Introduction

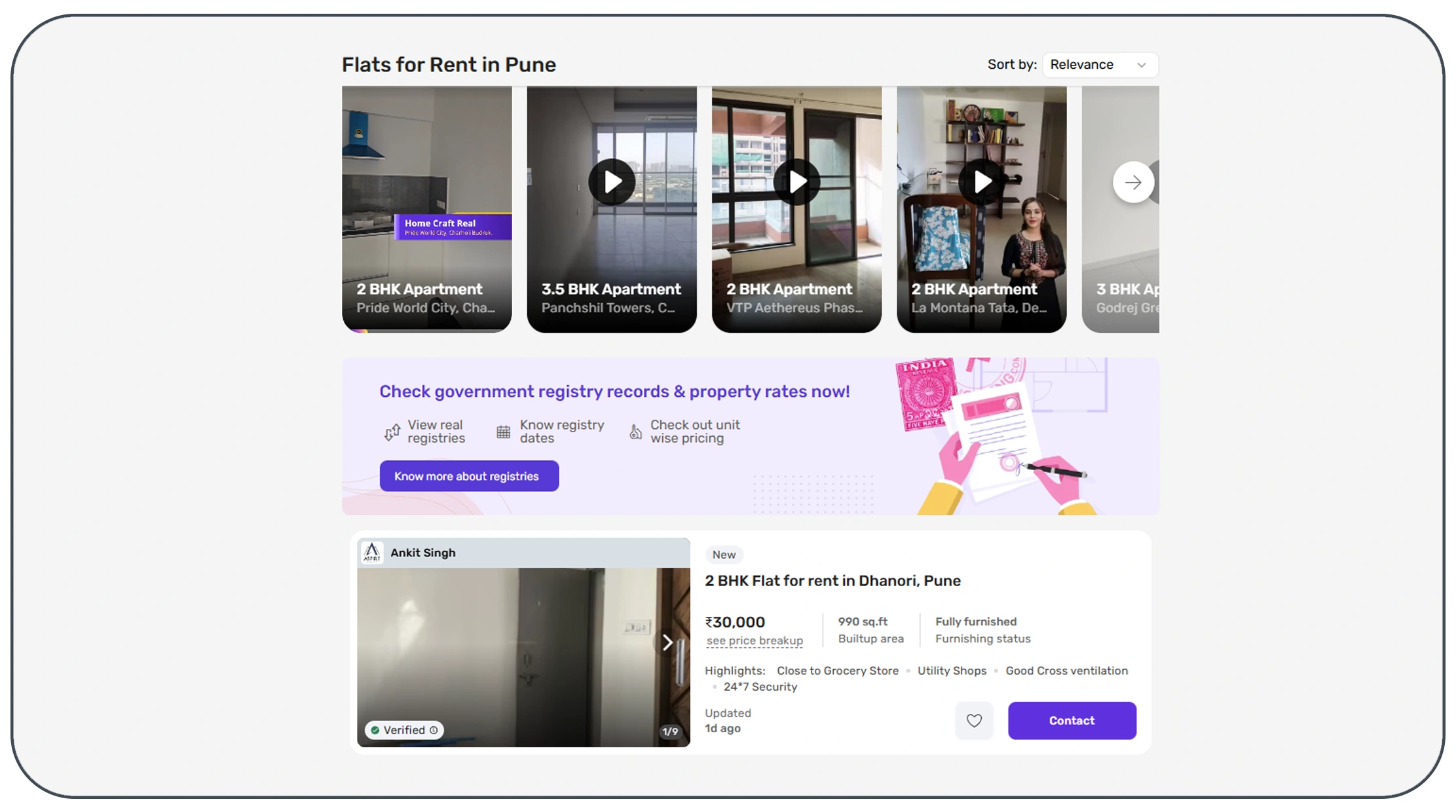

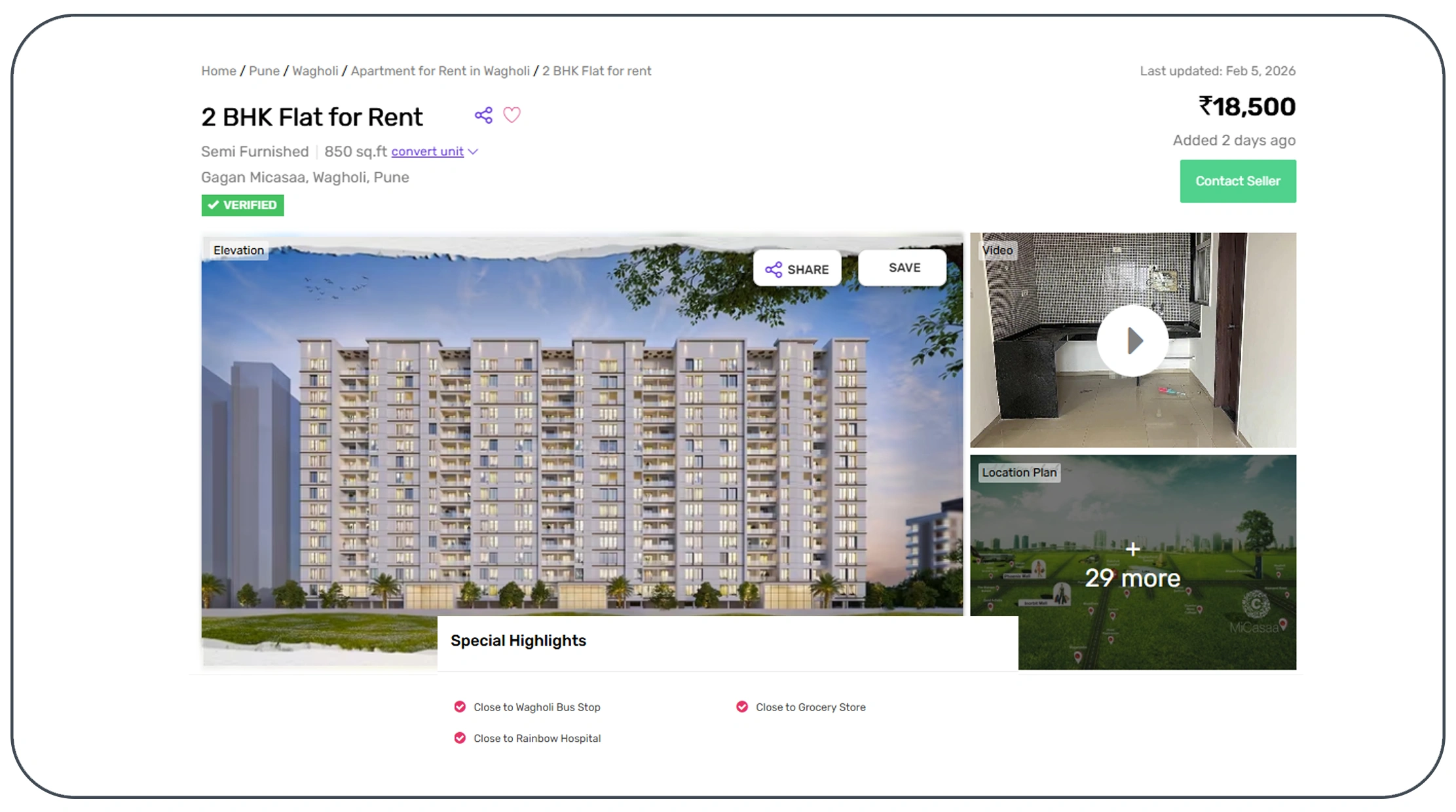

India's real estate market has transformed rapidly over the past decade, driven by digital-first property discovery and data-rich online platforms. Buyers and investors increasingly rely on portals like 99acres, MagicBricks, and Housing.com to evaluate prices, compare localities, and track inventory trends. This shift has created a massive volume of unstructured data that, when analyzed correctly, can unlock powerful forecasting insights.

To stay competitive, real estate businesses are now leveraging scrape data from Indian real estate portals to replace intuition-based decisions with measurable intelligence. Property listings across NoBroker, PropTiger, and Square Yards reflect real-time demand signals such as pricing changes, listing velocity, and buyer preferences.

By integrating this information through the Web Scraping Real Estate Data API, developers, brokers, and analysts can monitor market shifts as they happen. From residential absorption rates to commercial supply movements, data-driven forecasting has helped organizations improve prediction accuracy by nearly 30% between 2020 and 2026—reshaping how India's property market is understood and acted upon.

