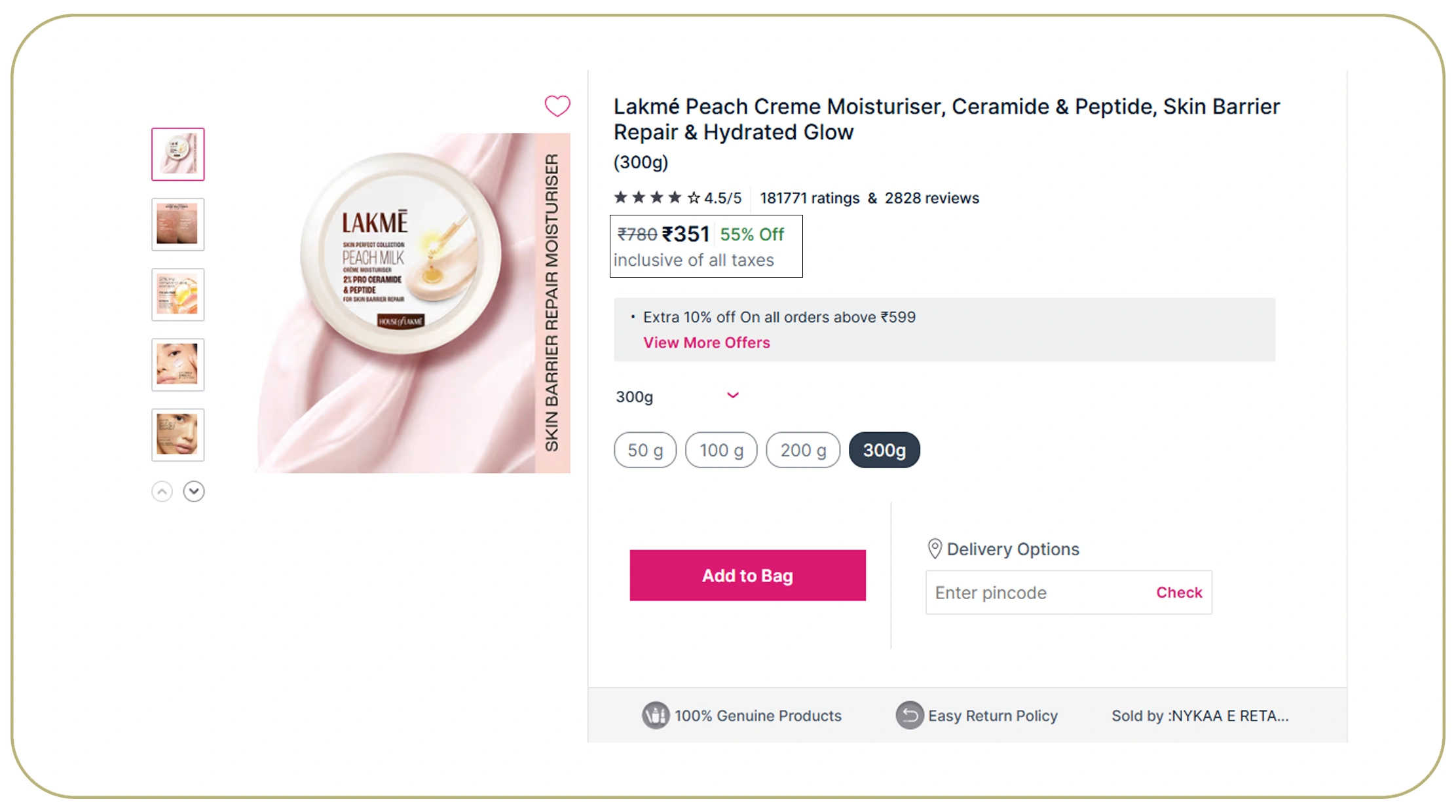

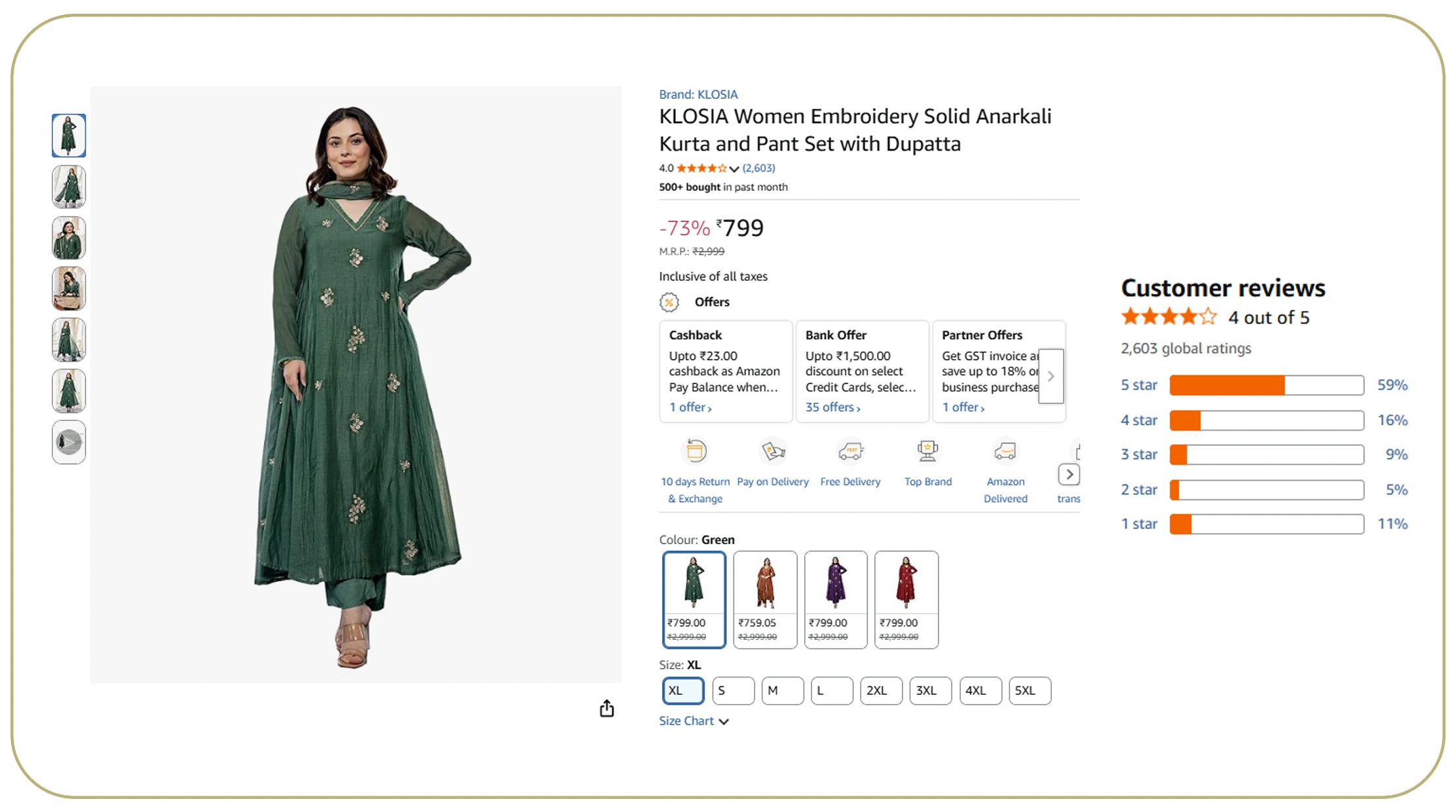

Understanding Pricing and Discount Behavior

Pricing intelligence is one of the most valuable outputs of fashion data scraping. Monitoring web scraping e-commerce platforms pricing data allows retailers to understand discount cycles, minimum price thresholds, and premium positioning across marketplaces.

Fashion discounting intensified after 2021, driven by competition and customer acquisition strategies. Platforms like Amazon, Flipkart, and Meesho frequently adjust prices multiple times per week.

Average Fashion Discount Rates (2020–2026)

| Year | Avg. Discount % |

|---|---|

| 2020 | 28% |

| 2022 | 35% |

| 2024 | 42% |

| 2026 | 48% |

By analyzing historical pricing data, brands can optimize MRP strategies, identify loss-leading tactics, and avoid destructive price wars—especially in crowded apparel categories.

Building Actionable Fashion Data Assets

Raw scraped data becomes powerful only when structured into a usable E-Commerce Dataset. For fashion brands and analysts, datasets often include product metadata, seller ratings, review sentiment, pricing history, and availability timelines.

Between 2020 and 2026, demand for historical fashion datasets increased as AI-driven trend forecasting gained traction. Structured datasets enable machine learning models to predict color trends, seasonal demand, and regional buying behavior.

Fashion Dataset Utilization Growth

| Year | Companies Using Fashion Datasets |

|---|---|

| 2020 | 22% |

| 2022 | 41% |

| 2024 | 63% |

| 2026 | 78% |

Such datasets support merchandising, inventory planning, influencer collaborations, and private-label expansion across Myntra, Nykaa, and Amazon Fashion.

Scaling Data Collection with Automation

As marketplaces grow, manual scraping becomes unreliable. A scalable Web Scraping API ensures consistent access to structured fashion data across multiple platforms without disruption. APIs allow automated scheduling, standardized outputs, and seamless integration into analytics systems.

From 2020 to 2026, API-based data collection became the industry standard due to increased anti-bot measures and complex page structures.

Adoption of Automated Scraping (2020–2026)

| Year | API-Based Scraping Usage |

|---|---|

| 2020 | 35% |

| 2022 | 55% |

| 2024 | 72% |

| 2026 | 85% |

For fashion-focused businesses, API-driven extraction ensures reliable access to fresh data from Amazon, Flipkart, Myntra, Nykaa, and emerging platforms like Shopsy.

Why Choose Real Data API?

Real Data API is built to support scalable fashion intelligence across India’s largest marketplaces. Whether your goal is Product Development, how to get scraped data from e-commerce websites in India, competitive analysis, or pricing optimization, the platform delivers structured, compliant, and high-frequency data access.

With support for fashion-specific attributes, historical tracking, and real-time updates, Real Data API empowers brands, retailers, and analysts to convert marketplace data into measurable growth opportunities—without operational complexity.

Conclusion

Fashion e-commerce in India is no longer driven by intuition—it is powered by data. Understanding how to get scraped data from e-commerce websites in India enables brands to track trends, optimize pricing, forecast demand, and stay ahead in a highly competitive market.

If you’re ready to transform raw marketplace information into actionable fashion insights, Real Data API is your gateway.

Start extracting smarter fashion data today and turn insights into impact!