Decoding City-Level Pricing Behavior

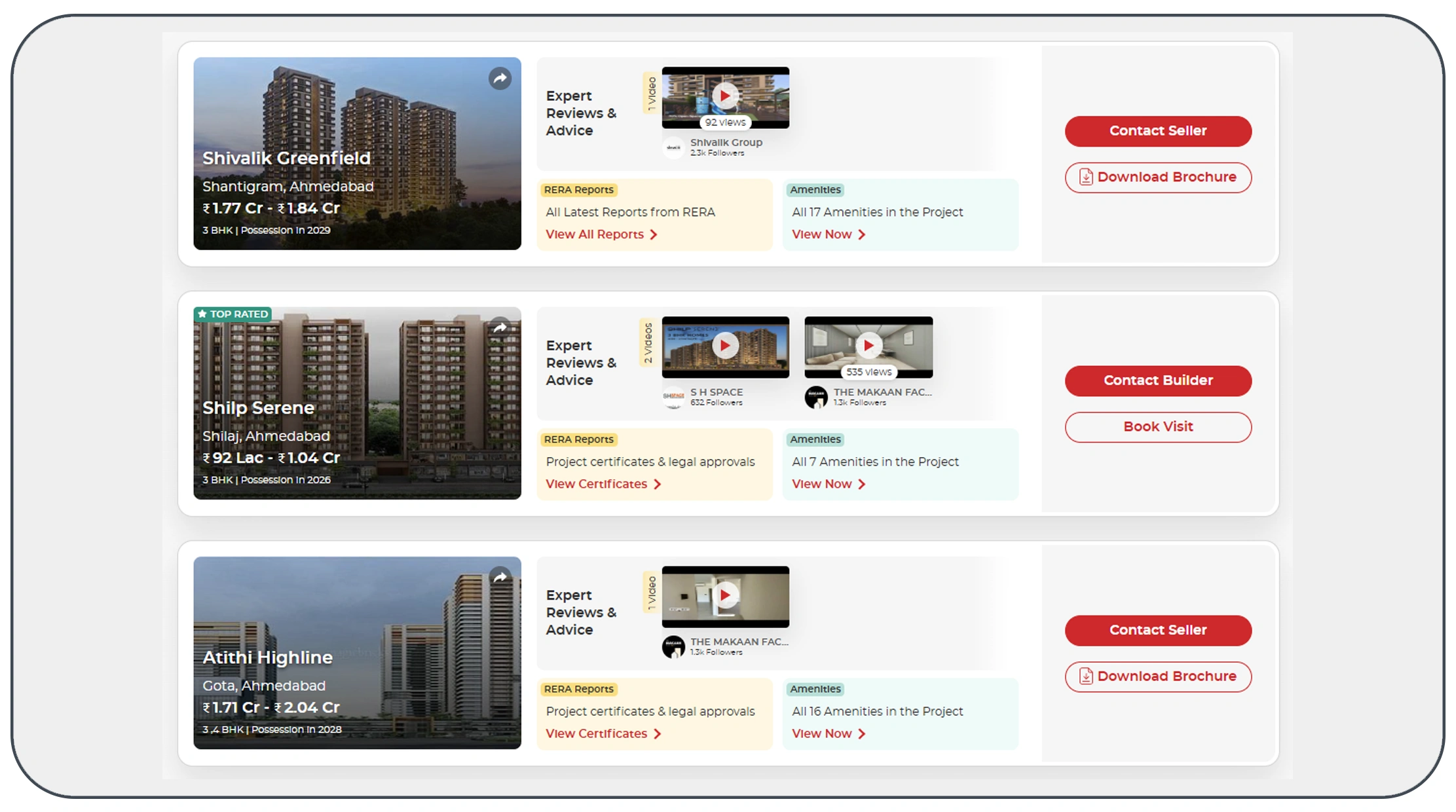

Accurate demand forecasting begins with understanding how prices behave across cities and micro-markets. Listings from platforms like Makaan, Quikr Homes, and OLX Property offer valuable insights into asking prices, discounts, and location-specific trends. Using extract property prices from Indian websites alongside Housing.com scraping API, businesses can capture structured pricing data across thousands of listings daily.

Between 2020 and 2026, post-pandemic recovery reshaped price patterns, especially in metro cities and high-growth corridors. Scraped data revealed that cities with strong employment recovery experienced faster price rebounds compared to others.

Indian Property Price Growth Trends (2020–2026)

| Year | National Avg Growth | Metro Cities | Tier-2 Cities |

|---|---|---|---|

| 2020 | -3% | -4% | -2% |

| 2021 | 2% | 3% | 2% |

| 2022 | 6% | 7% | 5% |

| 2023 | 8% | 9% | 7% |

| 2024 | 9% | 10% | 8% |

| 2025 | 10% | 11% | 9% |

| 2026 | 11% | 12% | 10% |

Granular price intelligence enables more precise demand forecasting and smarter investment decisions.

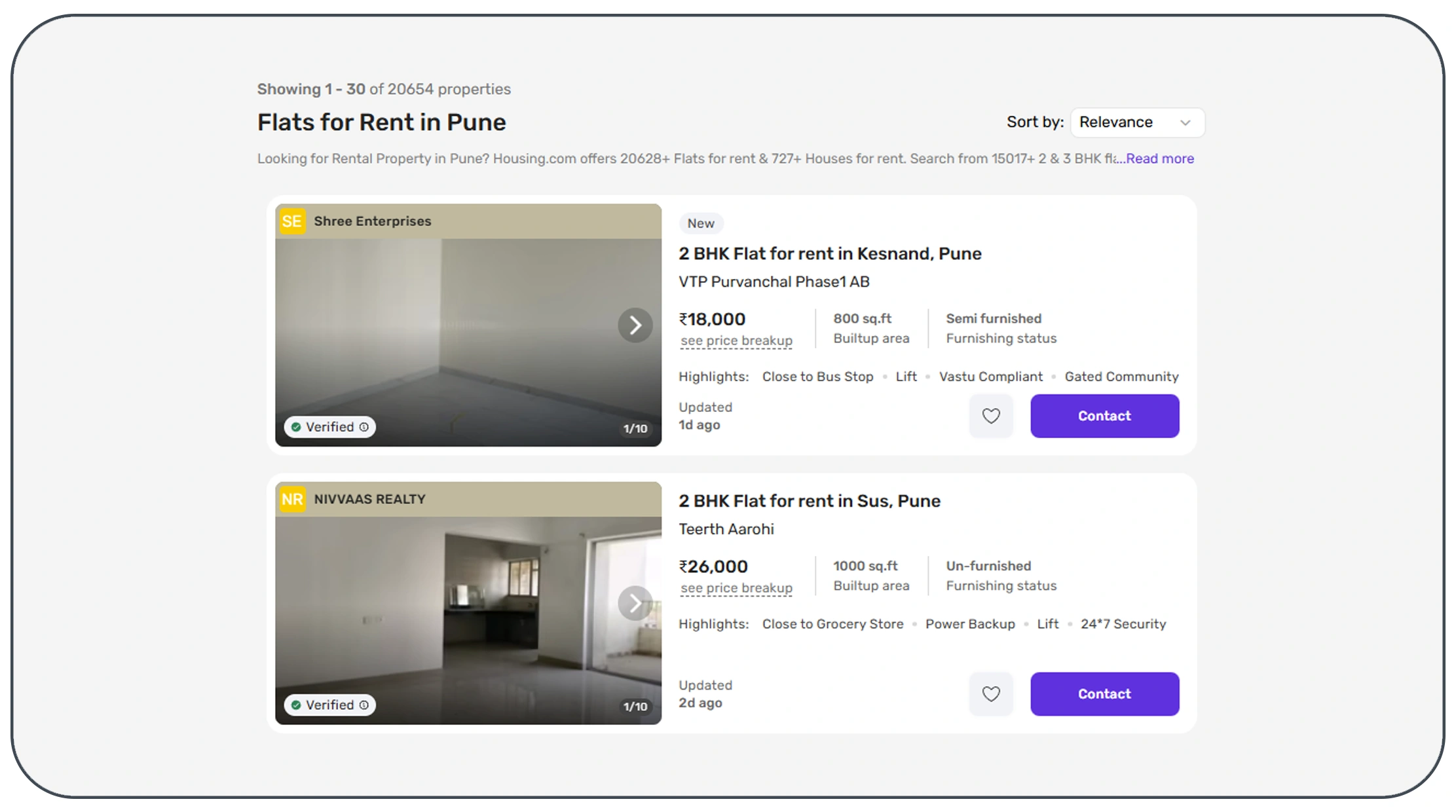

Tracking Demand Signals at Scale

Market demand is shaped by multiple variables—migration, affordability, infrastructure, and employment growth. By leveraging Indian housing market analysis via web scraper API, analysts can extract demand indicators such as listing frequency, property views, and buyer inquiries across portals like 99acres and MagicBricks.

These platforms collectively reflect buyer intent in real time, making them reliable indicators of shifting demand patterns. Scraped datasets reveal how demand surged in cities with expanding IT corridors and metro connectivity between 2022 and 2026.

Housing Demand Index Trends (2020–2026)

| Year | Demand Index | Supply Index | Gap |

|---|---|---|---|

| 2020 | 78 | 85 | -7 |

| 2021 | 82 | 86 | -4 |

| 2022 | 90 | 88 | +2 |

| 2023 | 96 | 90 | +6 |

| 2024 | 102 | 92 | +10 |

| 2025 | 108 | 94 | +14 |

| 2026 | 115 | 96 | +19 |

This intelligence allows stakeholders to anticipate demand surges before they reflect in transaction data.

Segment-Based Forecasting Insights

Residential and commercial markets follow different recovery cycles. Data from NoBroker and PropTiger clearly highlights these distinctions. Using a Residential and commercial property data Extractor with NoBroker property data scraping, businesses can analyze each segment independently.

Residential demand rebounded faster due to work-from-home flexibility, while commercial demand followed gradual recovery driven by IT and co-working expansion. Scraped listing data enables demand forecasting at a segment level rather than relying on aggregated assumptions.

Residential vs Commercial Demand Growth (2020–2026)

| Year | Residential | Commercial |

|---|---|---|

| 2020 | -5% | -12% |

| 2021 | 4% | -3% |

| 2022 | 9% | 5% |

| 2023 | 11% | 7% |

| 2024 | 12% | 9% |

| 2025 | 13% | 11% |

| 2026 | 14% | 13% |

Segment-focused insights improve forecasting accuracy and portfolio diversification.

Speed, Freshness, and Forecast Accuracy

Static market reports fail to capture rapid listing changes across platforms like Square Yards and Makaan. With real-time real estate data scraping India, organizations receive continuous updates on pricing shifts, new listings, and property removals.

Between 2020 and 2026, businesses using real-time datasets improved demand forecasting speed and significantly reduced lag-based errors. Faster access to fresh data allowed weekly and daily trend modeling instead of quarterly revisions.

Forecast Accuracy Improvement (2020–2026)

| Year | Traditional Data | Real-Time Data |

|---|---|---|

| 2020 | 62% | 70% |

| 2021 | 65% | 75% |

| 2022 | 68% | 82% |

| 2023 | 70% | 88% |

| 2024 | 72% | 90% |

| 2025 | 74% | 92% |

| 2026 | 75% | 95% |

Real-time intelligence turns forecasting into a proactive strategy.

Unified Multi-Portal Intelligence

Each real estate portal attracts a different buyer demographic. Combining 99acres data scraping with SquareYards real estate data scraping creates a holistic view of demand across premium, mid-range, and affordable segments.

Listings from Quikr Homes and OLX Property further enhance coverage by capturing secondary and resale markets often missed by premium platforms. Aggregating multi-source data improves locality-level forecasting accuracy and eliminates platform bias.

Listing Coverage Comparison (2020–2026)

| Year | Single Portal | Multi-Portal |

|---|---|---|

| 2020 | 55% | 72% |

| 2021 | 58% | 76% |

| 2022 | 61% | 81% |

| 2023 | 64% | 85% |

| 2024 | 67% | 88% |

| 2025 | 69% | 91% |

| 2026 | 71% | 94% |

Multi-portal intelligence significantly strengthens demand forecasting reliability.

Why Choose Real Data API?

Real Data API enables businesses to scrape data from Indian real estate portals at scale while ensuring accuracy, compliance, and automation. Our solutions power Real Estate Lead Generation Easily with Web Scraping, supporting advanced analytics, forecasting models, and decision-making workflows.

From enterprise-grade APIs to customized datasets, Real Data API helps real estate professionals transform raw listings data into actionable market intelligence.

Conclusion

Modern property demand forecasting depends on data depth, freshness, and coverage. With access to a unified Real Estate Dataset and the ability to scrape data from Indian real estate portals, organizations can improve forecast accuracy by over 30%, reduce risk, and capitalize on emerging opportunities faster.

Ready to gain a competitive edge in real estate forecasting? Partner with Real Data API today and unlock powerful, real-time market intelligence built for India's dynamic property ecosystem.